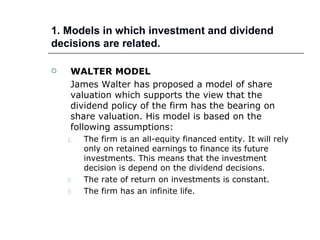

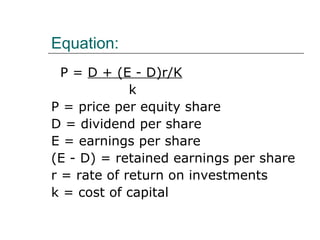

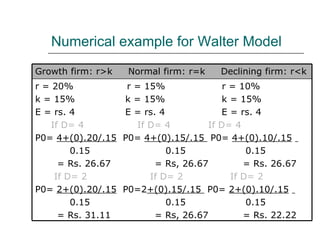

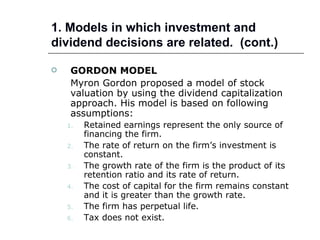

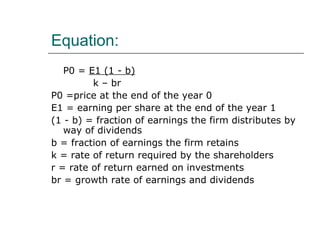

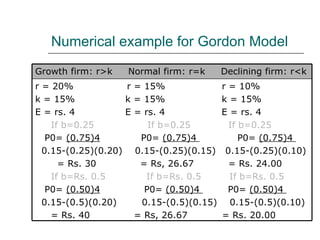

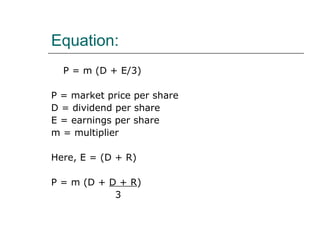

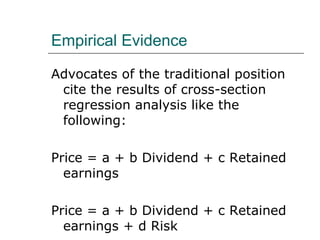

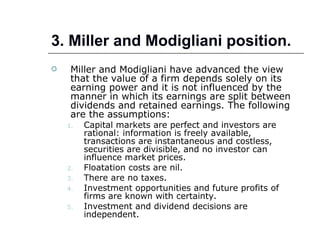

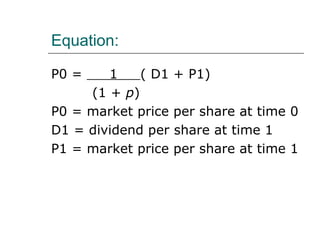

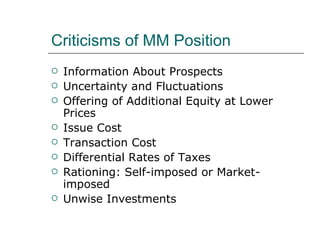

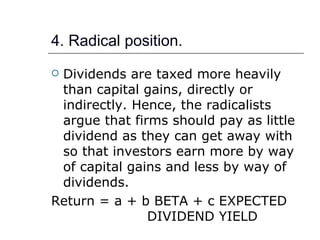

This document discusses dividend policy and its impact on firm value. It covers 5 sections: 1) Models relating investment and dividend decisions, including the Walter and Gordon models. 2) The traditional view that the market values dividends more than retained earnings. 3) The Miller-Modigliani position that dividend policy does not impact value under certain assumptions. 4) The radical view that dividends should be minimized due to tax advantages of capital gains. 5) An overall picture of two broad schools of thought on the relationship between dividends and share value.