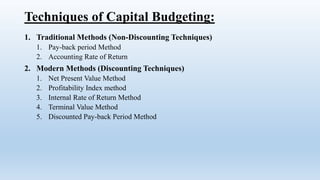

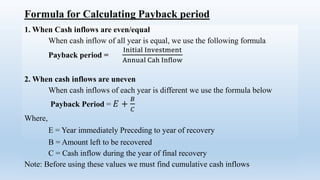

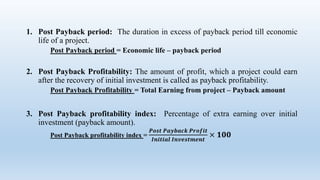

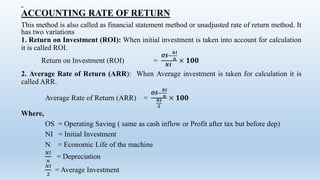

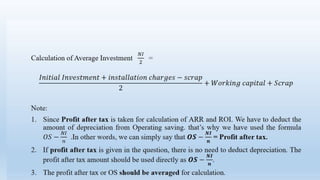

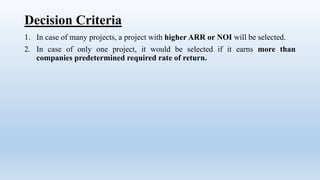

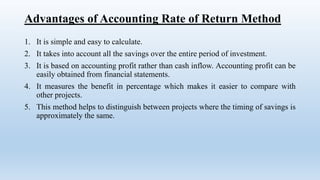

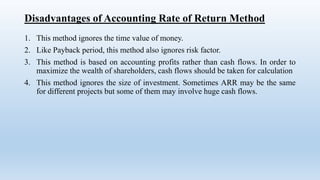

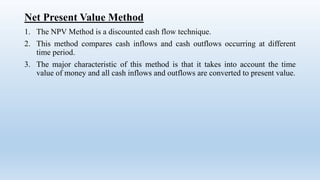

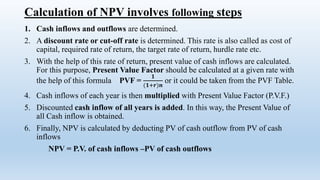

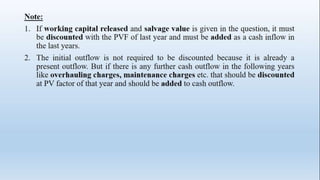

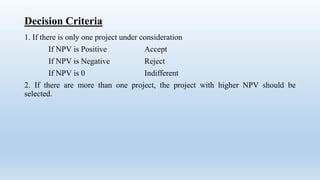

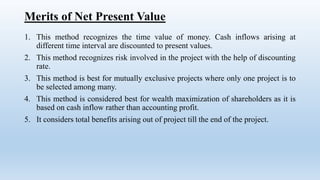

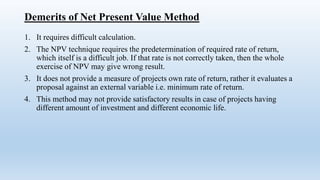

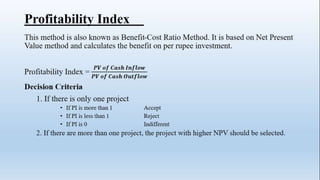

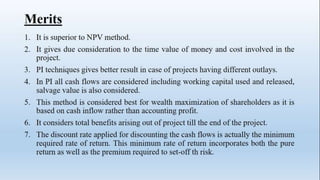

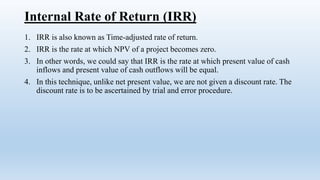

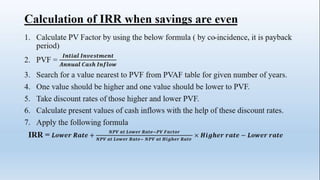

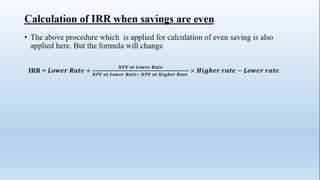

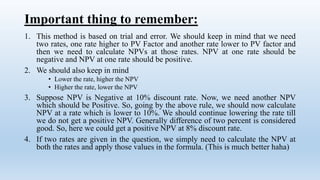

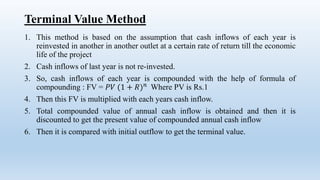

This document discusses various capital budgeting techniques, including traditional non-discounting methods like payback period and accounting rate of return, as well as modern discounting techniques like net present value, internal rate of return, and profitability index. It provides formulas and steps for calculating each technique, discusses their advantages and disadvantages, and provides decision criteria for evaluating projects.