Capital Investment Decision or Capital Budgeting

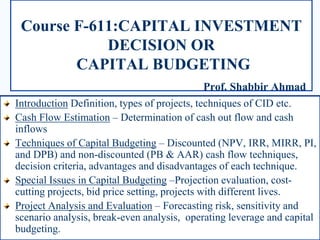

- 1. Course F-611:CAPITAL INVESTMENT DECISION OR CAPITAL BUDGETING Prof. Shabbir Ahmad Introduction Definition, types of projects, techniques of CID etc. Cash Flow Estimation – Determination of cash out flow and cash inflows Techniques of Capital Budgeting – Discounted (NPV, IRR, MIRR, PI, and DPB) and non-discounted (PB & AAR) cash flow techniques, decision criteria, advantages and disadvantages of each technique. Special Issues in Capital Budgeting –Projection evaluation, cost- cutting projects, bid price setting, projects with different lives. Project Analysis and Evaluation – Forecasting risk, sensitivity and scenario analysis, break-even analysis, operating leverage and capital budgeting.

- 2. Course F-611:CAPITAL INVESTMENT DECISION OR CAPITAL BUDGETING Inflation and Capital Budgeting Options in Capital Budgeting Strategy and Analysis in Using Net Present Value Cost of Capital, and Capital Budgeting Capital Budgeting for Levered Firm Risk and Capital Budgeting – Absolute measure and relative measure of risk, certainty equivalent method and risk adjusted discount rate method. Text Books Fundamentals of Corporate Finance by Ross, Westerfield, JORDAN Corporate Finance by Ross, Westerfield, JAFFE Capital Budgeting & Long-term Finance by Neil Seitz Managerial Finance by Lawrence J GITMAN Essentials of Managerial Finance by Eugene F. Brigham

- 3. Course F-611:CAPITAL INVESTMENT DECISION OR CAPITAL BUDGETING Course Evaluation Class Attendance ----- 10 Mid-term – I -----------15 Mid-term – II ----------15 Class Test/Quiz --------10 Term Paper/Pres.------10 Final Exam -------------40 Total --------------------100

- 4. CAPITAL BUDGETING OR CAPITAL INVESTMENT DECISION Goal of Firm Maximization of the owner’s wealth, which is attained through maximization of the current market price of the outstanding shares.

- 5. CAPITAL BUDGETING OR CAPITAL INVESTMENT DECISION Capital Investment Decisions or Capital Budgeting involves company’s long term investment decision. It includes evaluation of the firm’s expenditure decisions that involve current outlays but are likely to produce benefits or returns over a long period of time. Capital Budgeting is the process of evaluating and selecting long-term investments in fixed or capital assets that are consistent with the firm’s goal of maximizing owner’s wealth.

- 6. CAPITAL BUDGETING OR CAPITAL INVESTMENT DECISION The process of identifying, analyzing, and selecting investment projects whose returns (i.e. cash inflows) are expected to extend beyond one year. Example: Suppose a firm must decide whether to purchase a new plastic moulding machine for $125,000. How it should decide? Will the machine be profitable? Will our firm earn a high rate of return on the investment?

- 7. CAPITAL BUDGETING OR CAPITAL INVESTMENT DECISION Why a firm makes capital investment? In order to secure a stream of benefits in future years that add value to the firm through cash inflows over future times.

- 8. CAPITAL BUDGETING OR CAPITAL INVESTMENT DECISION Applications Purchase of fixed assets Mechanization of production method Selection from alternative equipments Introduction of new products Expansion of business Modernization and replacement

- 9. FEATURES/CHARACTERISTICS OF CID (IMPORTANCE) Long term investment decision (future profitability of firm). Returns or benefits are expected over number of years Investment involves huge amount of cash outflow (determines the destiny of the firm) Investment decision is generally irreversible (once made can not be changed) Relatively high degree of risk Relatively long time period between the initial outlay and the anticipated return

- 10. CLASSIFICATION OF PROJECTS By Size: Major Project. Minor Project. By Benefit: Cost Reduction Project. Market Expansion Project. Project for new products.

- 11. CLASSIFICATION OF PROJECTS By Degree of Dependence: Mutually Exclusive Projects. Independent Projects. By Cash Flow pattern: Conventional Project.( - + + + + + i.e. outflow followed by a series of inflow). Non Conventional Projects ( - + + - + - + i.e. if the project inflows & outflows are mixed & zigzag pattern).

- 12. End of Year 0 1 2 3 4 5 10,000 Cash outflow 2000 2000 2000 2000 2000 Cash Inflows Conventional Cash Flow Pattern: This consists of an initial outflow followed only by a series of inflows.

- 13. End of Year 10,000 8000 Cash outflow 2000 2000 2000 2000 Cash Inflows 0 1 2 3 4 5 Non-conventional Cash Flow Pattern: This consists of an initial outflow followed by a series of inflows and outflows.

- 14. CAPITAL INVESTMENT DECISION ►Determination of Cash Outflow or Investment ► Projection or Forecast or Estimation of Future Cash Inflows ► Determination of Appropriate Discount Rate (i.e. Cost of Capital)

- 15. CASH FLOW DETERMINATION A project should be evaluated on the basis of Incremental After Tax Cash Flows. Incremental After Tax Cash Flows for project evaluation consist of any and all changes in the firm’s future cash flows that are a direct consequence of taking the project or the difference between a firm’s future cash flows with a project and those without the project.

- 16. CASH FLOW DETERMINATION Only the relevant cash flows should be taken under consideration in determining the cash flows (i.e. inflows or outflows) for making capital investment decision. Relevant cash flows should be included in a capital budgeting analysis. These cash flows will only occur if the project is accepted Relevant cash flows are those which influence the firm’s decision regarding accepting or rejecting a project.

- 17. CASH FLOW DETERMINATION Irrelevant cash flows are those which do not affect the firm’s decision regarding accepting or rejecting a project i.e. they exist if the firms accepts a project or if rejects a project. Irrelevant cash flows should NOT be included in capital budgeting analysis.

- 18. CASH FLOW DETERMINATION Asking the Right Question Will this cash flow occur ONLY if we accept the project?” If the answer is “yes”, it should be included in the analysis because it is incremental If the answer is “no”, it should not be included in the analysis because it will occur anyway If the answer is “part of it”, then we should include the part that occurs because of the project

- 19. CASH OUTFLOW OR INVESTMENT DETERMINATION Cost of new asset or project Add installation cost (if any) Add transportation cost (if any) Add removal cost of old asset (only if borne by the company) Less selling price of old asset (if new asset replaces old asset) + / - Tax on sale of old asset Less Amount of investment tax credit (AITC)

- 20. Depreciation Depreciation is a non-cash expense, consequently, it is relevant because it affects taxes. Depreciation tax shield i.e. amount of annual tax savings from depreciation expense = D x T D = depreciation expense T = tax rate

- 21. Computing Depreciation Straight-line depreciation Annual Dep. = Installed cost / number of useful years MACRS Need to know which asset class is appropriate for tax purposes Multiply percentage given in table by the installed cost

- 22. Example: Depreciation You purchase equipment for $100,000 and it costs $10,000 to have it installed. The company’s tax rate is 40%. What is the depreciation expense each year?

- 23. Example: Three-year MACRS Year MACRS percent D 1 .3333 .3333(110,000) = 36,663 2 .4444 .4444(110,000) = 48,884 3 .1482 .1482(110,000) = 16,302 4 .0741 .0741(110,000) = 8,151 BV in year 6 = 110,000 – 36,663 – 48,884 – 16,302 – 8,151 = 0

- 24. CASH OUTFLOW OR INVESTMENT DETERMINATION Example The Sprint Inc. is trying to estimate the net cash outflow required to replace an old machine with a new one. The new machine’s purchase price is $270,000. An additional $7,000 will be required for transportation and $5,000 will be required to install the machine. As the new machine has greater capacity to produce, there will be an additional investment of $20,000 in raw material inventory in the initial year. The new machine will be depreciated on straight-line basis over five years of useful life. The old machine was purchased two years ago at a cost of $70,000 has a remaining useful life of five years. It is also subject to straight-line depreciation. The company is entitled to investment tax allowance of 25%. The corporate tax rate is 55% and the capital gain tax rate is 30%. Find the net cash outflow considering separately each of the following scenarios: i) If the old machine is sold for $40,000 ii) If the old machine is sold for $50,00. NCO.xls iii) If the old machine is sold for $60,000. iv) If the old machine is sold for $90,000.

- 25. CASH INFLOW DETERMINATION Operating Cash Flow (OCF) Operating Cash Flow (OCF) = EBIT + depreciation – taxes OCF = Net income + depreciation when there is no interest expense OCF = Sales – Costs – Taxes (Don’t subtract non-cash deductions) OCF = (Sales – Costs)(1 – T) + Depreciation*T Opportunity Cost Sunk Cost Erosion or Side Effects Financing Cost Change in Net Working Capital

- 26. Common Types of Cash Flows Sunk costs – costs that have accrued in the past and should not be included capital budgeting analysis Opportunity costs – costs of lost options and should be included in capital budgeting analysis Side effects Positive side effects – benefits to other projects Negative side effects – costs to other projects and should be included in capital budgeting analysis Changes in net working capital (should be included in capital budgeting analysis) Financing costs (should not be included in capital budgeting analysis) Taxes should be considered

- 27. PROJECTCASH FLOW DETERMINATION Year 0 1 2 3 OCF Change in NWC Opportunity Cost Capital Spending/CO ATSV PCF

- 28. After-tax Salvage If the salvage value is different from the book value of the asset, then there is a tax effect Book value = installed cost – accumulated (i.e. total ) depreciation After-tax salvage value (ATSV) = salvage – Tc(salvage – book value)

- 29. TECHNIQUES OF CAPITAL BUDGETING The techniques of capital budgeting are divided into two broad groups A) Non discounted cash flow techniques i.e. techniques that do not consider time value of money as such do not discount the future cash flows B) Discount cash flow (DCF) techniques i.e. techniques that do not consider time value of money as such do not discount the future cash flows

- 30. TECHNIQUES OF CAPITAL BUDGETING A) Non-DCF techniques include the following: i) Payback Period Method ii) Average Accounting Return or Accounting Rate of Return B) DCF techniques include the following: i) Net Present Value (NPV) ii) Internal Rate of Return (IRR) iii) Profitability Index (PI) or Benefit-Cost Ratio (BCR) iv) Discounted Payback Period Method

- 31. The Payback Period Rule How long does it take the project to “pay back” its initial investment? Payback Period = number of years to recover initial costs Minimum Acceptance Criteria: set by management

- 32. The Payback Period Rule (continued) Disadvantages: Ignores the time value of money Ignores cash flows after the payback period Biased against long-term projects Requires an arbitrary acceptance criteria A project accepted based on the payback criteria may not have a positive NPV Advantages: Easy to understand Biased toward liquidity

- 33. The Discounted Payback Period Rule How long does it take the project to “pay back” its initial investment taking the time value of money into account?

- 34. The Average Accounting Return Rule Another attractive but fatally flawed approach. Disadvantages: Ignores the time value of money Uses an arbitrary benchmark cutoff rate Based on book values, not cash flows and market values Advantages: The accounting information is usually available Easy to calculate Investent of Value Book Average Income Net Average AAR

- 35. The Net Present Value (NPV) Rule Net Present Value (NPV) = Total PV of future CI’s - Initial Investment ∑PV of Cash Inflows – ∑PV of Cash Outflows Minimum Acceptance Criteria: Accept if NPV > 0 Ranking Criteria: Choose the highest NPV

- 36. Why Use Net Present Value? Accepting positive NPV projects benefits shareholders. NPV uses cash flows NPV uses all the cash flows of the project NPV discounts the cash flows properly

- 37. Good Attributes of the NPV Rule 1. Uses cash flows 2. Uses ALL cash flows of the project Reinvestment assumption: the NPV rule assumes that all cash flows can be reinvested at the discount rate or cost of capital.

- 38. The Internal Rate of Return (IRR) Rule IRR: the discount rate that sets NPV to zero or the rate of return available from investing in a project. Minimum Acceptance Criteria: Accept if the IRR exceeds the required return. Ranking Criteria: Select alternative with the highest IRR Reinvestment assumption: All future cash flows assumed reinvested at the IRR. Disadvantages: IRR may not exist or there may be multiple IRR Problems with mutually exclusive investments Advantages: Easy to understand and communicate

- 39. The Internal Rate of Return: Example Consider the following project: 0 1 2 3 $50 $100 $150 -$200 The internal rate of return for this project is 19.44% 3 2 ) 1 ( 150 $ ) 1 ( 100 $ ) 1 ( 50 $ 0 IRR IRR IRR NPV

- 40. Problems with the IRR Approach Multiple IRRs. The Scale Problem The Timing Problem Investing or Financing

- 41. The NPV Payoff Profile for This Example Discount Rate NPV 0% $100.00 4% $71.04 8% $47.32 12% $27.79 16% $11.65 20% ($1.74) 24% ($12.88) 28% ($22.17) 32% ($29.93) 36% ($36.43) 40% ($41.86) If we graph NPV versus discount rate, we can see the IRR as the x-axis intercept. IRR = 19.44% ($60.00) ($40.00) ($20.00) $0.00 $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 -1% 9% 19% 29% 39% Discount rate NPV

- 42. Multiple IRRs There are two IRRs for this project: 0 1 2 3 $200 $800 -$200 - $800 ($150.00) ($100.00) ($50.00) $0.00 $50.00 $100.00 -50% 0% 50% 100% 150% 200% Discount rate NPV 100% = IRR2 0% = IRR1 Which one should we use?

- 43. The Scale Problem Would you rather make 100% or 50% on your investments? What if the 100% return is on a $1 investment while the 50% return is on a $1,000 investment?

- 44. The Timing Problem 0 1 2 3 $10,000 $1,000 $1,000 -$10,000 Project A 0 1 2 3 $1,000 $1,000 $12,000 -$10,000 Project B The preferred project in this case depends on the discount rate, not the IRR.

- 45. The Timing Problem ..TimingProb.xls ($4,000.00) ($3,000.00) ($2,000.00) ($1,000.00) $0.00 $1,000.00 $2,000.00 $3,000.00 $4,000.00 $5,000.00 0% 10% 20% 30% 40% Discount rate NPV Project A Project B 10.55% = crossover rate 16.04% = IRRA 12.94% = IRRB

- 46. Mutually Exclusive vs. Independent Project Mutually Exclusive Projects: only ONE of several potential projects can be chosen, e.g. acquiring an accounting system. RANK all alternatives and select the best one. Independent Projects: accepting or rejecting one project does not affect the decision of the other projects. Must exceed a MINIMUM acceptance criteria.

- 47. The Profitability Index (PI) Rule Minimum Acceptance Criteria: Accept if PI > 1 Ranking Criteria: Select alternative with highest PI Disadvantages: Problems with mutually exclusive investments Advantages: May be useful when available investment funds are limited Easy to understand and communicate Correct decision when evaluating independent projects Investent Initial Flows Cash Future of PV Total PI

- 48. The Practice of Capital Budgeting Varies by industry: Some firms use payback, others use accounting rate of return. The most frequently used technique for large corporations is IRR or NPV.

- 49. Example of Investment Rules Compute the IRR, NPV, PI, and payback period for the following two projects. Assume the required return is 10%. Year Project A Project B 0 -$200 -$150 1 $200 $50 2 $800 $100 3 -$800 $150

- 50. Example of Investment Rules Project A Project B CF0 -$200.00 -$150.00 PV0 of CF1-3 $241.92 $240.80 NPV = $41.92 $90.80 IRR = 0%, 100% 36.19% PI = 1.2096 1.6053

- 51. Example of Investment Rules Payback Period: Project A Project B Time CF Cum. CF CF Cum. CF 0 -200 -200 -150 -150 1 200 0 50 -100 2 800 800 100 0 3 -800 0 150 150 Payback period for project B = 2 years. Payback period for project A = 1 or 3 years?

- 52. Relationship Between NPV and IRR Discount rate NPV for A NPV for B -10% -87.52 234.77 0% 0.00 150.00 20% 59.26 47.92 40% 59.48 -8.60 60% 42.19 -43.07 80% 20.85 -65.64 100% 0.00 -81.25 120% -18.93 -92.52