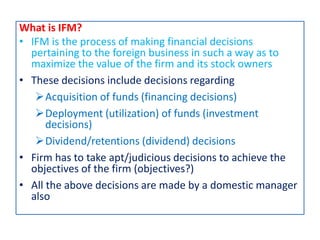

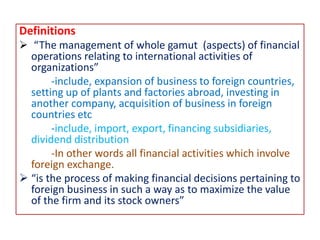

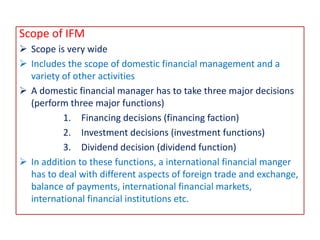

This document discusses the role and responsibilities of an international financial manager. It begins with an introduction to concepts like globalization and the rise of multinational corporations. It then defines international financial management as managing the financial functions of a business's international operations. The key responsibilities of an international financial manager include:

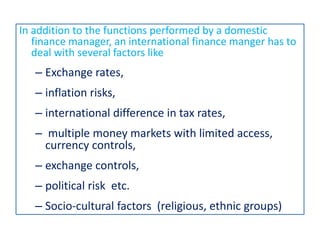

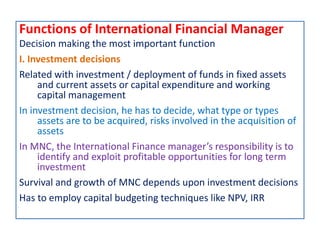

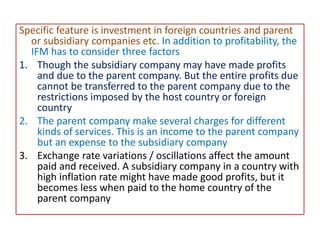

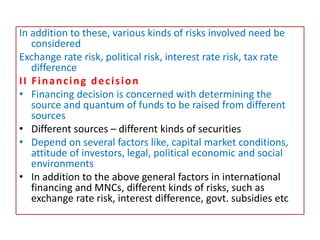

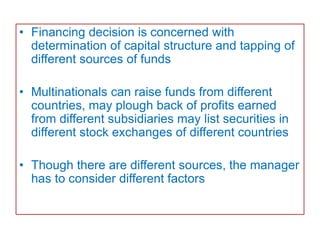

1) Making investment, financing, and dividend decisions while considering additional factors like exchange rates, inflation risks, and tax rates in different countries.

2) Coordinating the financial activities of a multinational corporation's subsidiaries across various countries.

3) Estimating and minimizing various risks associated with international operations like exchange rate risk, political risk, and interest rate risk.