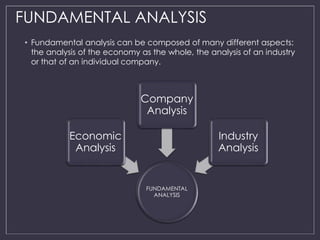

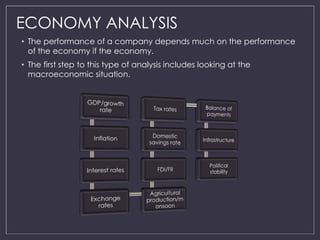

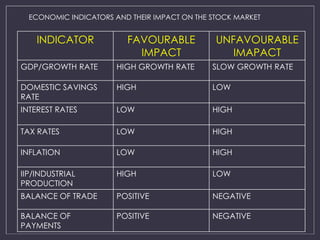

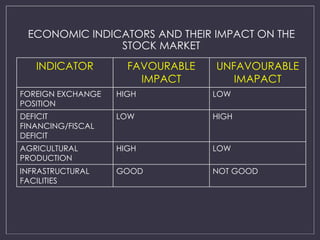

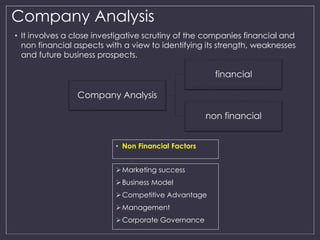

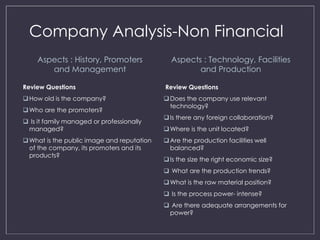

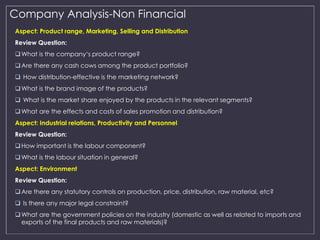

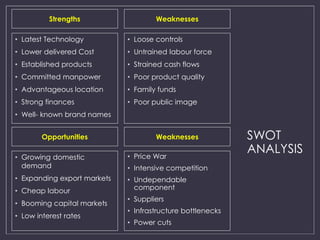

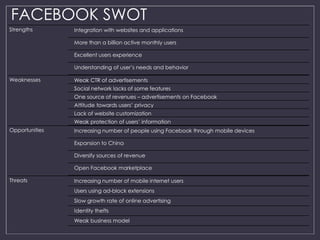

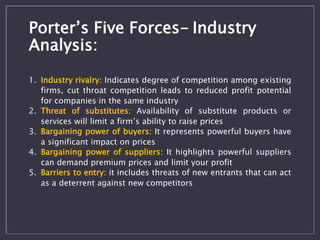

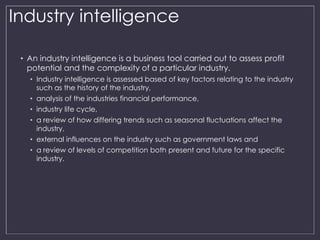

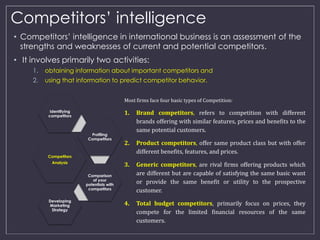

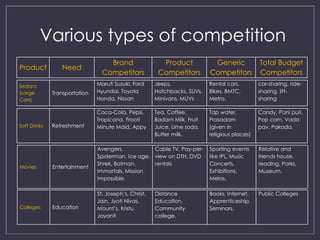

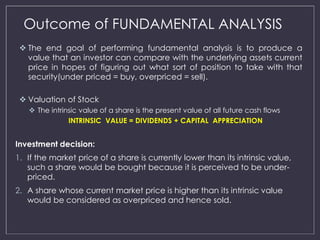

This document discusses fundamental analysis techniques for evaluating securities. It defines fundamental analysis as focusing on underlying business factors like financials, management, and prospects to determine a security's value. The document outlines different levels of analysis, including analyzing the overall economy, individual industries, and specific companies. It provides examples of analyzing economic indicators, using Porter's Five Forces for industry analysis, evaluating competitors, and assessing profitability metrics. The goal of fundamental analysis is to answer questions about a company's growth, profits, competitive positioning, debt repayment ability, and accounting practices.