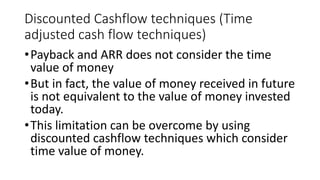

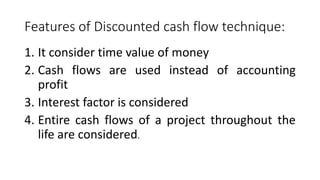

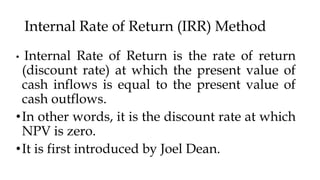

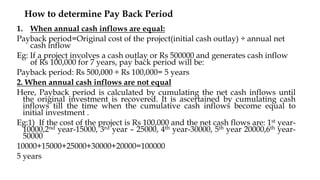

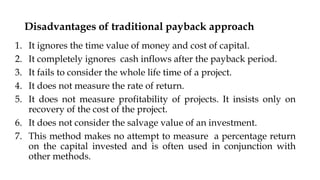

Capital budgeting is a process of making long-term investment decisions related to capital expenditures that involve significant financial outlays and yield future benefits over several years. The process includes identifying, evaluating, and selecting investment projects while considering cash flows, risks, and the time value of money. Different methods for investment appraisal are used, ranging from traditional techniques like payback period to modern discounted cash flow methods such as net present value and internal rate of return.

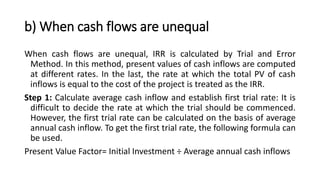

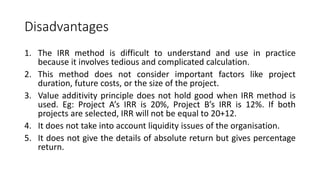

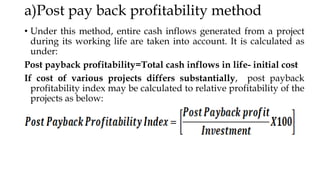

![b)Post back profitability

Post back profitability=Total cash flows in life- initial cost

Project A:

(8X20000)-100000=60000

Project B:

[(3x3000)+(5x1000)]-100000= 40000](https://image.slidesharecdn.com/module2capitalbudgeting-241117043417-6d754639/85/module-2-capital-budgeting-pdf-financial-management-25-320.jpg)