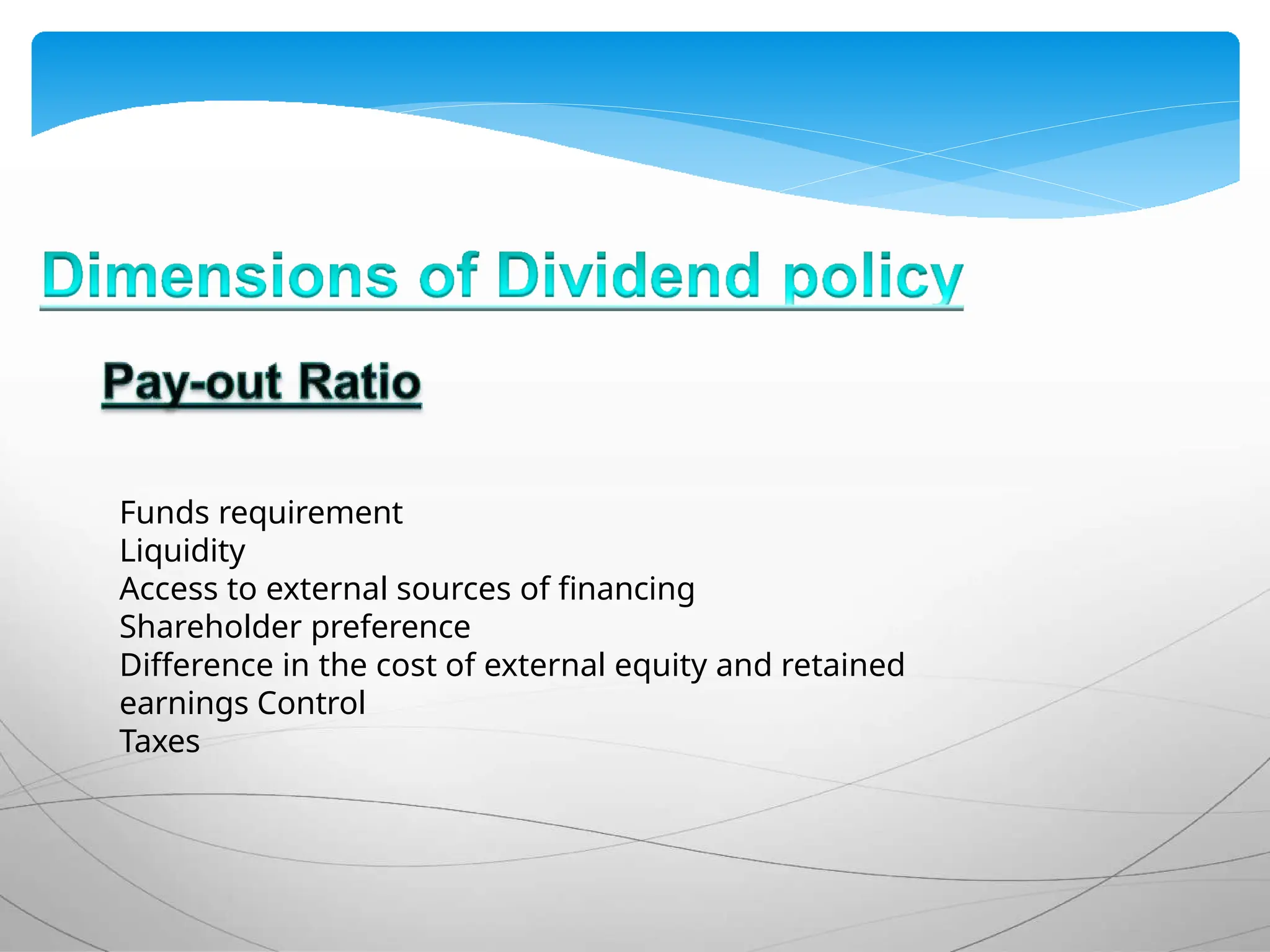

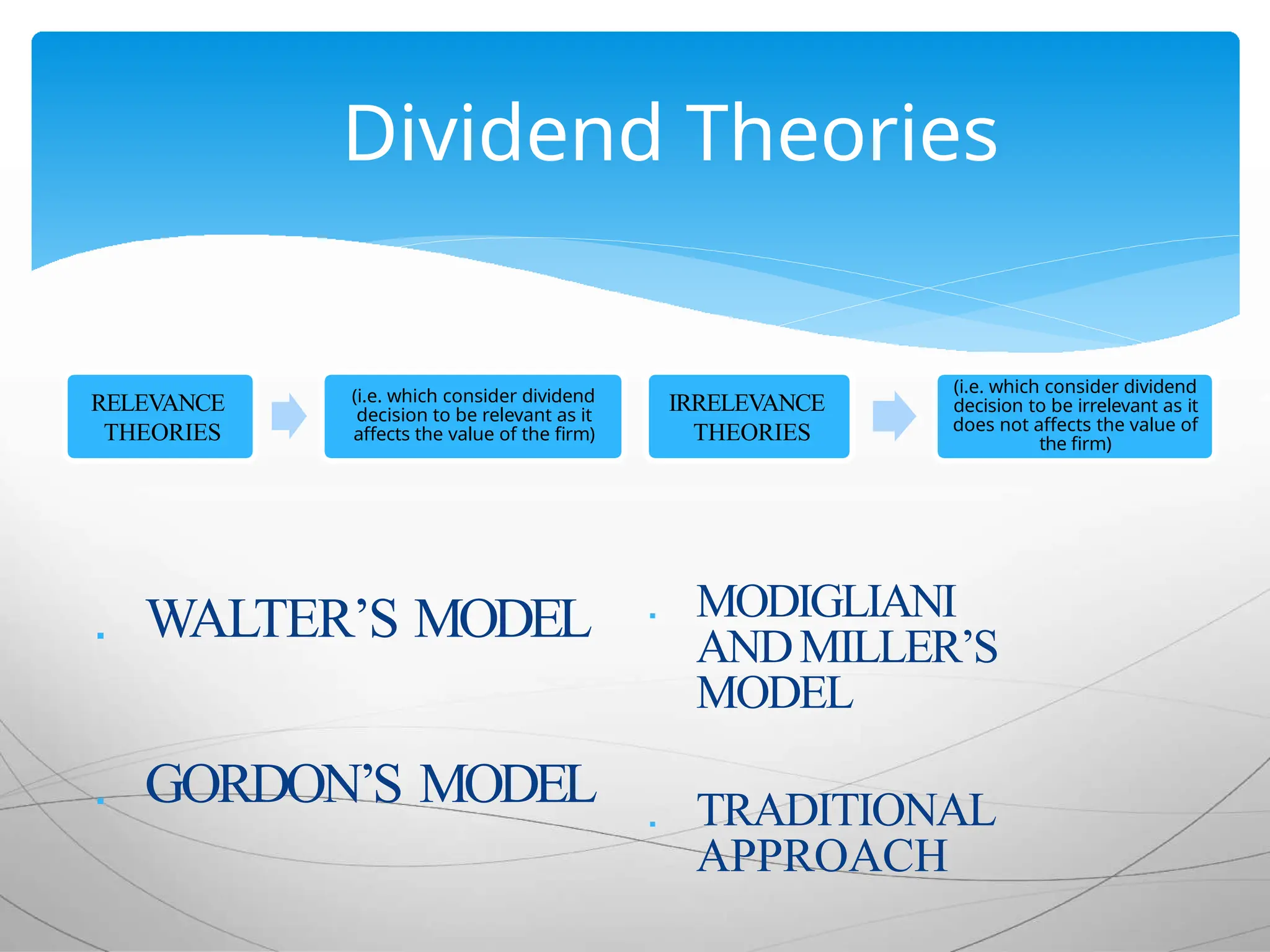

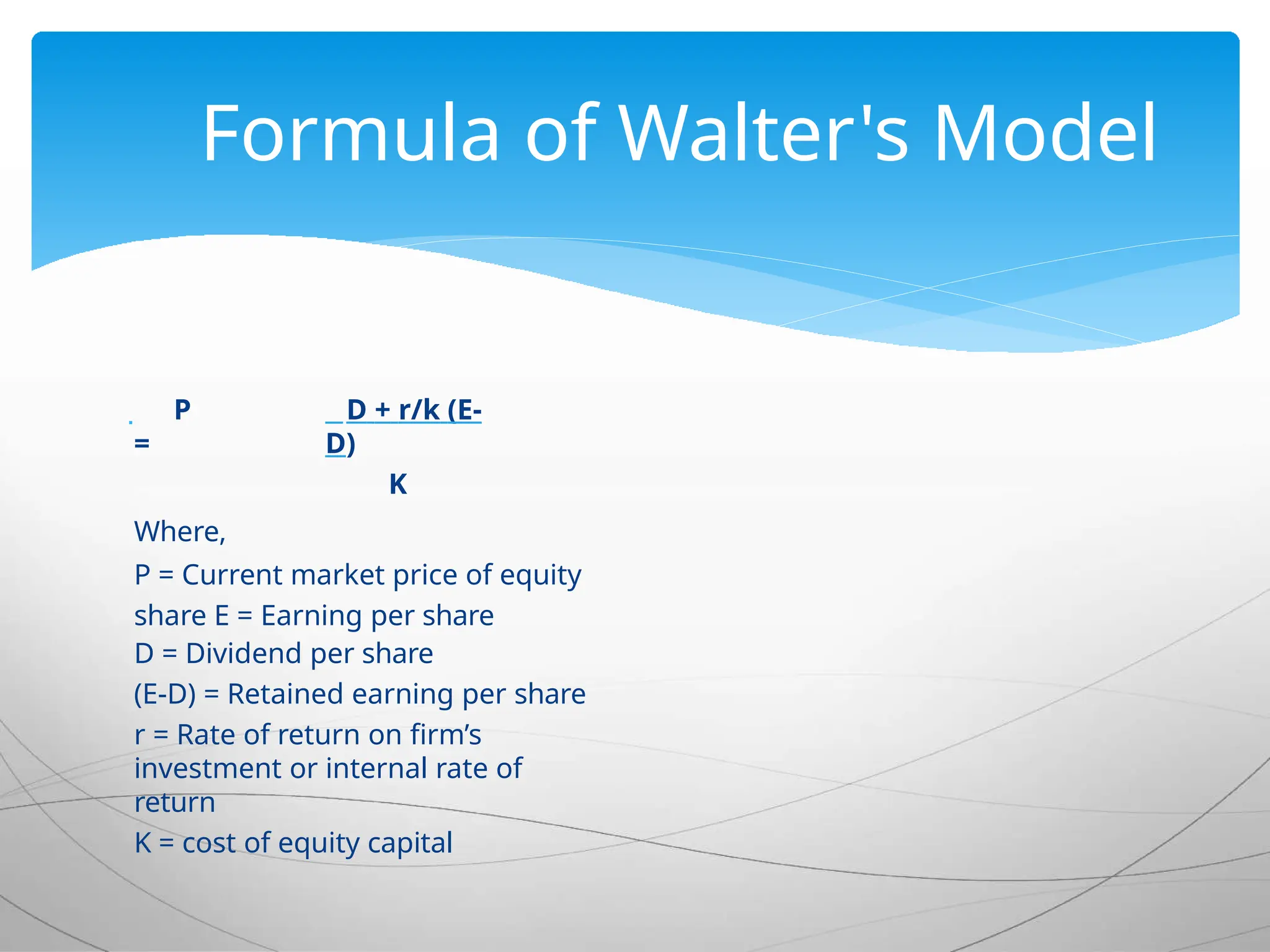

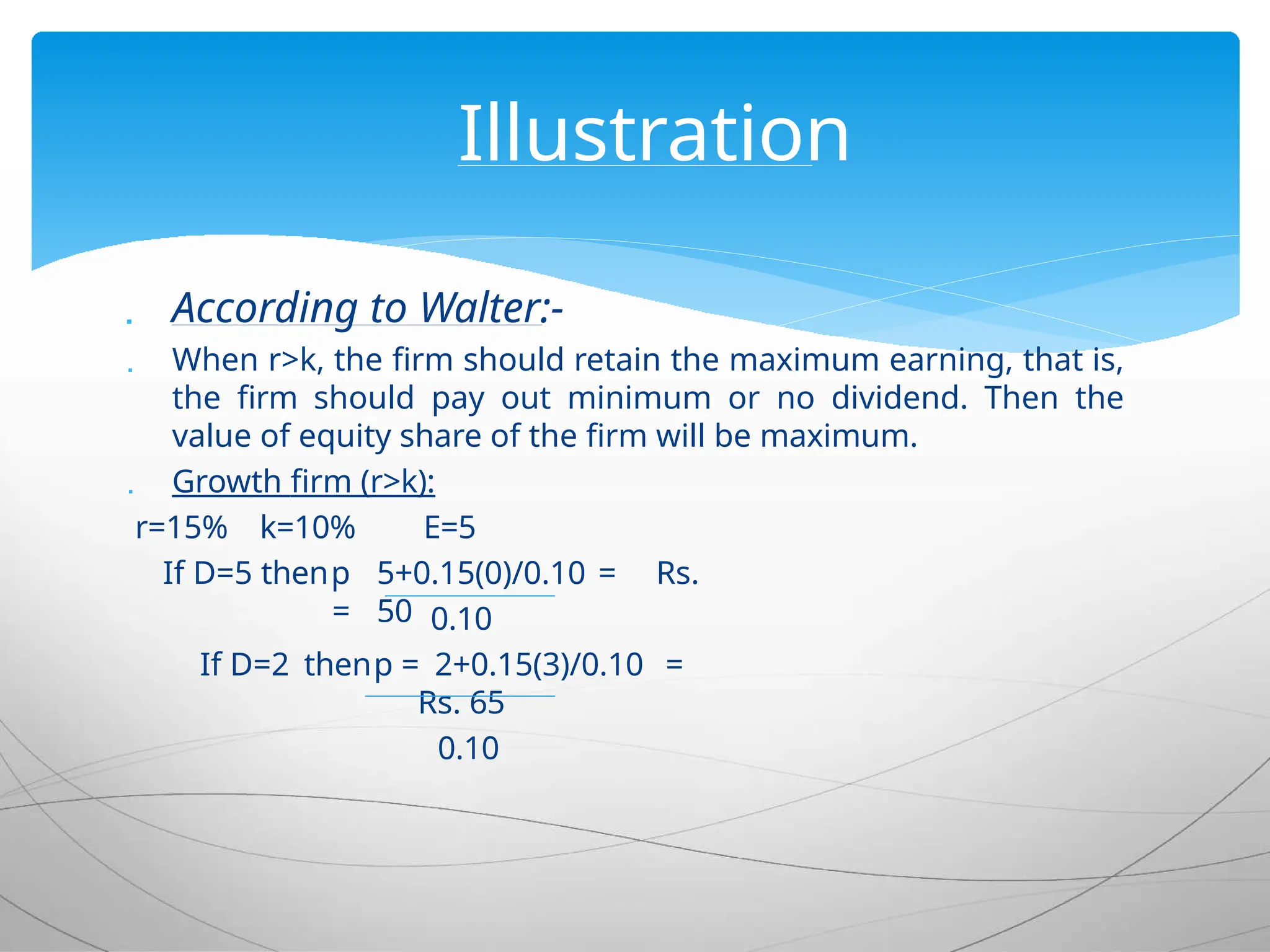

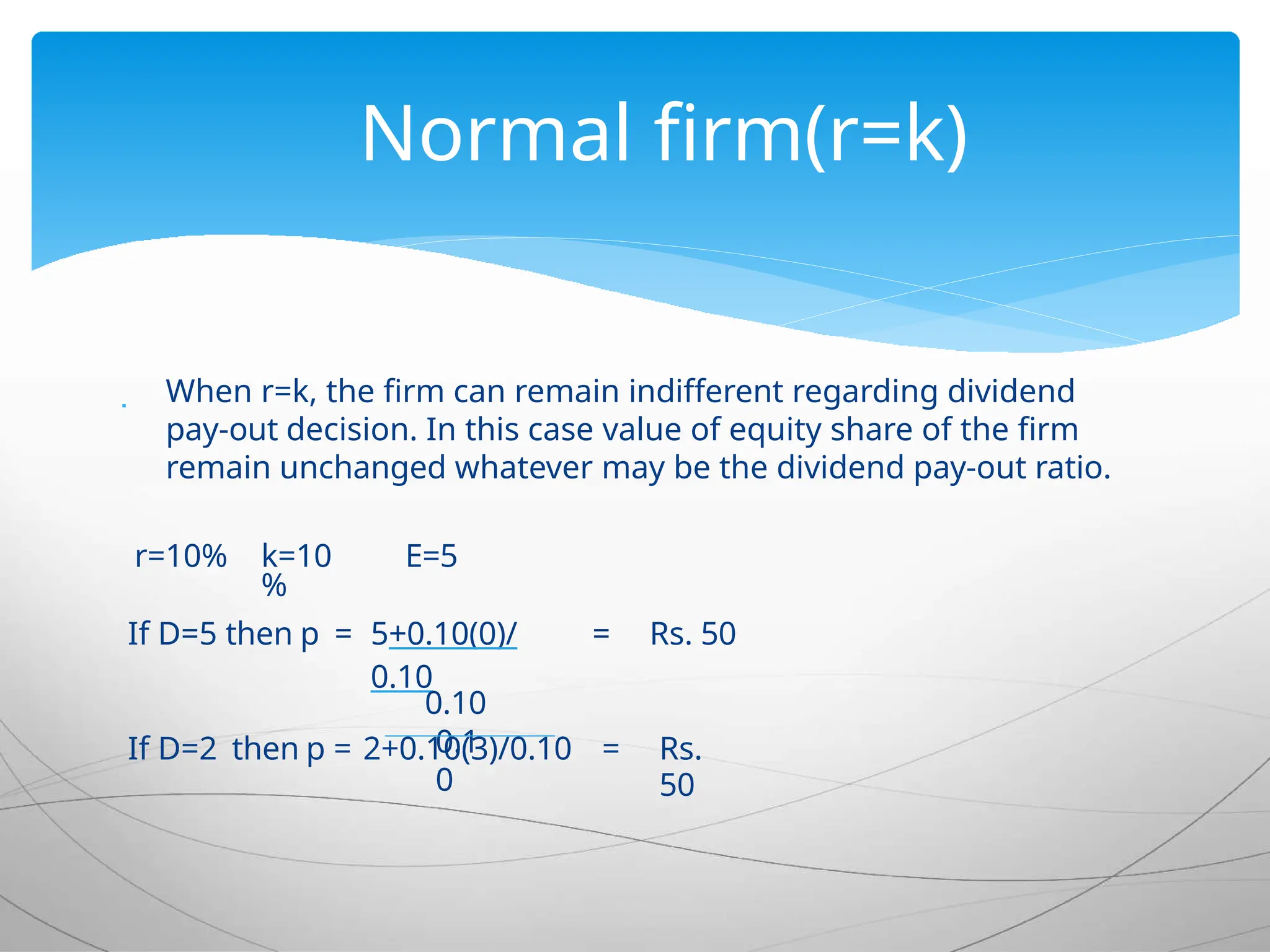

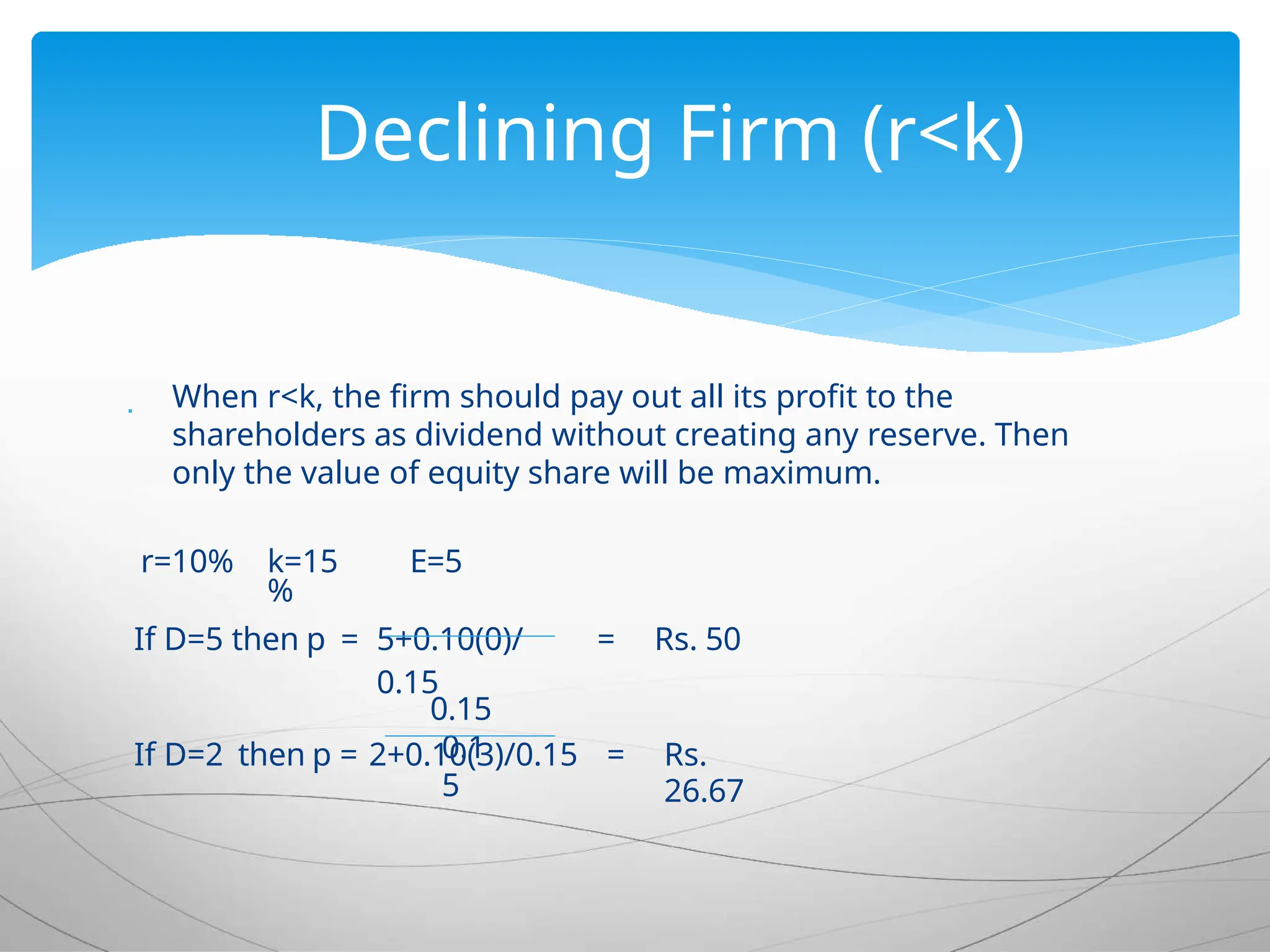

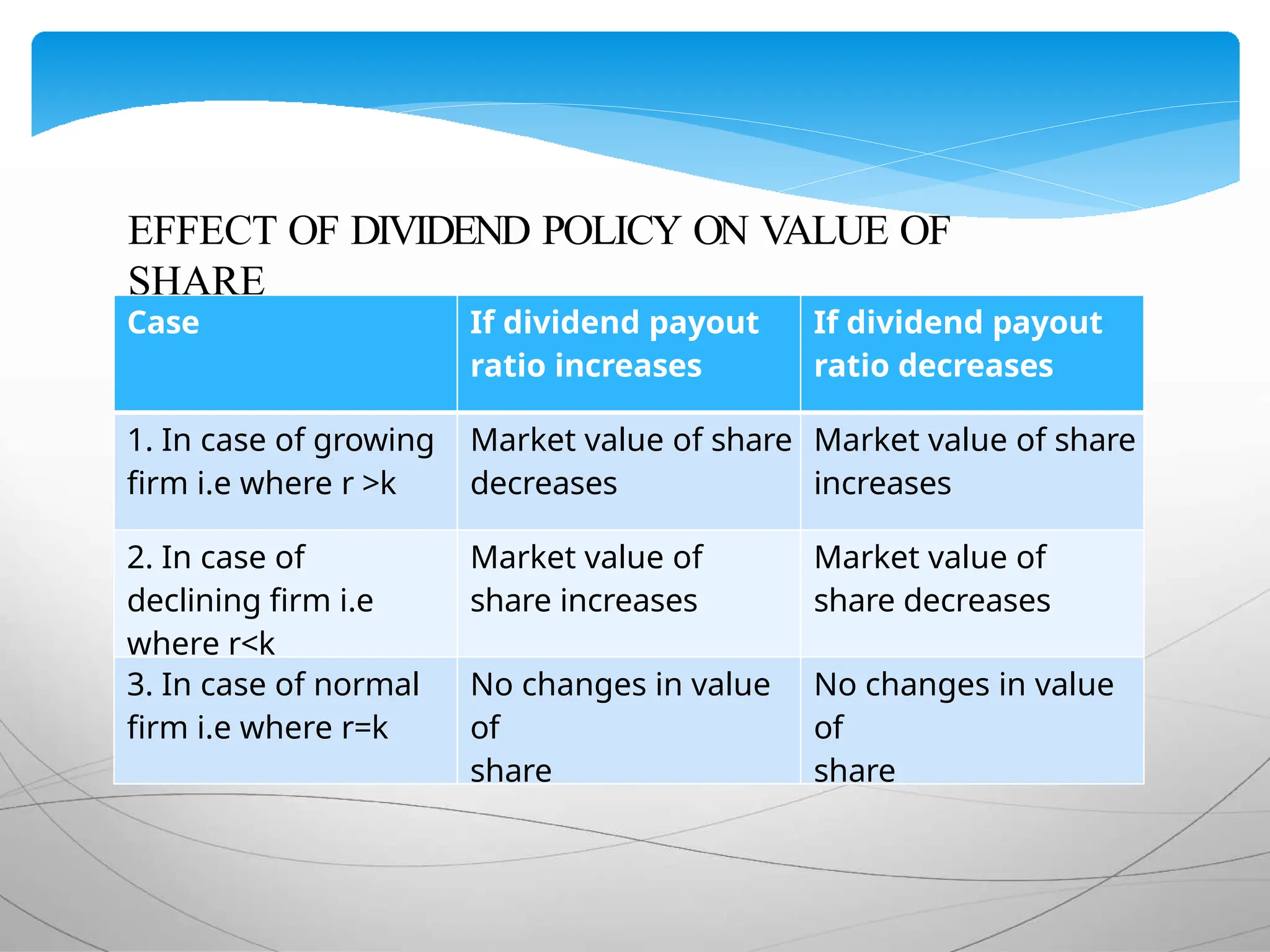

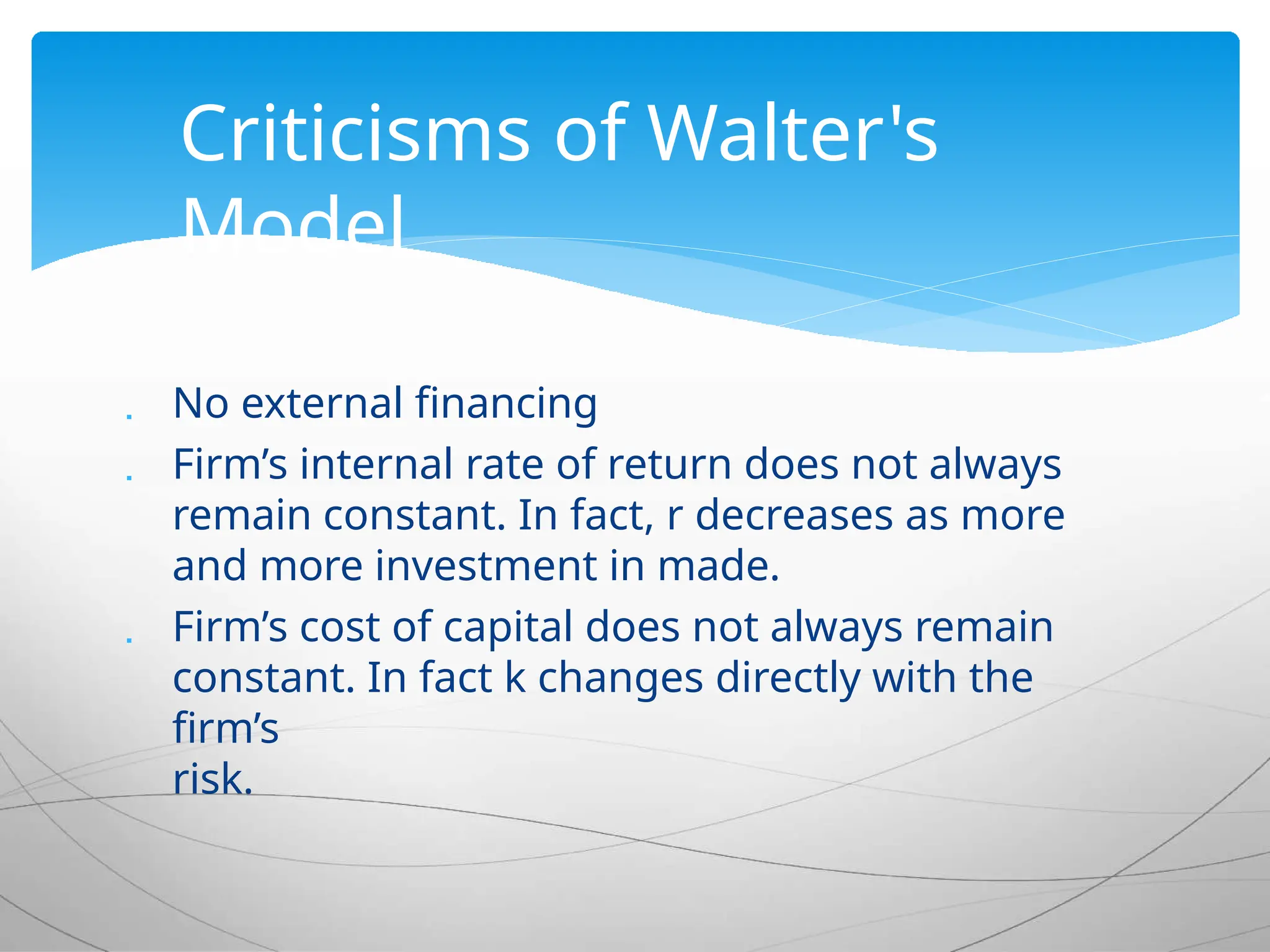

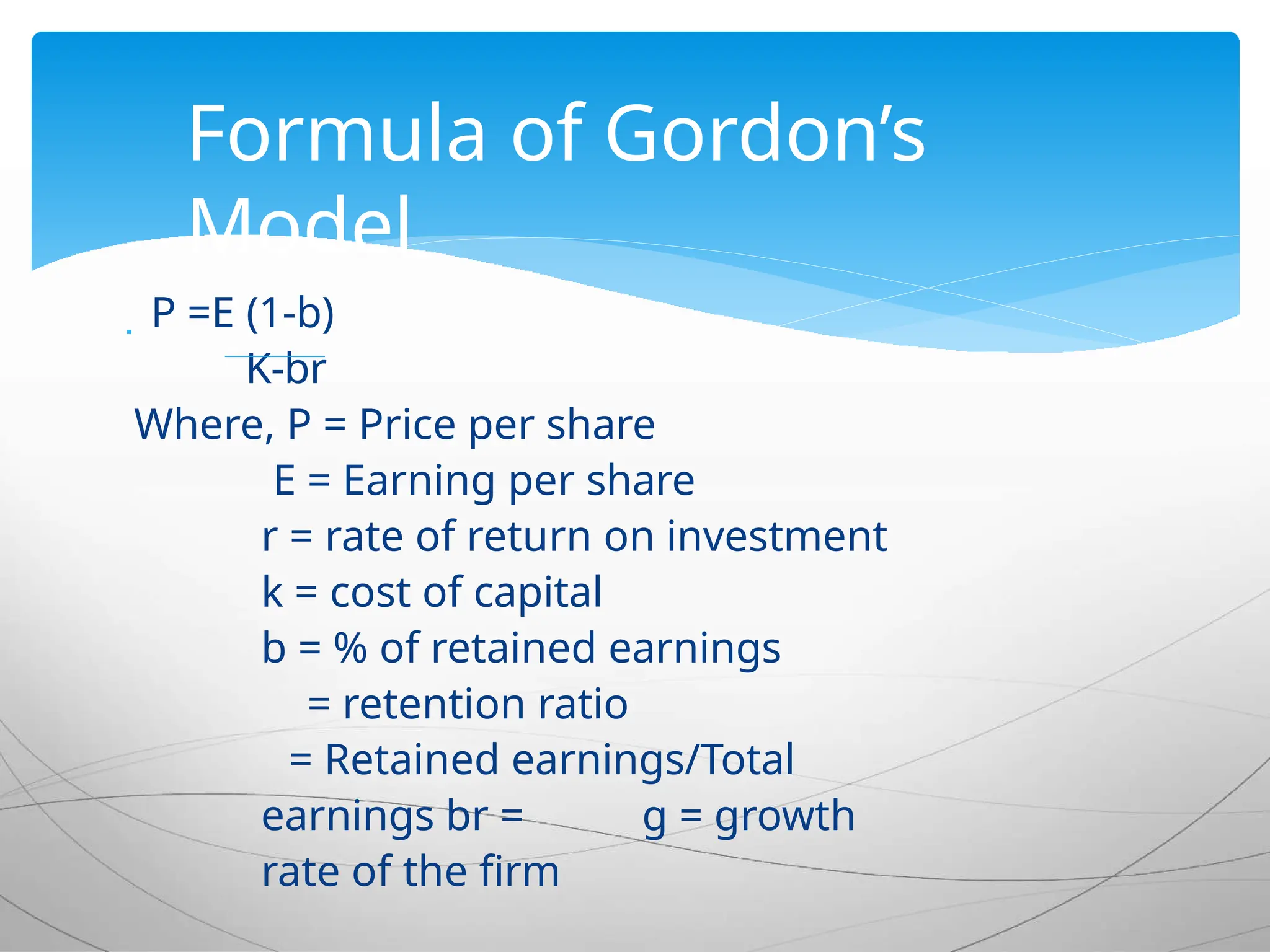

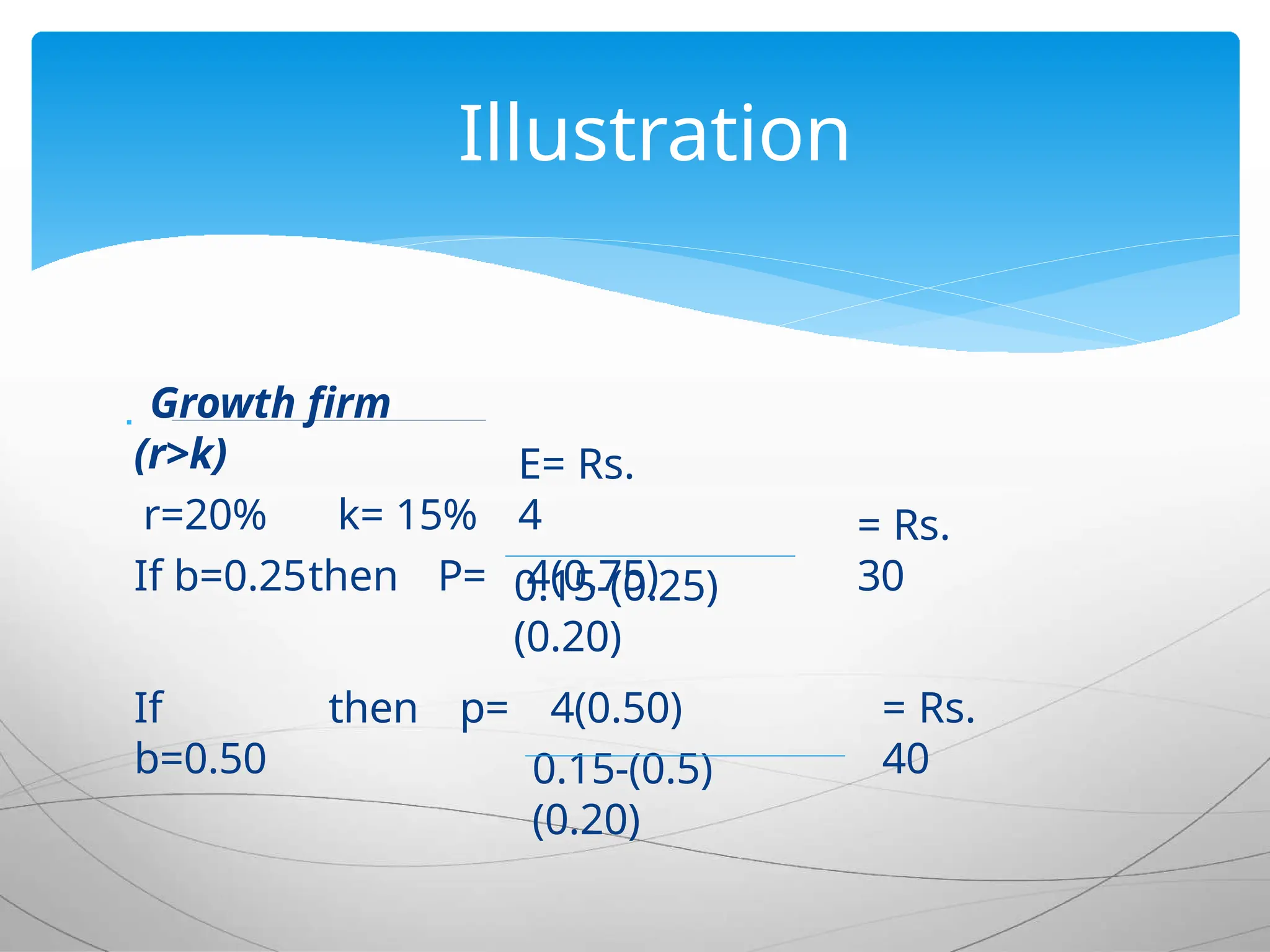

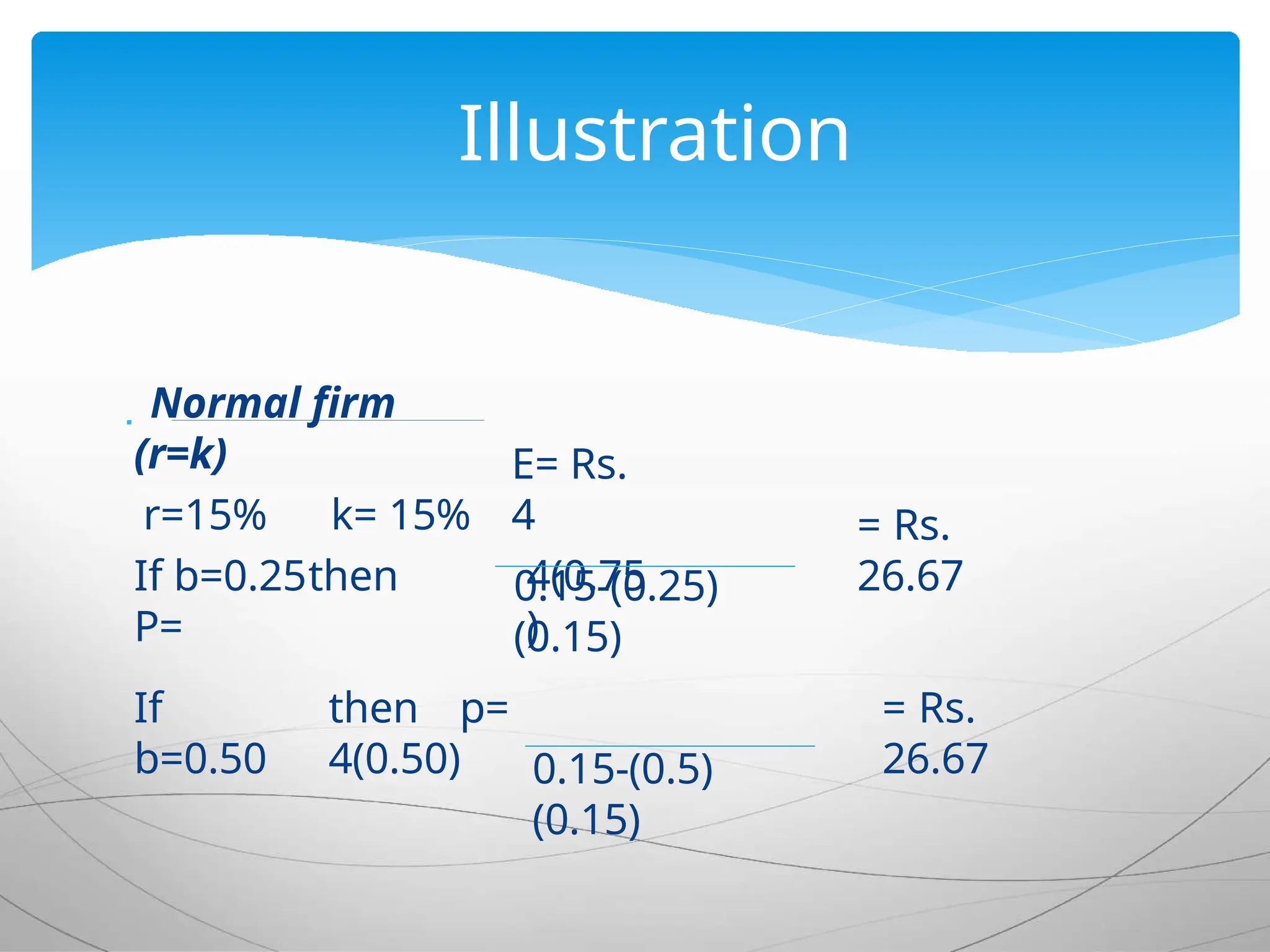

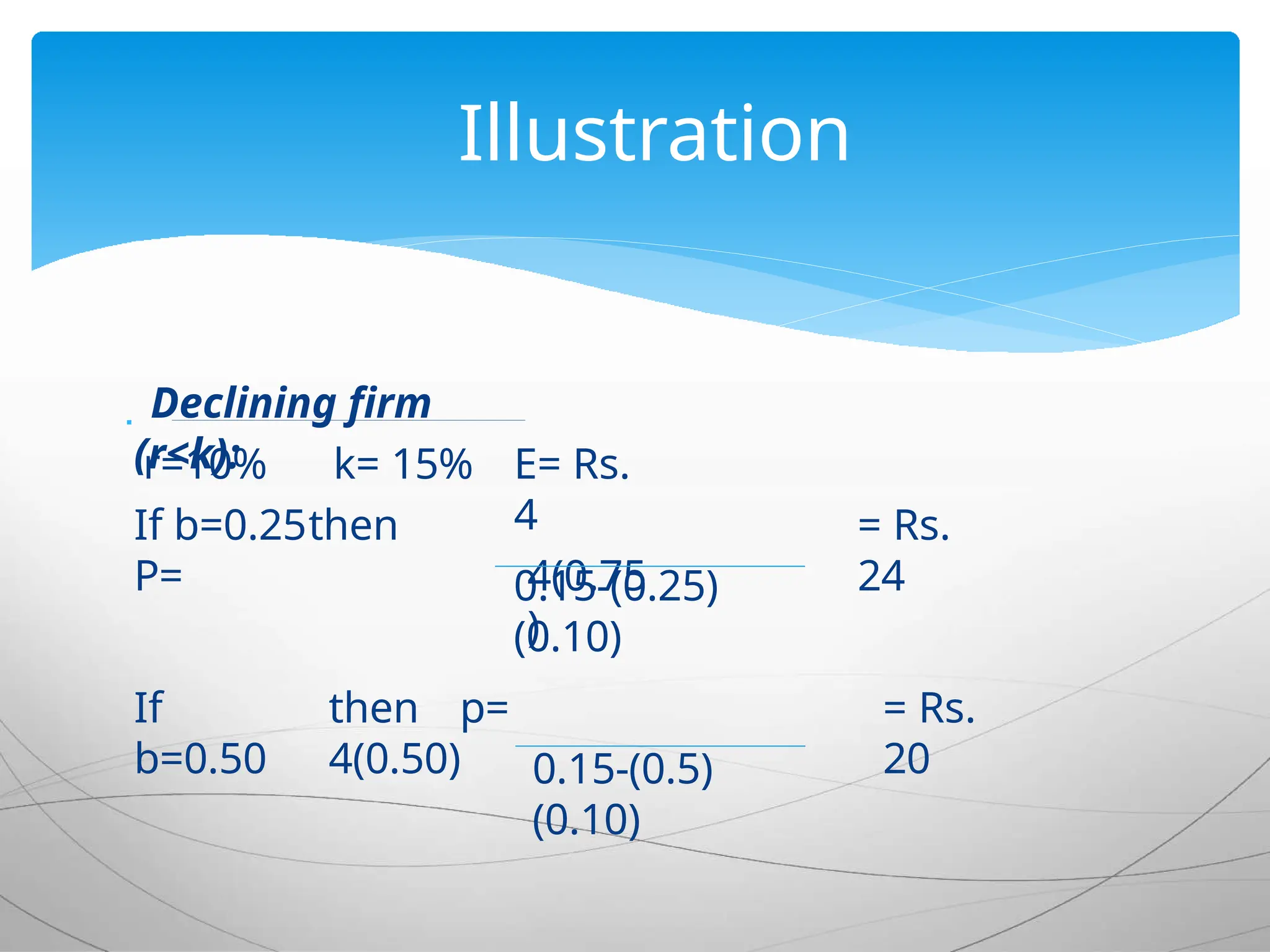

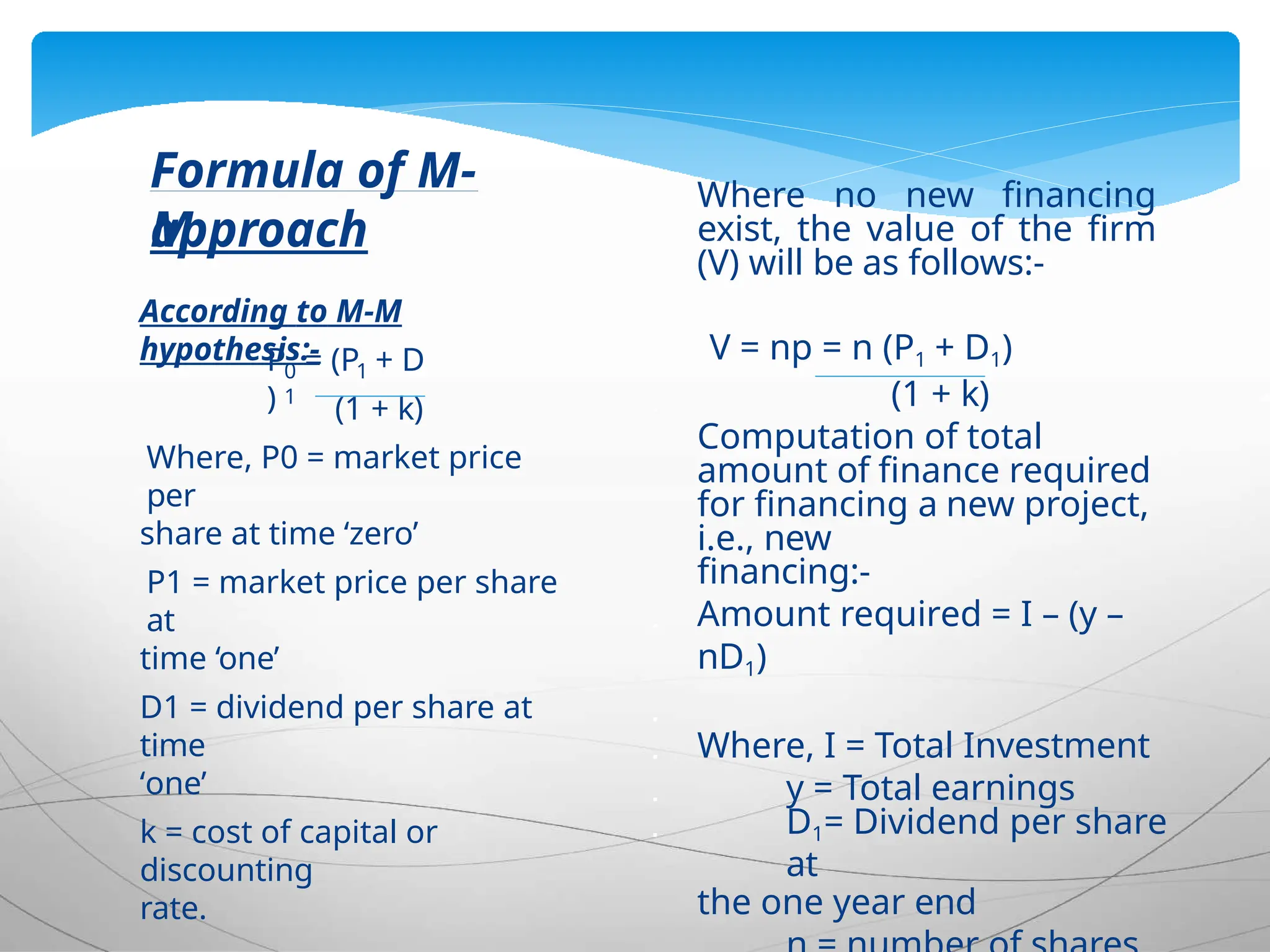

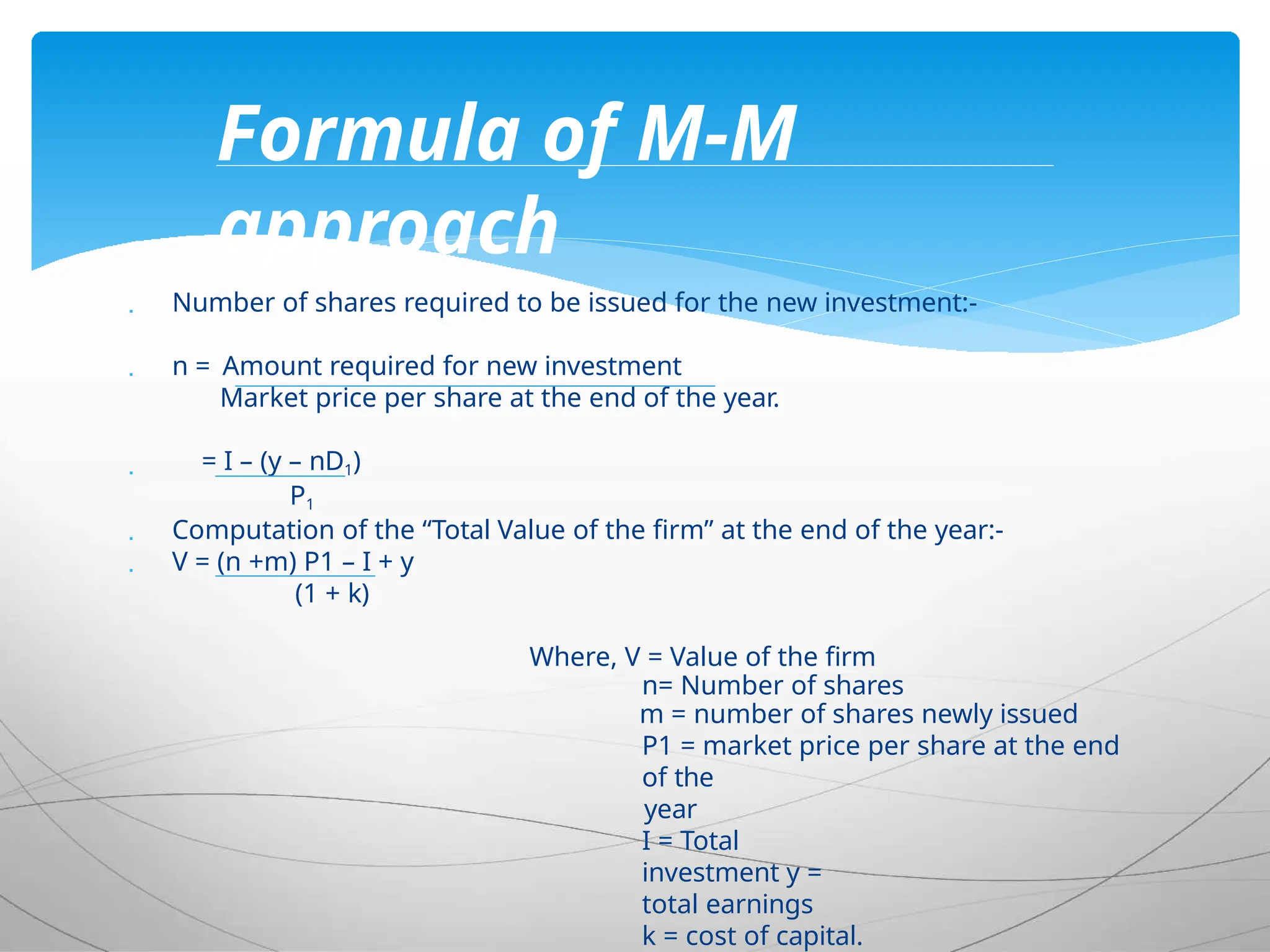

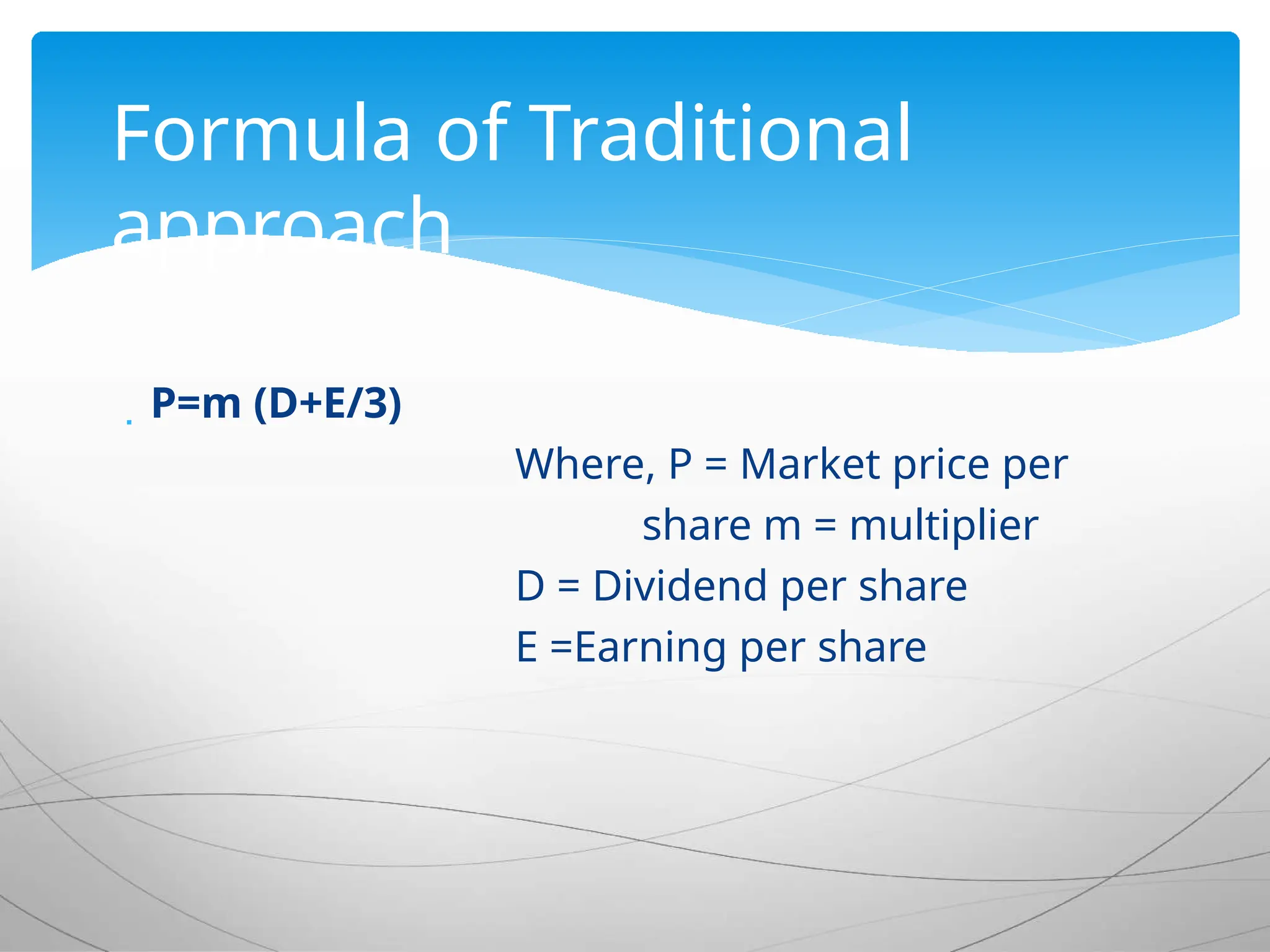

The document delves into the concept of dividends, categorizing them based on types of shares and payment methods, while explaining the implications of dividend policies on firm valuation. It presents several dividend theories, including relevance theories (Walter's and Gordon's models) which assert dividends influence share value, and irrelevance theories (Modigliani-Miller) which claim dividend decisions do not impact firm value. Additionally, it contrasts the effects of different dividend payout ratios on market share value for growing, normal, and declining firms.