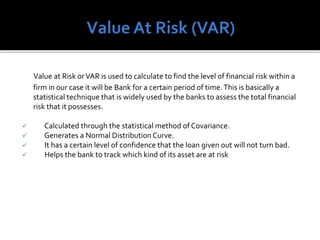

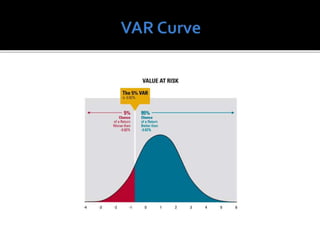

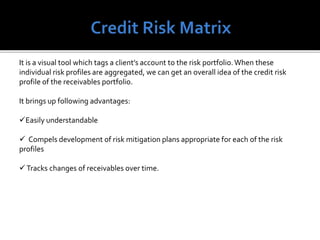

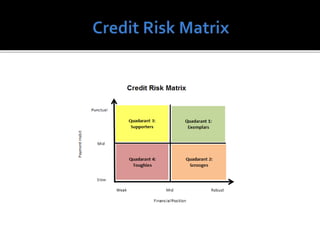

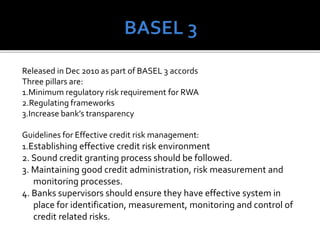

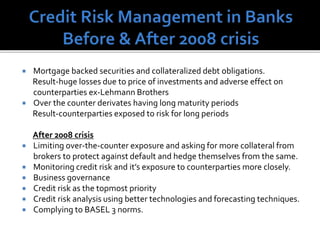

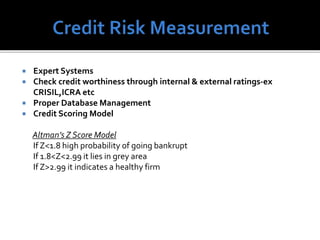

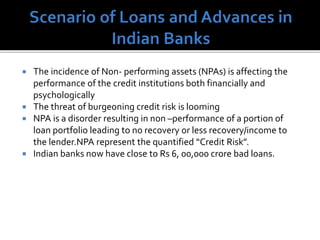

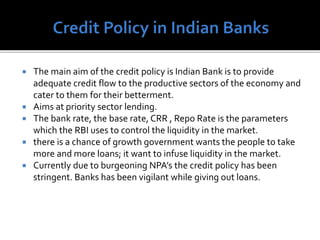

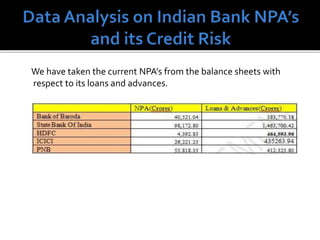

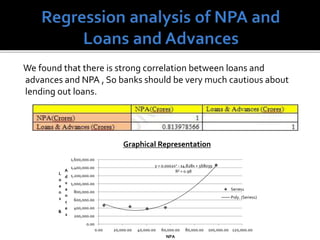

The document discusses credit risk management in Indian banks, emphasizing the sector's resilience amidst global economic turmoil and the high levels of non-performing assets (NPAs) affecting financial performance. It outlines the importance of a robust credit policy, decision-making processes to assess credit risk, and strategies for mitigating potential losses. Key recommendations include adhering to Basel III norms, employing advanced technologies for risk assessment, and fostering a strong credit risk management culture within banks.

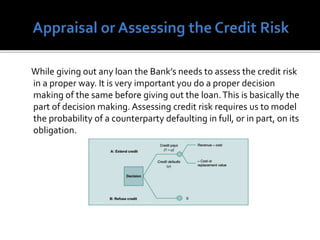

![Three scenarios arises now

Extend credit and you get returns. ………. (1)

Extend credit but loan is not re- payed (loan turns bad) ………. (2)

Refuse credit ………. (3)

(1)+ (2) can be clubbed to get the total cost which turns out to be

= (Revenue-cost) x (1-p) - cost x p [where cost is the cost of the

loan]

=0 if the credit is refused. [ p is the credit defaulting

probability]

Now it depends on bank’s discretion which way to go depending on the

decision tree, if extending credit yields a positive result then it should go

with it. But if the result is negative the bank should refuse the credit.

This totally depends on bank’s research and findings while giving out a

loan.](https://image.slidesharecdn.com/creditriskmanagementpresentation-170218113135/85/Credit-risk-management-presentation-16-320.jpg)