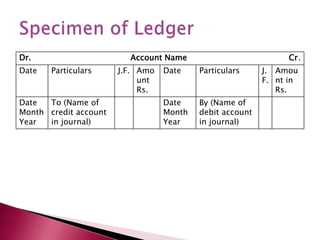

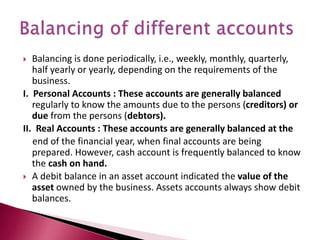

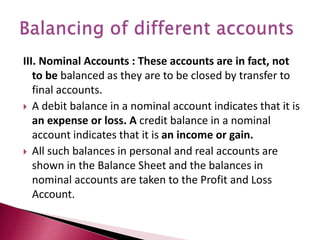

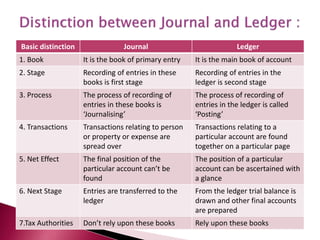

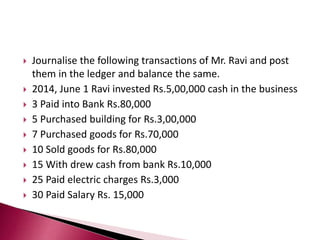

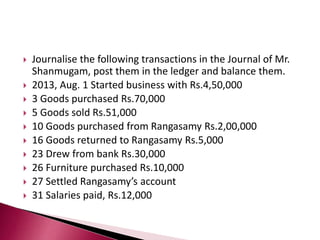

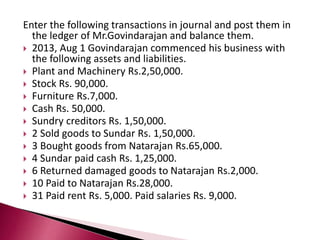

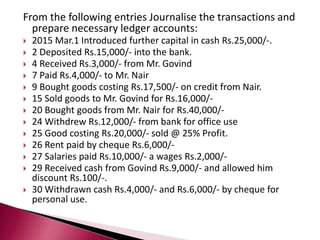

The document discusses the meaning, contents, and purpose of ledgers in accounting. It explains that a ledger is the principal book of accounts that contains all personal, real, and nominal accounts from the journal. Transactions are posted from the journal to the relevant accounts in the ledger. Accounts are balanced by determining the difference between total debits and credits, and the ledger provides a complete record of business transactions and accounting information. Examples are given of ledger layout, posting entries, and balancing accounts.