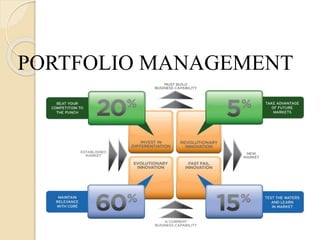

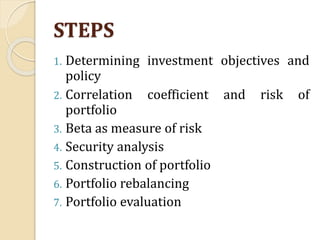

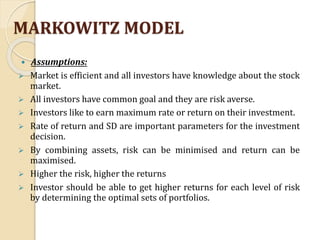

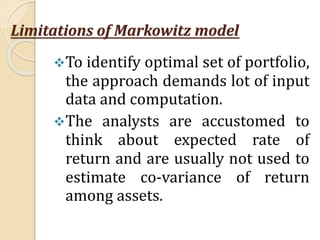

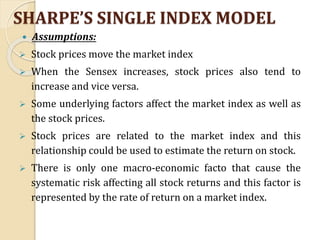

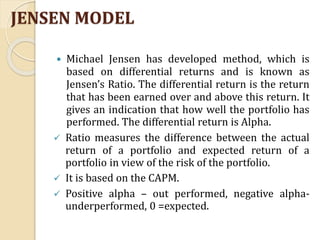

This document discusses various models for portfolio management including the Markowitz model, Sharpe's single index model, Jensen model, and Treynor's model. The Markowitz model aims to minimize risk and maximize return by combining assets. Sharpe's single index model assumes stock prices move with the market index. The Jensen model measures performance by calculating alpha, the return over the expected return based on the risk of the portfolio. Treynor's model measures excess return per unit of systematic risk as measured by a portfolio's beta.