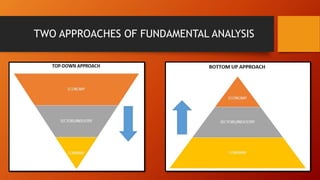

Fundamental analysis involves examining qualitative and quantitative factors related to a security to determine its intrinsic value. This includes analyzing macroeconomic factors like the overall economy and industry conditions, as well as company-specific factors like financial statements and management. There are two approaches to fundamental analysis: economy analysis which focuses on outputs like GDP, unemployment, and inflation; and industry analysis which evaluates demand, supply, and competitiveness. Company analysis delves into the balance sheet, financial position, products/services, and uses financial ratios to evaluate profitability, liquidity, activity, debt, market performance, and capital budgeting. Fundamental analysis provides valuable insights but should be approached cautiously given potential biases.