This document summarizes the efficient market hypothesis (EMH) in three sentences:

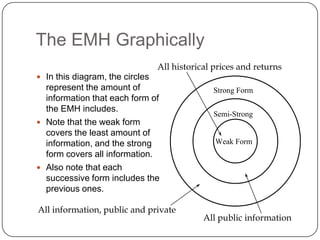

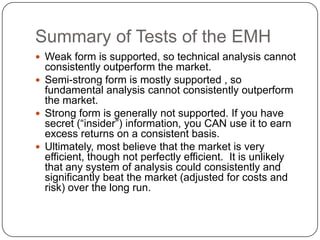

The EMH states that market prices fully reflect all available public information and adjust instantly to new information. It has three forms - weak, semi-strong, and strong - with each form incorporating more types of information. Most research supports the weak and semi-strong forms, finding that historical data and public information are reflected in prices, but the strong form is not supported as non-public information can be used to earn excess returns.