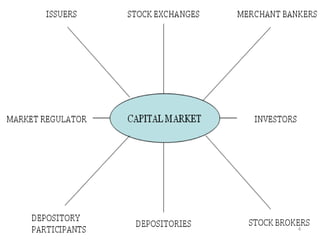

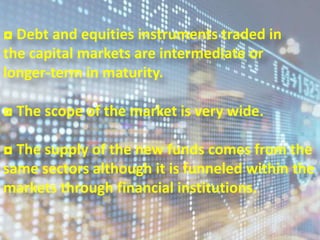

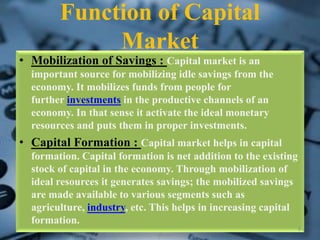

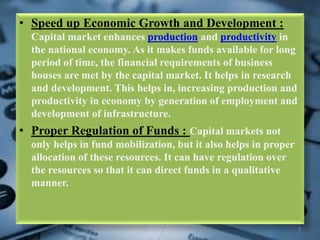

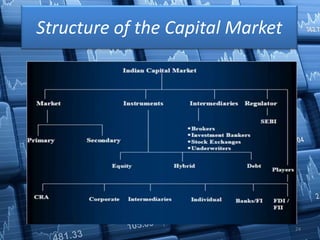

The capital market is a complex system that facilitates the mobilization of long-term funds for businesses, government, and individuals, with instruments like debt and equities. It plays a crucial role in capital formation, economic growth, and the proper allocation of resources while providing a continuous investment avenue and liquidity for investors. Key factors affecting capital structure decisions include cash flow, cost of debt, and equity expectations, along with the regulatory environment shaped by institutions like SEBI and recent reforms.