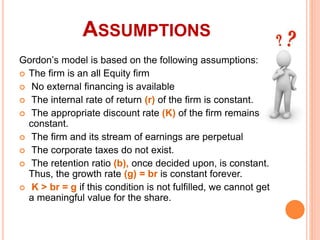

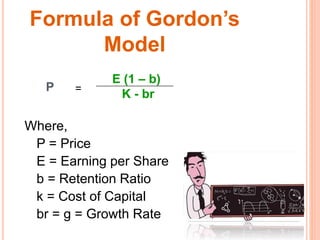

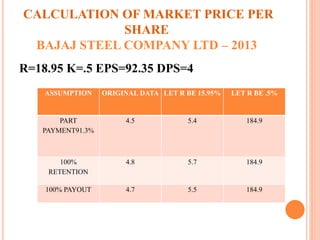

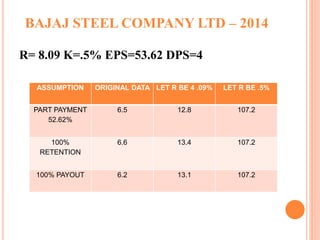

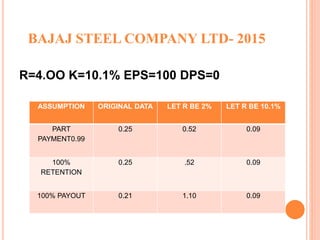

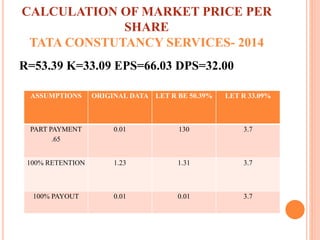

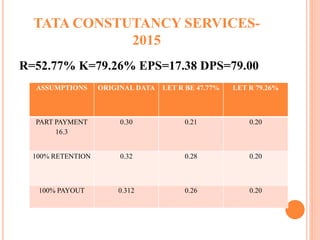

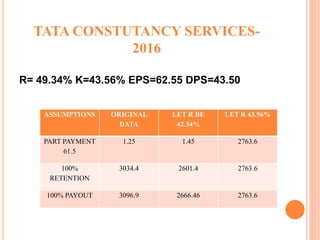

Gordon's model posits that a firm's dividend policy impacts its value and that share price reflects the present value of future dividends. The model assumes conditions such as a constant internal rate of return and a perpetual earnings stream, with the market price derived from future dividend payouts. The researcher concluded that the model was disproven for both Bajaj Steel and Tata Consultancy Services across the analyzed years.