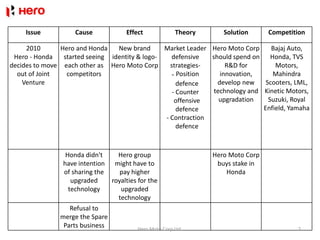

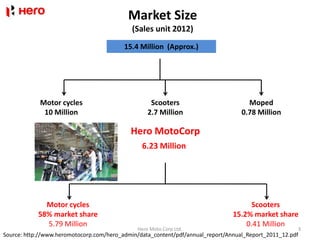

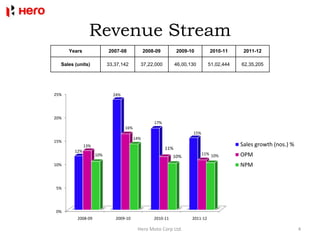

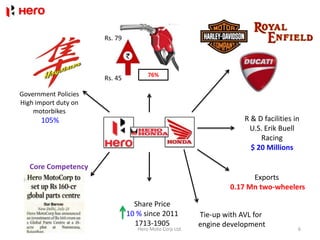

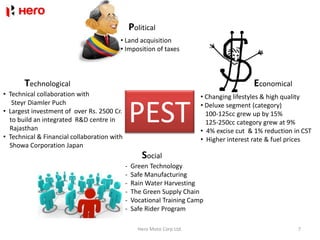

Hero Moto Corp Ltd. is an Indian motorcycle and scooter manufacturer formerly known as Hero Honda. In 2010, Honda decided to move out of the joint venture, leading Hero and Honda to see each other as competitors. This caused issues around brand identity, technology sharing, and royalty payments that Hero Moto Corp had to address. It responded with defensive marketing strategies and buying a stake in Honda. The document discusses Hero Moto Corp's market share and competitors, revenue growth, bargaining power with suppliers and customers, R&D investments, and political, technological, economic, and social factors influencing its business environment.