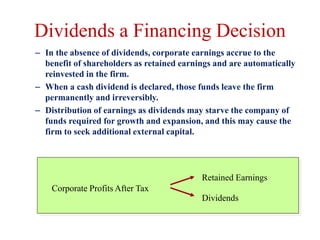

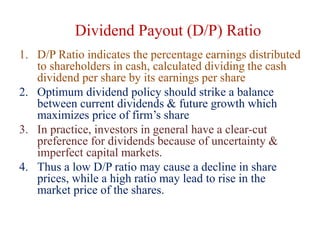

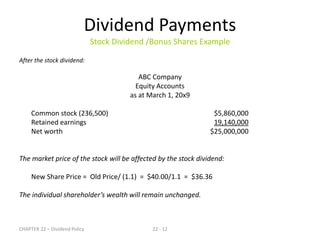

This document discusses dividend theory and policy. It explains that in the absence of dividends, corporate earnings accrue to shareholders as retained earnings that are automatically reinvested in the firm. However, when dividends are declared, those funds leave the firm permanently. The document then outlines several factors that determine a firm's dividend policy, including dividend payout ratio, stability of dividends, legal restrictions, and owners' considerations. It provides examples and explanations of different types of dividend payments, including cash dividends, stock dividends, stock splits, and share repurchases.

![CHAPTER 22 – Dividend Policy 22 - 14

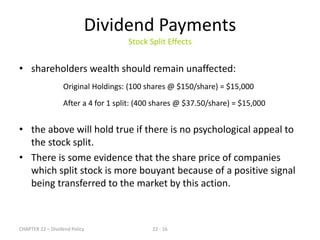

Dividend Payments

Stock Split Example

The Board of Directors of XYZ Company is considering using a stock split to put its

shares into a better trading range. They are confident that the firm’s stock price will

continue to rise given the firm’s outstanding financial performance. Currently, the

company’s shares are trading for $150 and the company’s shareholders equity accounts

are as follows:

Commons shares (100,000 outstanding) $1,500,000

Retained earnings 15,000,000

Net Worth $16,500,000

A 2 for 1 Stock Split:

New Share Price = P0[1/(2/1)] = $150[1/(2/1)] = $150[.5] = $75.00

The firm’s equity accounts:

Commons shares (200,000 outstanding) $1,500,000

Retained earnings 15,000,000

Net Worth $16,500,000](https://image.slidesharecdn.com/dividendtheorypolicy-170303055735/85/Dividend-theory-amp-policy-14-320.jpg)

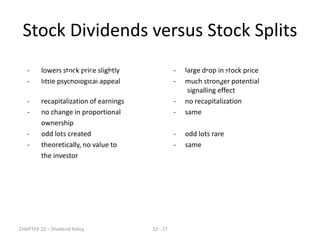

![CHAPTER 22 – Dividend Policy 22 - 15

Dividend Payments

Further Stock Split Examples

A 4 for 3 Stock Split:

New Share Price = P0[1/(4/3)] = $150[1/(4/3)] = $150[.75] = $112.50

The firm’s equity accounts:

Commons shares (133,333 outstanding) $1,500,000

Retained earnings 15,000,000

Net Worth $16,500,000

A 3 for 4 Reverse Stock Split:

New Share Price = P0[1/(3/4)] = $150[1/(3/4)] = $150[1.33] = $200.00

The firm’s equity accounts:

Commons shares (75,000 outstanding) $1,500,000

Retained earnings 15,000,000

Net Worth $16,500,000

Clearly the Board can use stock splits and reverse stock splits to place the firm’s stock in a particular

trading range.](https://image.slidesharecdn.com/dividendtheorypolicy-170303055735/85/Dividend-theory-amp-policy-15-320.jpg)