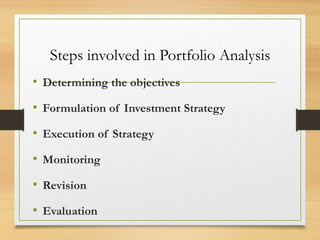

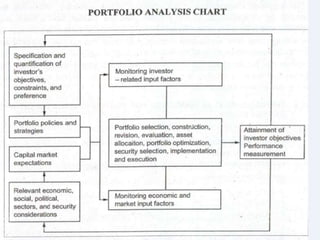

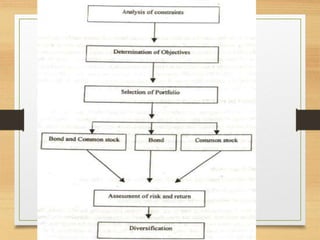

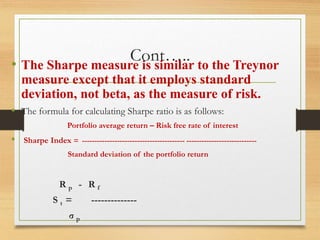

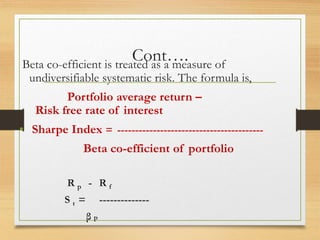

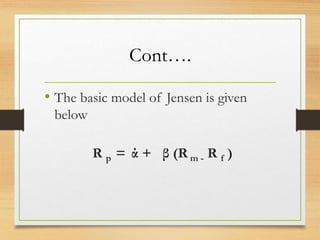

This document defines key concepts related to portfolio management including portfolio, portfolio analysis, construction, and evaluation. A portfolio is a combination of different financial securities like stocks, bonds, and cash held by investors. Portfolio management involves identifying objectives, developing strategies, monitoring performance, and evaluating results. Portfolio analysis assesses the risks of an entity's business areas. Construction requires determining objectives and formulating investment strategies. Evaluation models like Sharpe ratio, Treynor ratio, and Jensen measure are used to assess risk-adjusted performance.