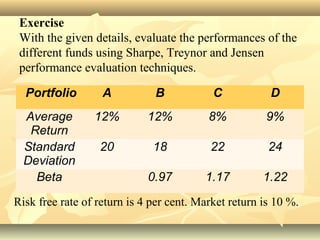

Here are the performance evaluations of funds A, B, C and D using Sharpe, Treynor and Jensen techniques:

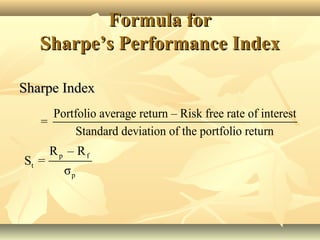

Sharpe Ratio:

A = (12%-4%)/20 = 0.4

B = (12%-4%)/18 = 0.44

C = (8%-4%)/22 = 0.18

D = (9%-4%)/24 = 0.17

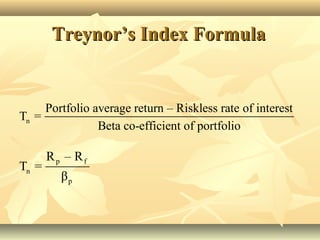

Treynor Ratio:

A = (12%-4%)/0.97 = 0.8

B = (12%-4%)/1.17 = 0.8

C = (8%-4%)/1.22 = 0.4

D = (