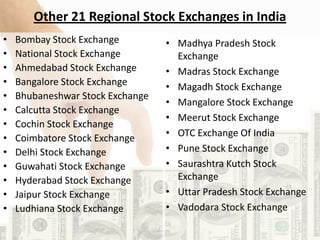

The capital market is a financial system that facilitates the exchange of money between those with excess capital and those in need, focusing on long-term investments such as shares and bonds. It includes primary markets for new securities and secondary markets for trading previously issued securities, supported by various suppliers and borrowers. Regulatory bodies, like SEBI and RBI, oversee market operations to protect investors and ensure stability, while numerous stock exchanges in India and internationally provide trading platforms.