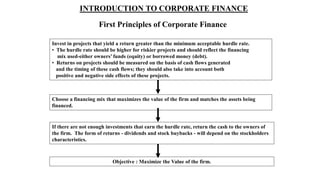

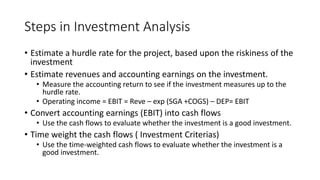

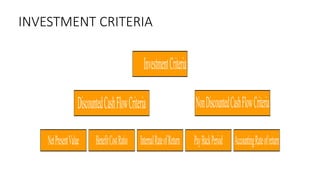

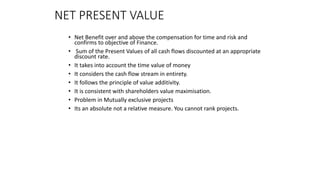

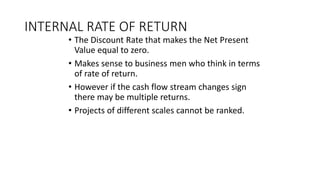

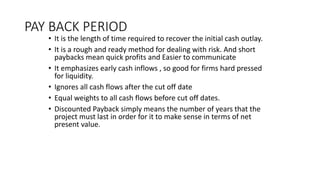

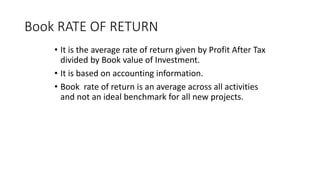

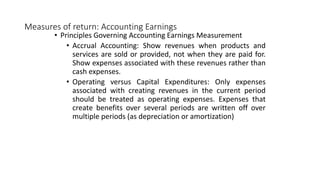

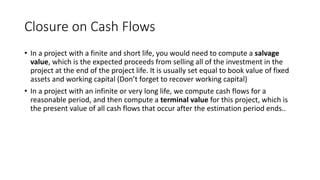

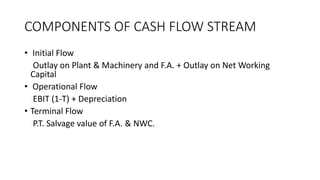

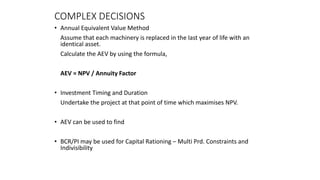

The document outlines the principles of capital budgeting in corporate finance, emphasizing the importance of investing in projects that produce returns exceeding the minimum acceptable hurdle rate while considering project risk. Key methods for investment analysis, such as net present value and internal rate of return, are presented, along with considerations for cash flow measurement and the impact of sunk costs. The analysis also highlights complex decision-making scenarios, including capital rationing and risk assessment techniques.