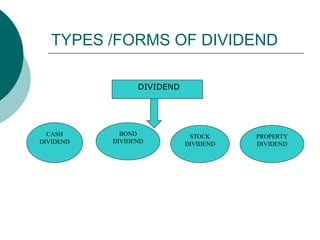

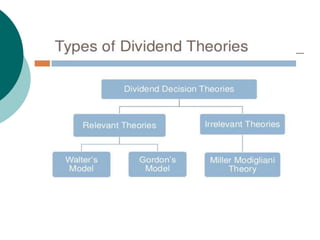

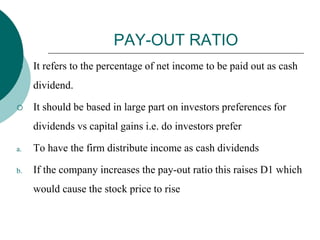

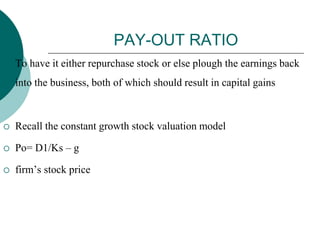

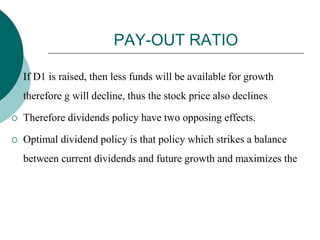

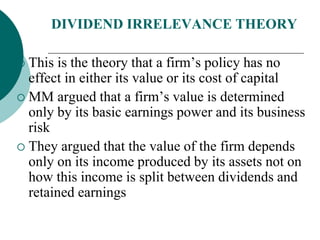

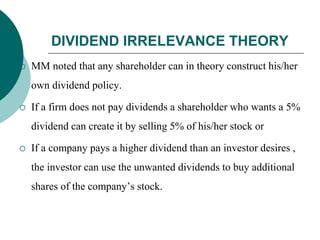

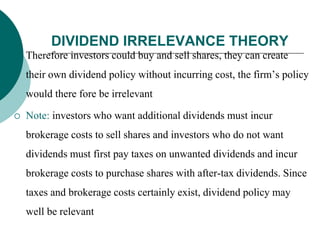

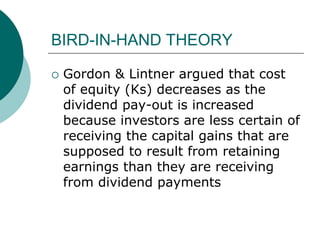

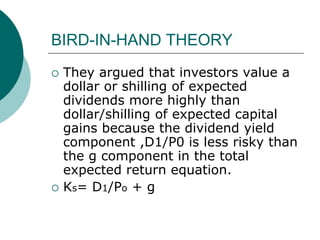

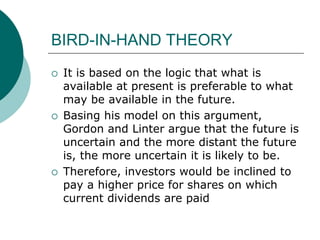

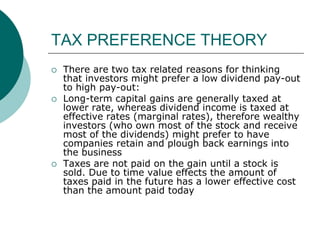

Dividend policy refers to a company's decision on how much of its earnings to distribute to shareholders as dividends versus retaining for reinvestment. There are several theories on dividend policy, including the dividend irrelevance theory, which argues dividend policy does not impact share price, and the bird-in-hand theory, that shareholders prefer dividends to uncertain future capital gains. A company must consider constraints, investment opportunities, alternative capital sources, and the impact on its cost of capital when determining its dividend policy. Common dividend policies include stable, residual, stock splits, and stock dividends.