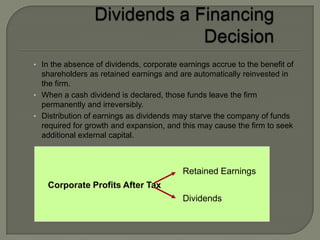

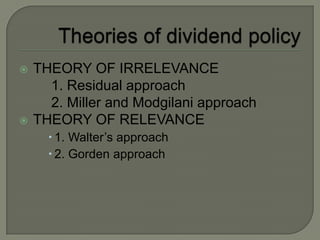

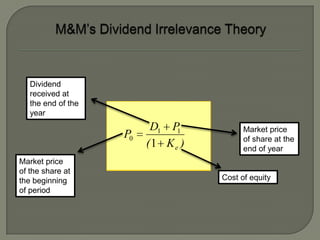

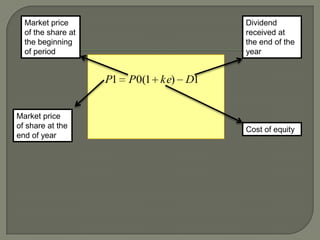

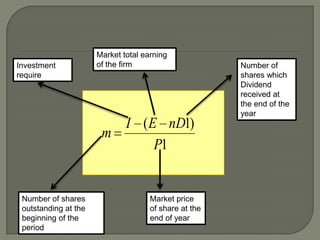

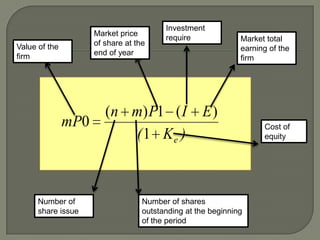

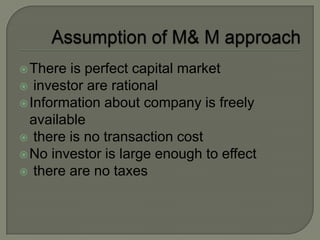

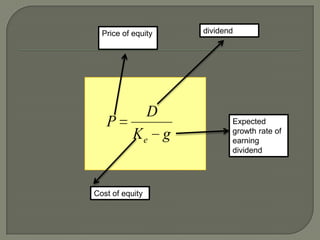

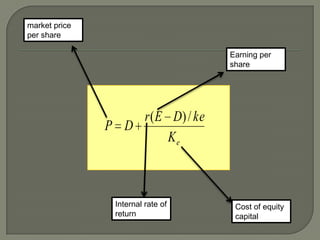

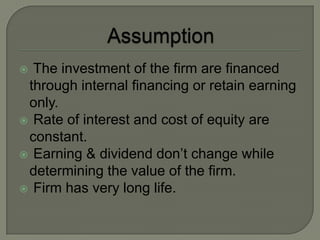

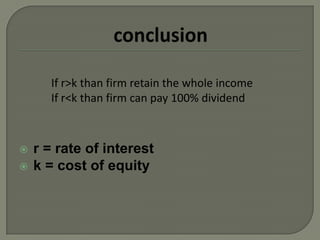

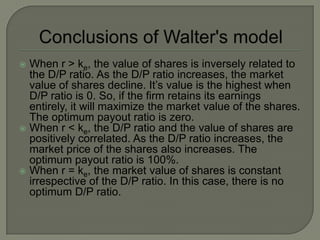

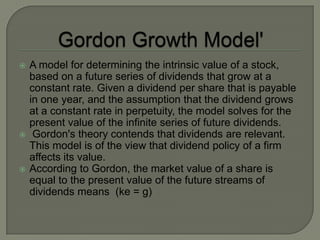

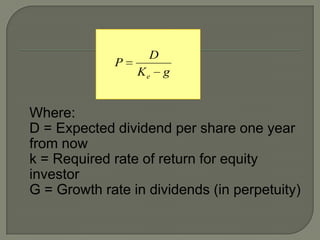

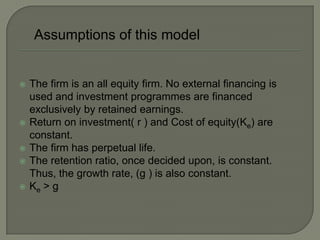

The document discusses dividend policy and its theories of relevance and irrelevance. It states that dividend policy refers to a board's decision on distributing residual earnings to shareholders. There are two choices - pay dividends or reinvest funds. The theories of irrelevance suggest dividend policy does not impact stock price or cost of capital, while relevance theories like Walter's model and Gordon's model suggest dividends are relevant. Gordon's model shows the value of a stock is equal to the present value of future perpetual dividend growth at a constant rate.