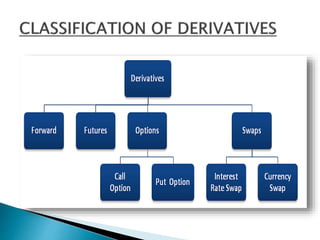

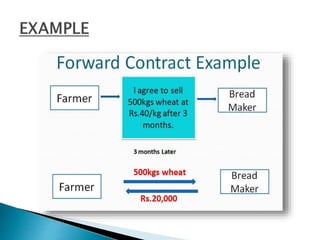

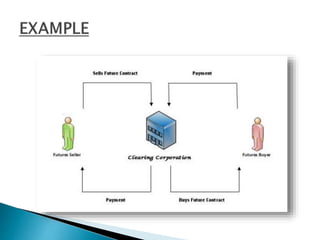

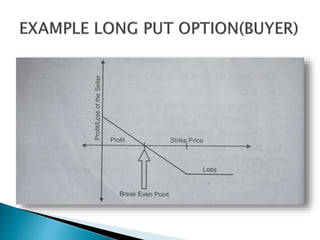

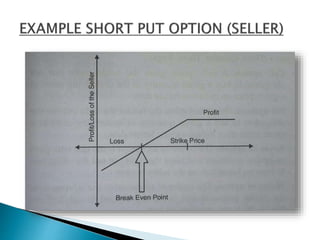

Derivatives derive their value from underlying assets such as equities, debt, currencies, and indices. Derivatives contracts include forwards, futures, options, and swaps. Forwards and futures are agreements to buy or sell an asset at a future date, while options provide the right but not obligation to buy or sell. Swaps involve exchanging cash flows of an underlying asset. Derivatives can be used for hedging risk, speculation, or arbitrage opportunities between markets.