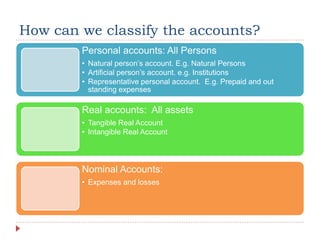

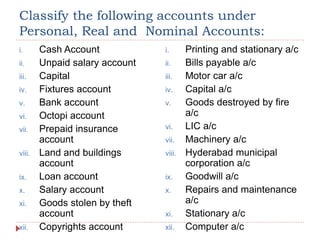

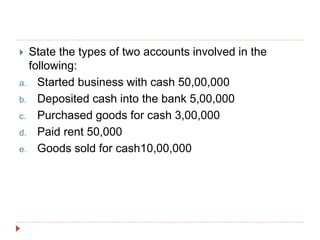

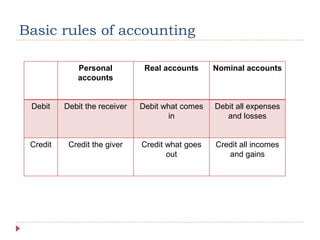

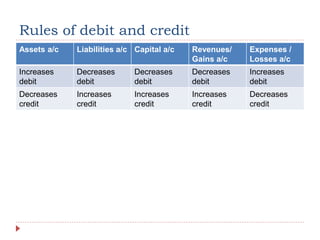

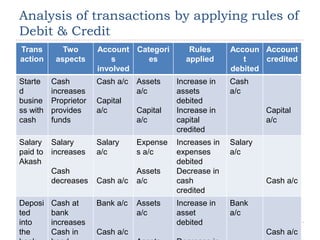

Double entry bookkeeping is a method of recording accounting transactions where every transaction has two equal and opposite accounting entries. The key principle is that for every debit, there must be an equal and opposite credit. Luca Pacioli introduced this system in 1494. It provides more accurate, complete recording of transactions compared to conventional single-entry bookkeeping systems. Accounts are classified as personal, real, or nominal depending on what type of asset, person, or expense/income they represent. Debits and credits follow set rules according to these account types.