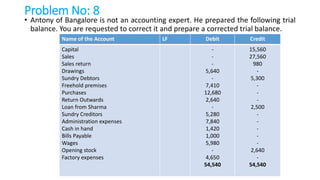

Here are the corrections to Antony's trial balance:

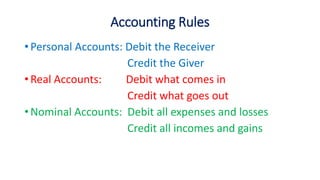

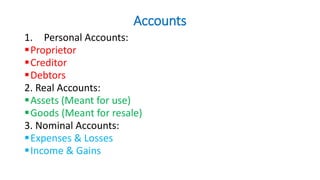

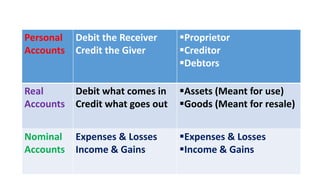

1) Capital and Drawings are personal accounts so they will have debit and credit balances respectively.

2) Freehold premises and Opening stock are asset accounts so they will have debit balances.

3) Sales, Sales return, Loan from Sharma, Bills Payable are nominal accounts so they will have credit balances.

4) Sundry Debtors, Sundry Creditors, Cash in hand are asset/liability accounts so they will have debit/credit balances respectively.

5) Purchases and Return Outwards are nominal accounts so they will have debit balances.

6) Administration expenses, Wages, Factory expenses are expense accounts so they will have