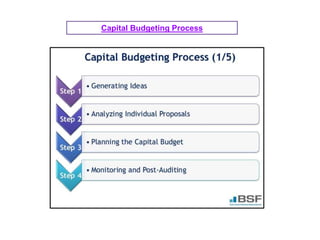

The document discusses capital budgeting, which is the process companies use to evaluate long-term investments. It involves identifying potential capital projects, analyzing their expected cash flows, prioritizing projects based on available resources and strategy, and monitoring approved projects. The goals are to increase company value and returns. Key aspects covered include the capital budgeting process, principles, types of projects, and importance of making sound capital budgeting decisions given the large investments, long-term implications, risks, and difficulty of accurately forecasting future cash flows.