1. The document discusses risk on portfolios and individual securities, as well as measures of risk like average absolute deviation and standard deviation.

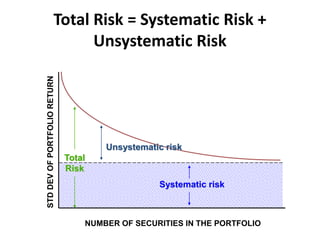

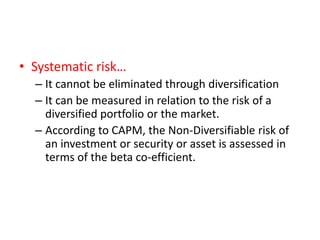

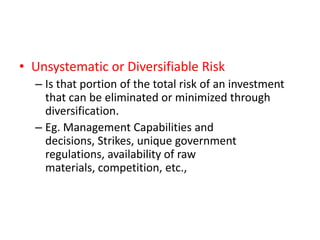

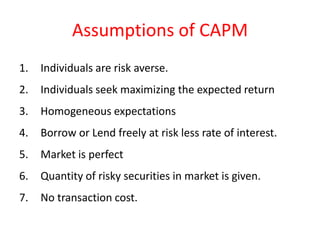

2. It then explains the Capital Asset Pricing Model (CAPM), which relates expected return and systematic risk for assets. CAPM was developed by William Sharpe and considers both systematic and unsystematic risk factors.

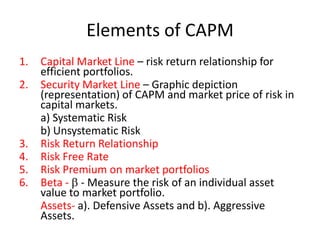

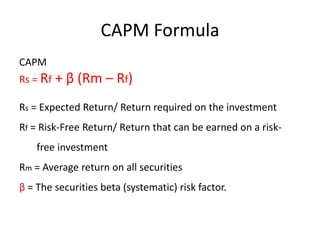

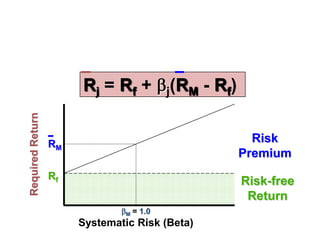

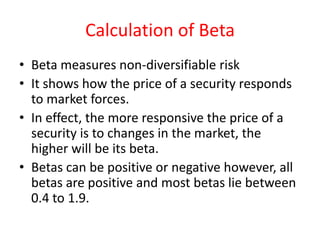

3. The key elements of CAPM are outlined, including the capital market line, security market line, beta as a measure of individual asset risk compared to the market portfolio, and the CAPM formula.