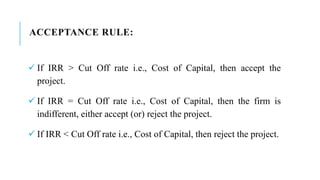

The document discusses capital budgeting, which refers to the planning process used to determine whether long-term investments are worth funding with cash. It defines capital budgeting, outlines its key characteristics and process, and describes various techniques used, including payback period, accounting rate of return, net present value, internal rate of return, and profitability index. It also discusses determining relevant cash flows, the cost of capital, and calculating the weighted average cost of capital.