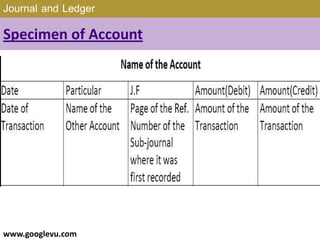

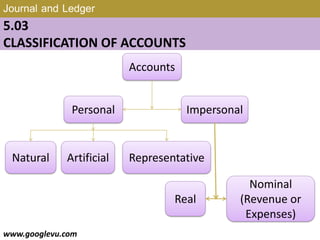

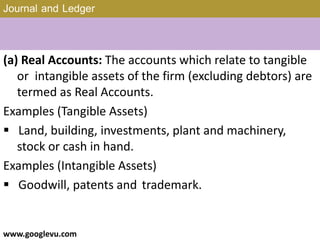

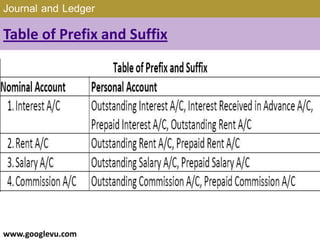

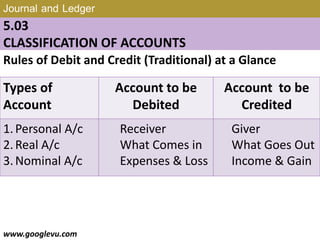

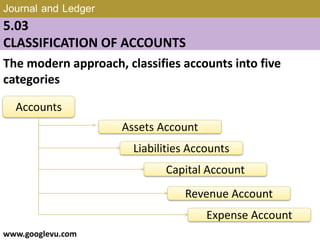

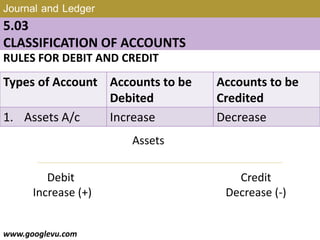

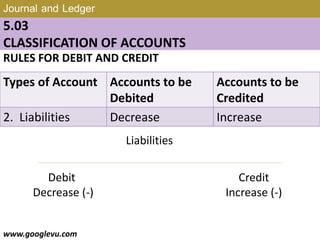

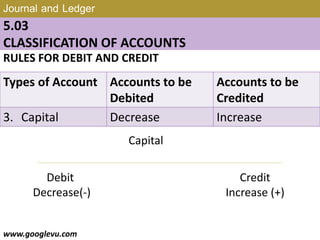

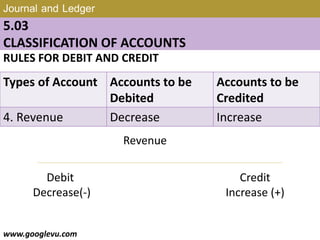

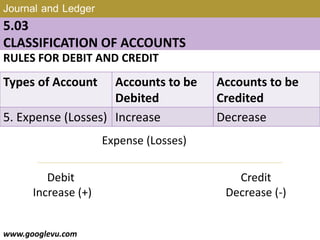

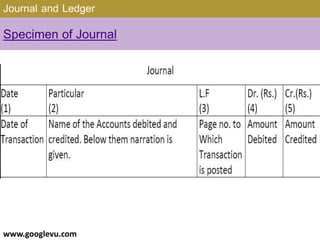

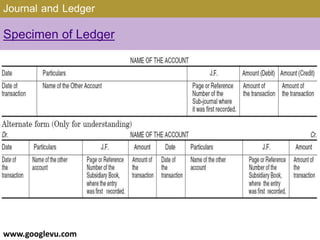

Chapter 5 discusses the journal and ledger, introducing key concepts such as the meaning of accounts, the roles of debit and credit, and classifications of accounts (traditional and modern). It explains the process of journalizing, including simple and compound entries, and details the structure and purpose of ledgers. Additionally, it covers the sub-division of journals into various types for specific transactions and the mechanics of balancing ledger accounts.