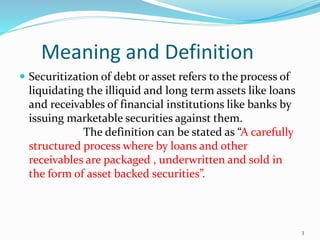

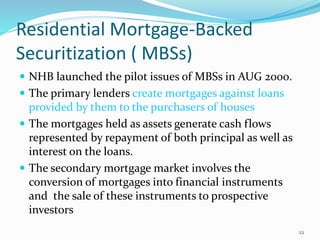

This document discusses securitization and housing finance in India. It begins by defining securitization as the process of liquidating illiquid long-term assets like loans and receivables by issuing marketable securities against them. It then outlines the key parties and stages involved in securitization. Some benefits of securitization include additional funding, profitability, and risk spreading. Housing finance and the role of the National Housing Bank in promoting affordable housing are also summarized. Securitization has grown the Indian debt market and housing finance sector.