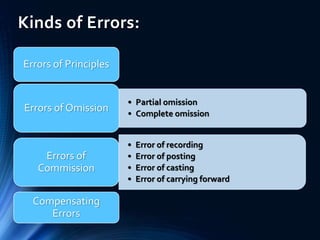

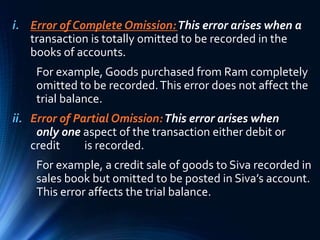

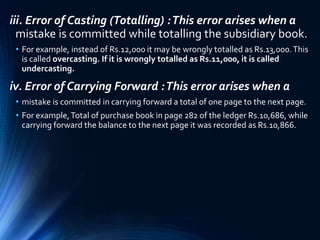

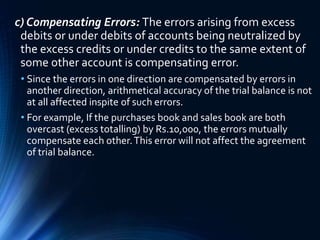

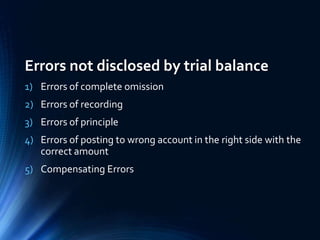

The document discusses the rectification of errors in accounting, outlining various types of errors, such as errors of principles, omission, commission, and compensating errors. It explains how these errors can affect financial documentation, the trial balance, and includes procedures for correcting them, such as the use of a suspense account. The chapter emphasizes the importance of maintaining arithmetical accuracy and proper recording in financial accounting.