Capital budgeting is the process of evaluating long-term investment projects and determining whether they are worth funding through debt, equity, or retained earnings. It involves estimating future cash flows of potential projects, evaluating them using techniques like net present value, and choosing projects that increase shareholder value and have returns higher than the company's cost of capital. The objectives of capital budgeting include setting investment priorities, purchasing assets that generate positive returns, aligning investments with marketing plans, keeping pace with projected growth, and maintaining an optimal debt level.

![Capital Budgeting

23

CHAPTER – 8

METHODS AND IMPLEMENTATION

These methods use the incremental cash flows from each potential investment,

or project. Techniques based on accounting earnings and accounting rules are

sometimes used - though economists consider this to be improper - such as the

accounting rate of return, and "return on investment." Simplified and hybrid

methods are used as well, such as payback period and discounted payback

period.

Net Present Value (NPV),

Internal Rate of Return (IRR),

Payback Period,

Discounted Payback Period,

Average Accounting Rate of Return (AAR), and

Profitability Index (PI)

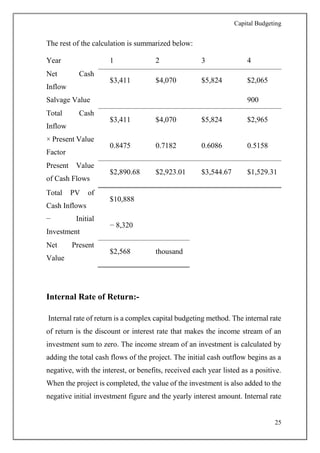

Net Present Value:-

Net present value is a widely used method of capital budgeting that determines

costs. Firms should always ensure that their rate of return of their investment

is always higher than their cost of capital and the premium that they place on

the risk of the investment. This concept is known as the hurdle rate. Net present

value is calculated by subtracting the present value of the costs from the present

value of the benefits of the capital project.

NPV = [

R1

(1+K)1

+

R2

(1+K)2

+

R3

(1+K)3

+

Rn

(1+K)n

]-Initial investment](https://image.slidesharecdn.com/capitalbudgeting-151105130320-lva1-app6892/85/Capital-budgeting-23-320.jpg)