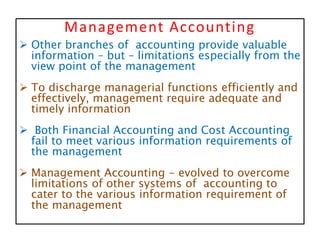

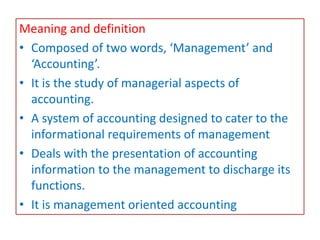

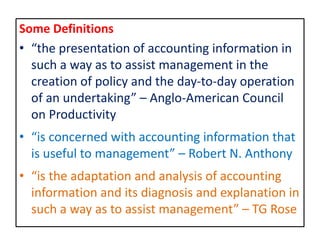

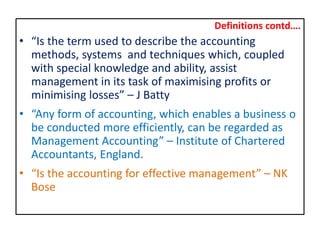

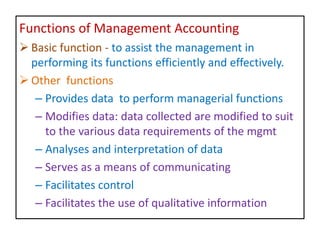

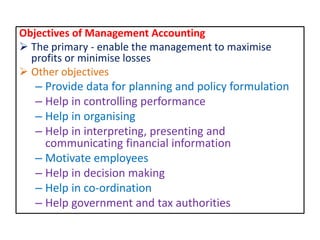

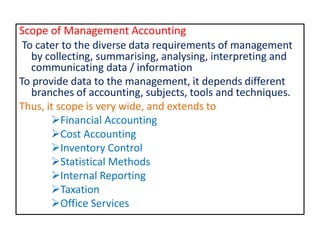

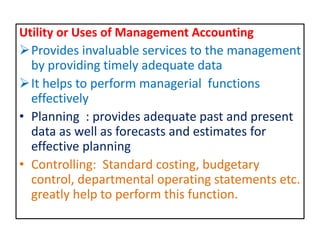

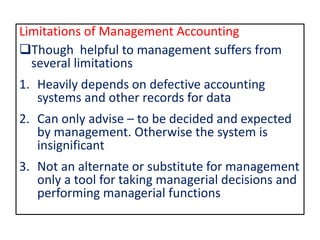

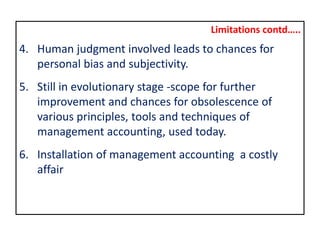

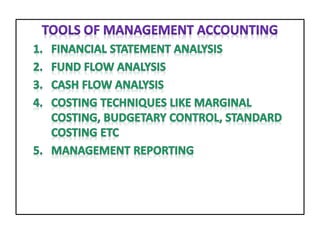

Accounting has existed for centuries and developed over time. Management accounting evolved to provide accounting information tailored to management's needs for decision making, planning, and control. It utilizes techniques like budgeting and standard costing. While valuable for management, management accounting relies on other accounting systems and human judgment, so it has limitations. Overall, it aims to improve organizational efficiency and profitability through informed managerial actions.