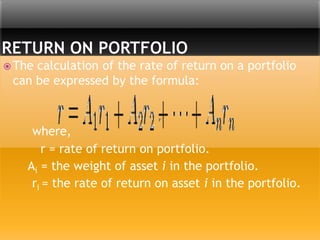

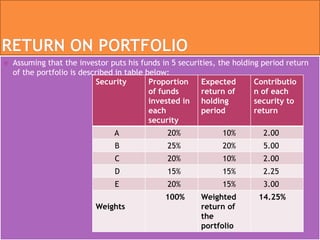

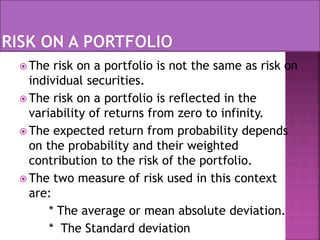

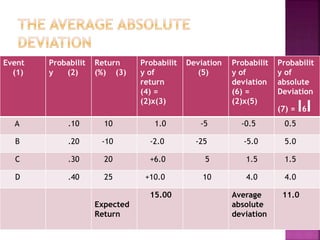

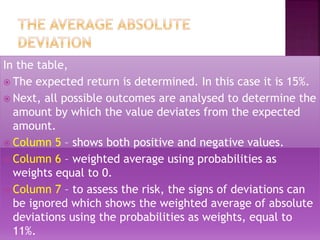

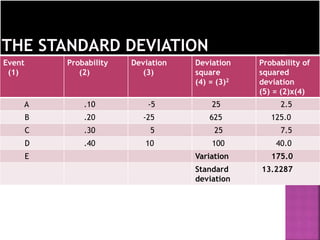

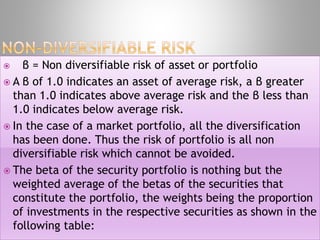

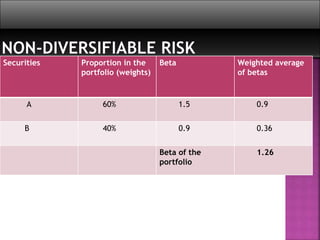

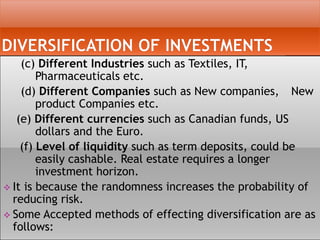

This document discusses portfolio analysis and security analysis. It defines portfolio analysis as determining the future risk and return of holding various combinations of individual securities. Portfolio analysis involves diversifying investments across different assets, industries, and companies to reduce non-systematic risk. The document contrasts traditional portfolio analysis, which focuses on lowest risk securities, with modern portfolio theory, which emphasizes combining high and low risk securities to maximize returns at a given level of risk. Key aspects of portfolio analysis include calculating expected returns, variance, and the standard deviation and beta of a portfolio to measure risk. Diversification is presented as an important tool to reduce unsystematic risk.