This document discusses key concepts related to capital budgeting and risk analysis. It begins with definitions of capital budgeting as the process of identifying, evaluating, planning, and financing capital investment projects. It describes the main features of capital budgeting projects as having large anticipated benefits, high risk, and a long time period between initial outlay and return.

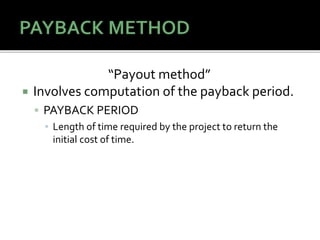

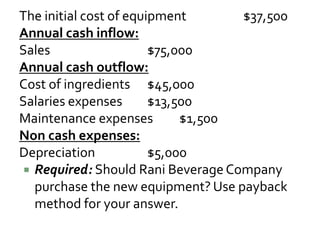

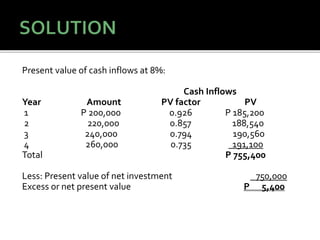

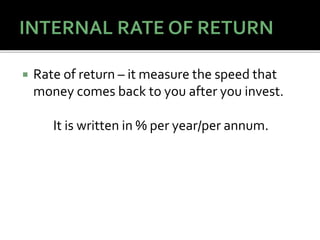

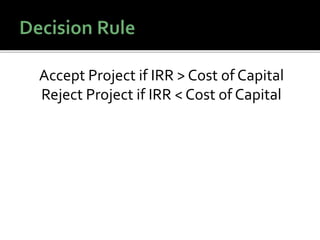

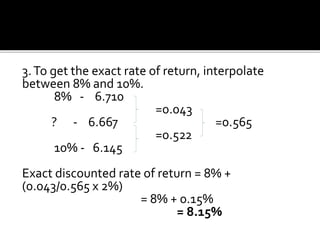

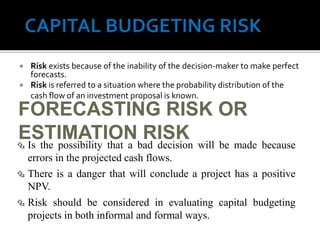

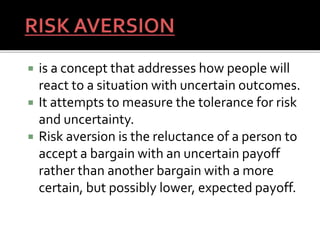

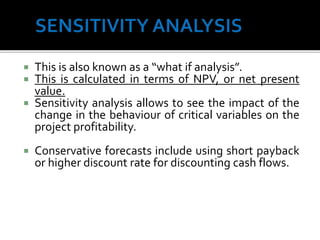

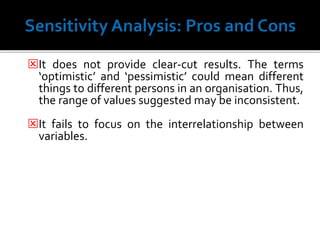

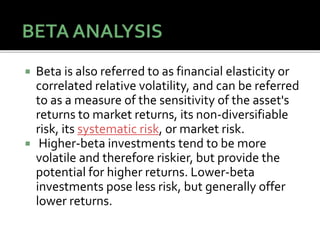

The document then covers various capital budgeting techniques for evaluating projects, including payback period, net present value (NPV), and internal rate of return (IRR). It provides examples of calculating each measure and the criteria for accepting projects. Finally, it discusses risk in capital budgeting, defining it as uncertainty in cash flow forecasts, and methods for measuring risk, such as

![PV = FV (1+i)-n

or

PV= FV x [1/(1+i)n]

or

PV= FV / (1+i)n](https://image.slidesharecdn.com/thecapitalbudgetingprocess-160322075917/85/The-capital-budgeting-process-25-320.jpg)