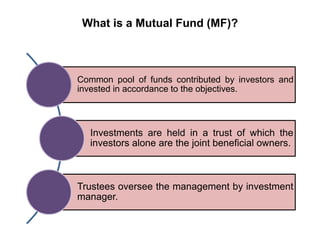

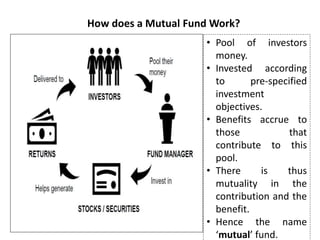

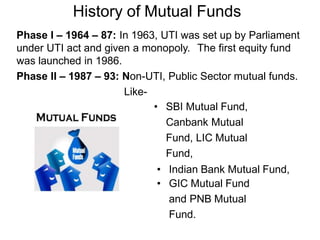

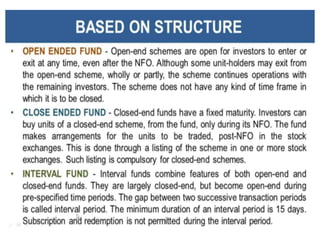

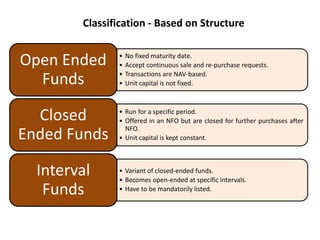

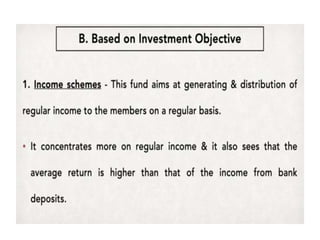

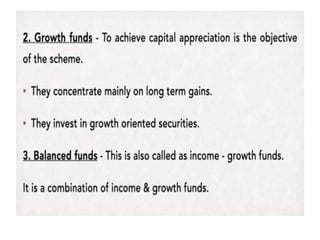

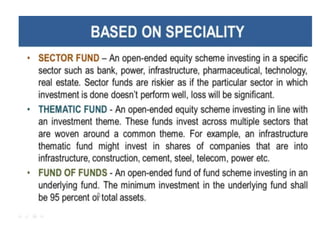

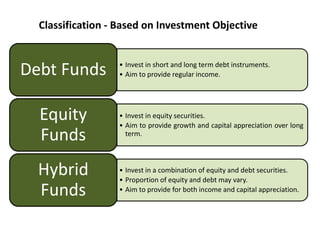

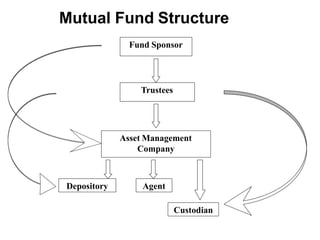

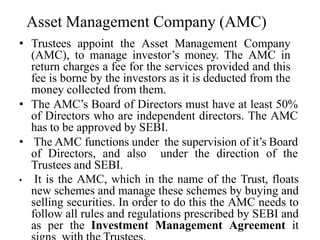

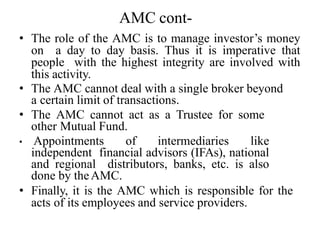

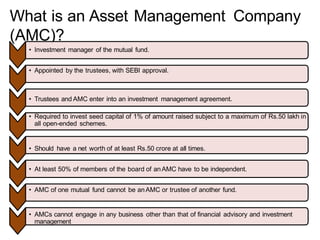

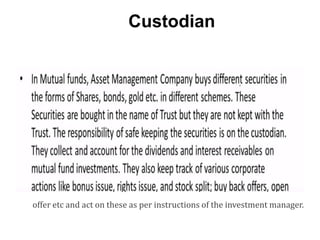

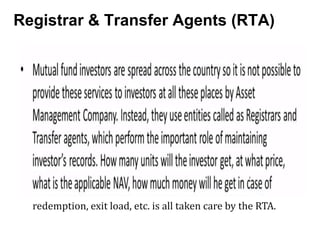

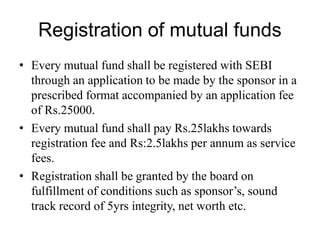

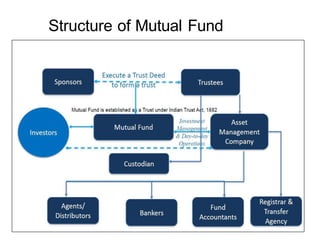

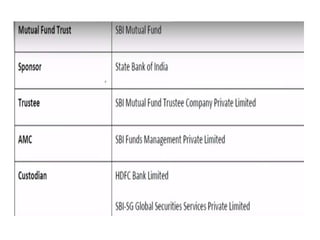

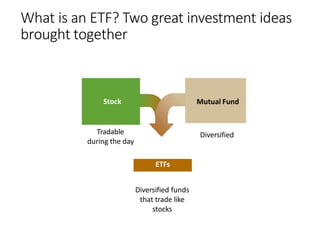

Mutual funds allow investors to pool their money together into a portfolio that is professionally managed. The document discusses different types of mutual funds such as equity funds, bond funds, and balanced funds, which invest in a mix of equity and debt. It also discusses the structure of mutual funds in India, which follows a three-tier model consisting of sponsors, trustees, and asset management companies (AMCs). AMCs manage the day-to-day activities of the mutual fund and charge fees. Overall, the document provides an overview of what mutual funds are, how they work, their benefits, and the different parties involved in mutual funds.