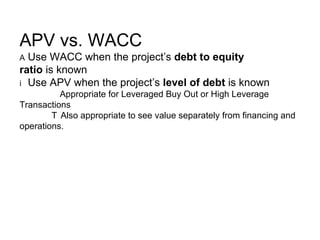

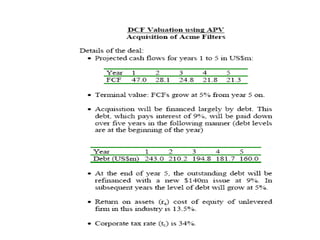

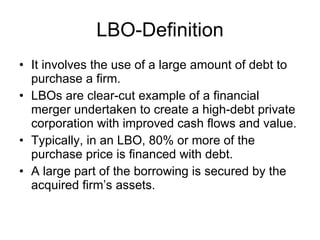

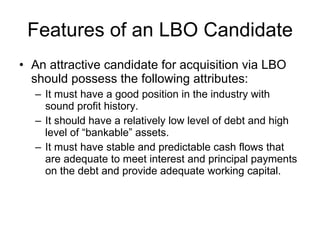

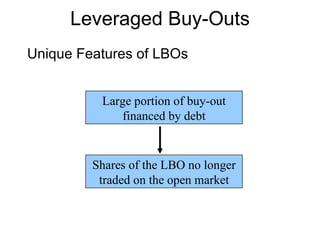

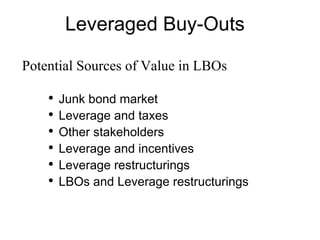

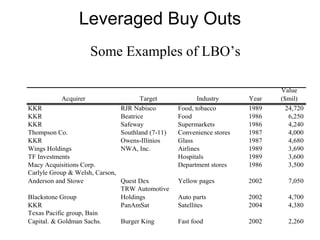

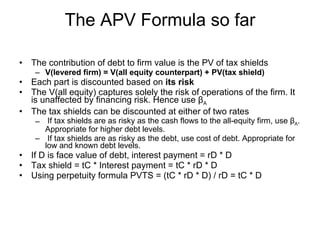

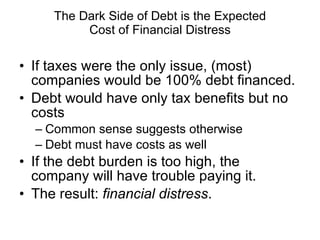

Leveraged buyouts (LBOs) involve using a large amount of debt to purchase a firm. Typically over 80% of the purchase price is financed through debt secured by the acquired firm's assets. Good LBO candidates have stable cash flows to service the debt, assets to collateralize loans, and a strong competitive position. The APV (adjusted present value) method values a leveraged firm by separately considering the value of operations and tax benefits of debt net of distress costs from high leverage.

![Full APV formula The value of a leveraged firm is: V(with debt) = V(all equity) + PV[tax shield] – PV[costs of distress] PV(costs of distress) depends on: Probability of distress Magnitude of costs encountered if distress occurs This is the full APV formula](https://image.slidesharecdn.com/leveragedbuyouts-100624104832-phpapp02/85/Leveraged-buy-outs-20-320.jpg)