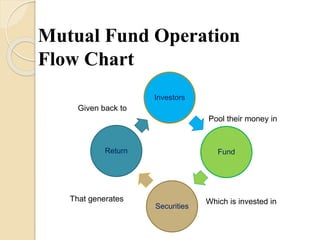

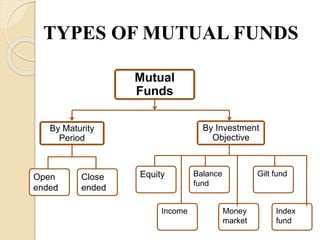

A mutual fund is an investment tool that pools money from many investors and invests it in stocks, bonds, and other securities. The document summarizes the history and growth of mutual funds in India from 1963 to the present in four phases. It describes the types of mutual funds including by maturity, investment objective, and advantages for investors such as portfolio diversification, professional management, reduced costs and risk, and liquidity.