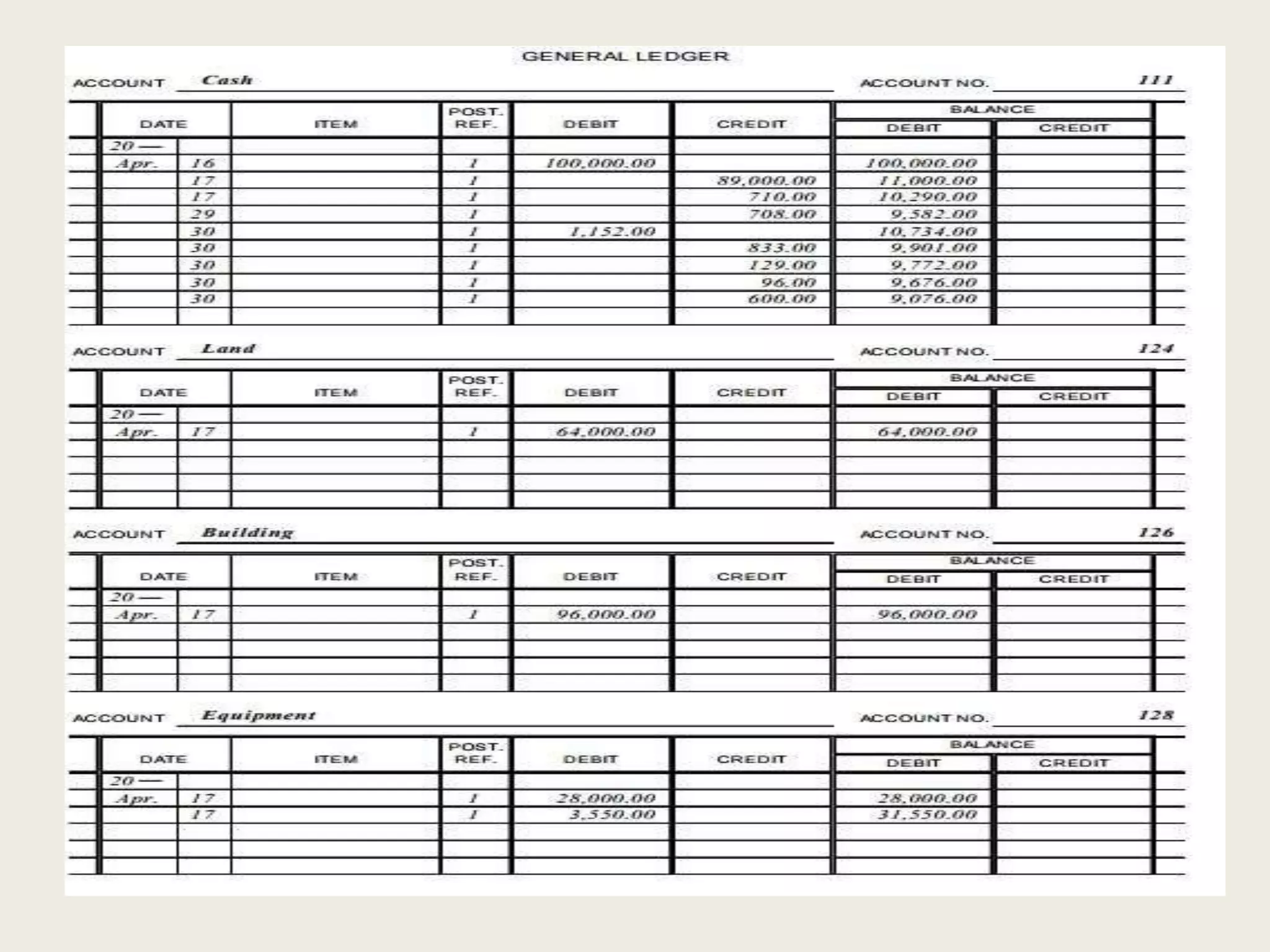

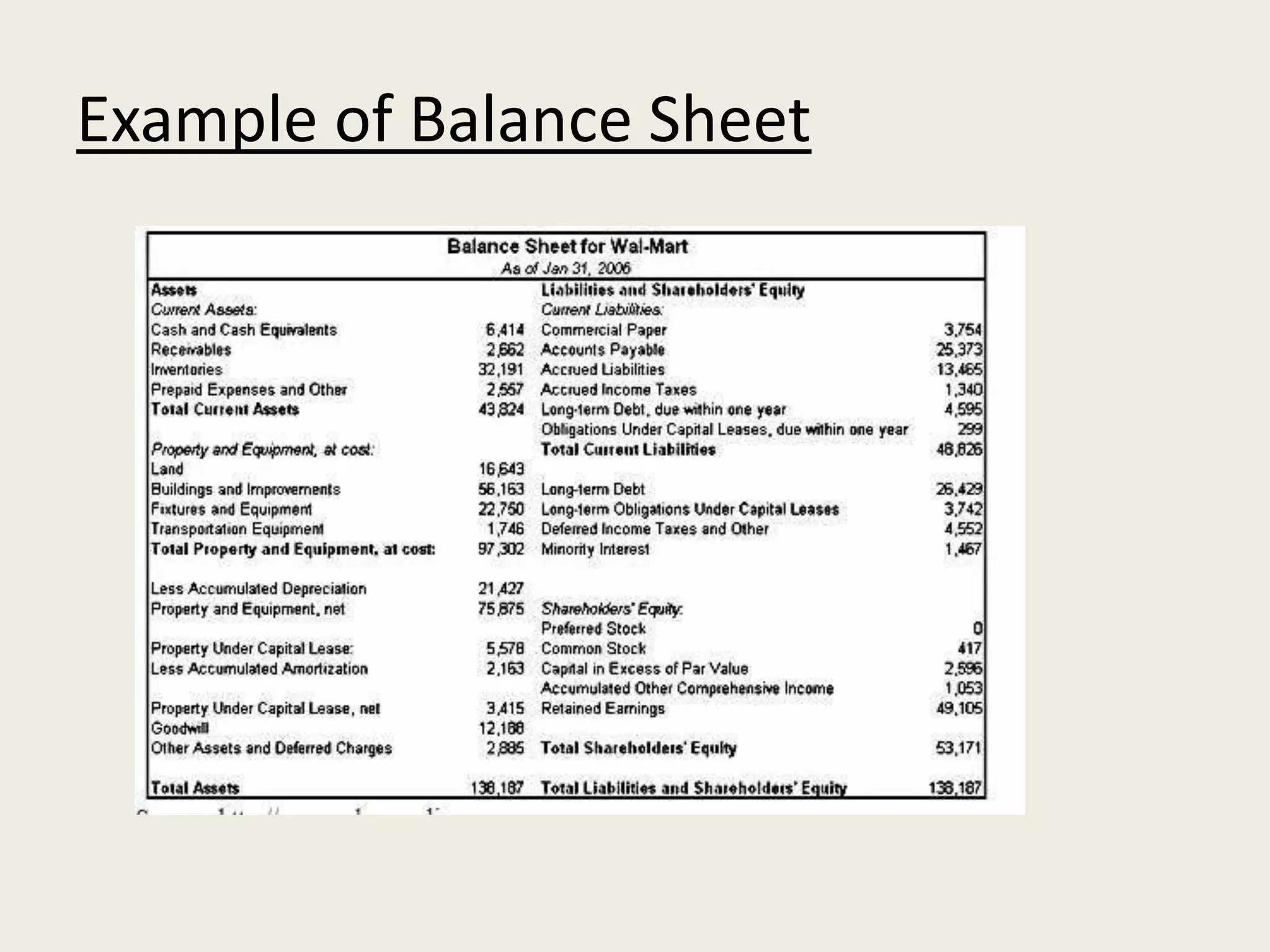

This document provides an overview of basic accounting concepts and processes. It defines key terms like assets, liabilities, equity, revenue, and expenses. It explains accounting transactions and how debits and credits work for different types of accounts. The accounting cycle is summarized as analyzing transactions, journalizing entries, posting to ledger accounts, taking a trial balance, making adjustments, and preparing final financial statements like the income statement and balance sheet. The goal of the accounting system is to ensure the equality of debits and credits is maintained throughout the recording of business events.