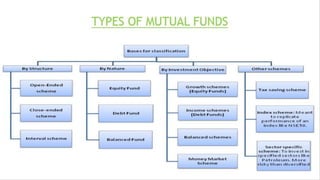

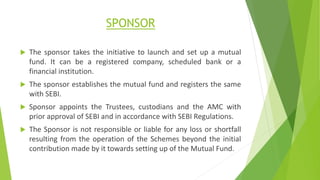

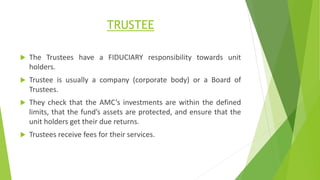

This document provides an overview of mutual funds in India. It introduces the presenters and defines mutual funds as vehicles for mobilizing savings that are important for economic growth. It then outlines the history and growth of mutual funds in India in four phases from 1964 to the present. It describes the key structures of open-ended, closed-ended, and interval funds. It also categorizes funds by nature, investment objective, and other schemes. The document discusses the advantages of diversification and professional management as well as the disadvantages of lack of control over costs. Finally, it outlines the roles of the sponsor, trustee, and asset management company in operating mutual funds.