The document summarizes the Lintner and Modigliani-Miller (MM) dividend models.

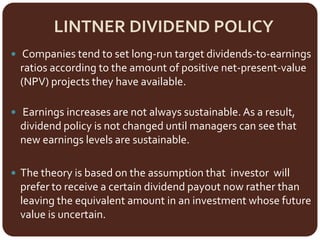

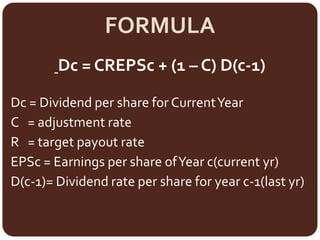

The Lintner model states that companies set long-run dividend to earnings ratios based on available investment opportunities. Dividend policy does not change until new earnings levels are seen as sustainable.

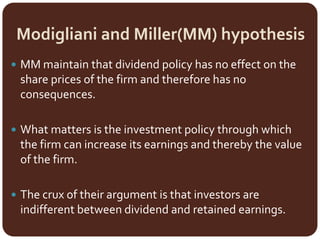

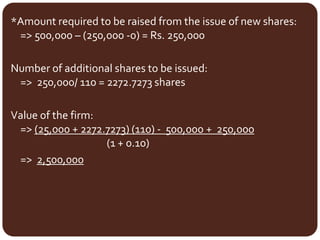

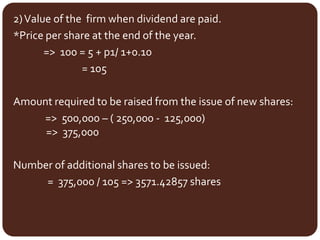

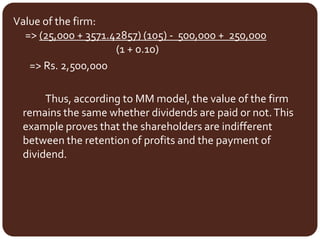

The MM hypothesis argues that dividend policy does not affect share prices or firm value. What matters is the investment policy that increases earnings. Investors are indifferent between dividends and retained earnings.

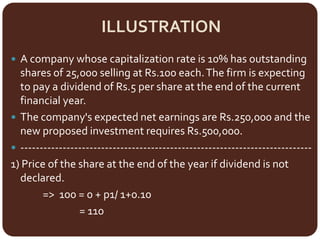

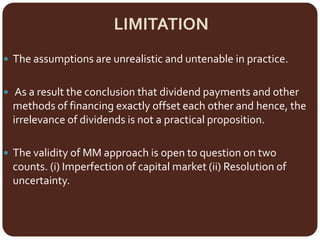

An example shows that under the MM assumptions, the value of a firm remains the same whether dividends are paid or not, proving shareholders' indifference between retention and dividends. However, the MM assumptions are unrealistic and