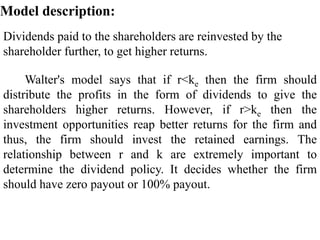

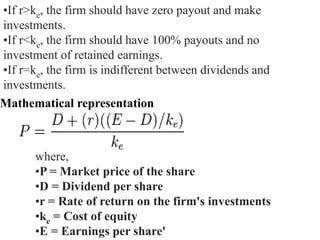

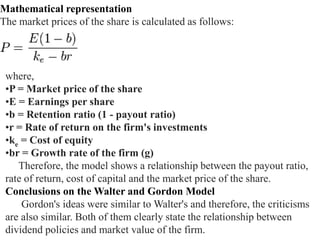

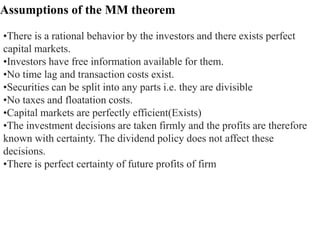

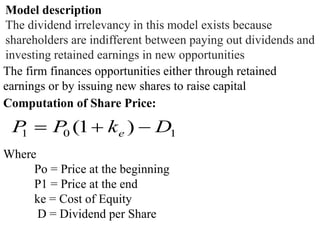

The document discusses dividend policy and models used in Indian corporate sectors. It provides an overview of Walter's model, Gordon's model, and the Modigliani-Miller model. Walter's model shows the relationship between return on investment, cost of equity, and dividend payout ratio. Gordon's model incorporates a growth rate determined by retention ratio and return on investment. The Modigliani-Miller theorem states that dividend policy does not impact firm value if markets are efficient. The document also discusses typical Indian corporate dividend practices and factors affecting dividend policy decisions.