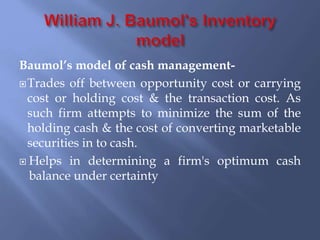

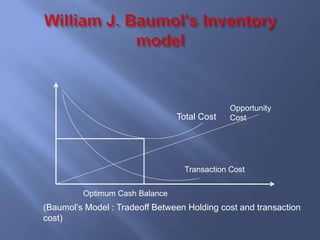

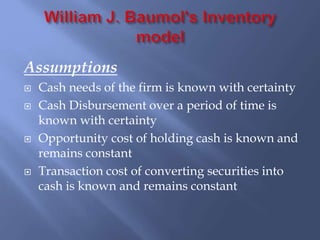

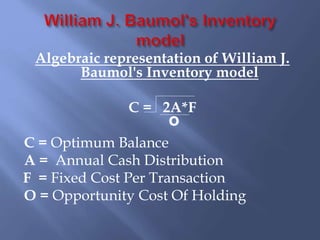

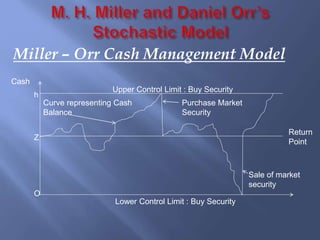

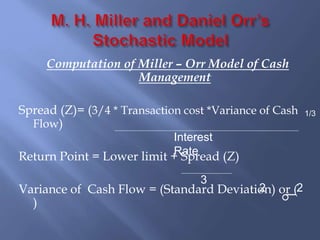

The document outlines key aspects of cash management, discussing both narrow and broad definitions of cash, including near-cash assets. It emphasizes the importance of managing cash flows, cash planning, and the various motives for holding cash, such as transaction, precautionary, and speculative motives. Furthermore, it reviews cash management models like Baumol’s and Miller-Orr’s, highlighting their applications and limitations in determining optimal cash balance under different scenarios.