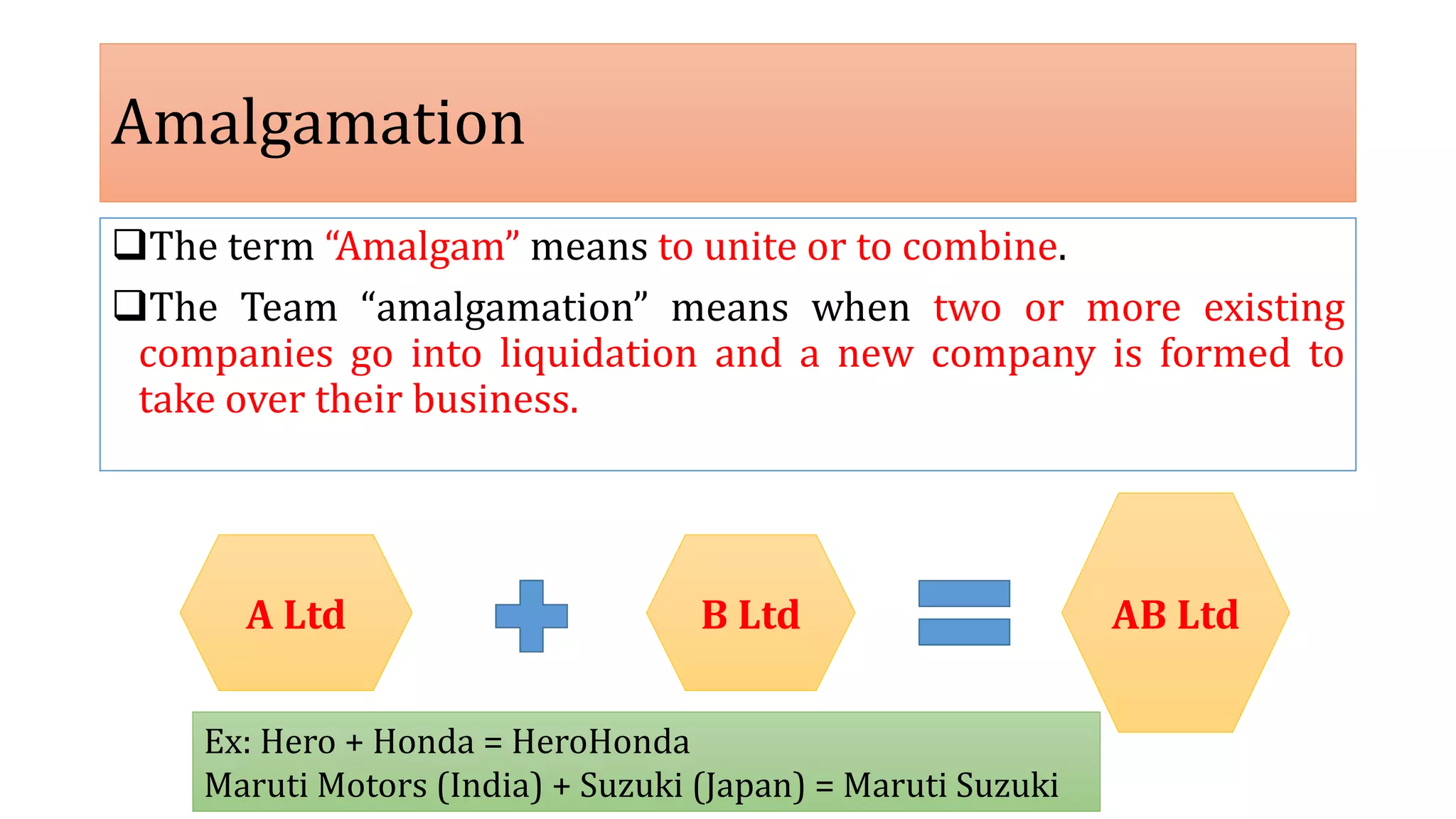

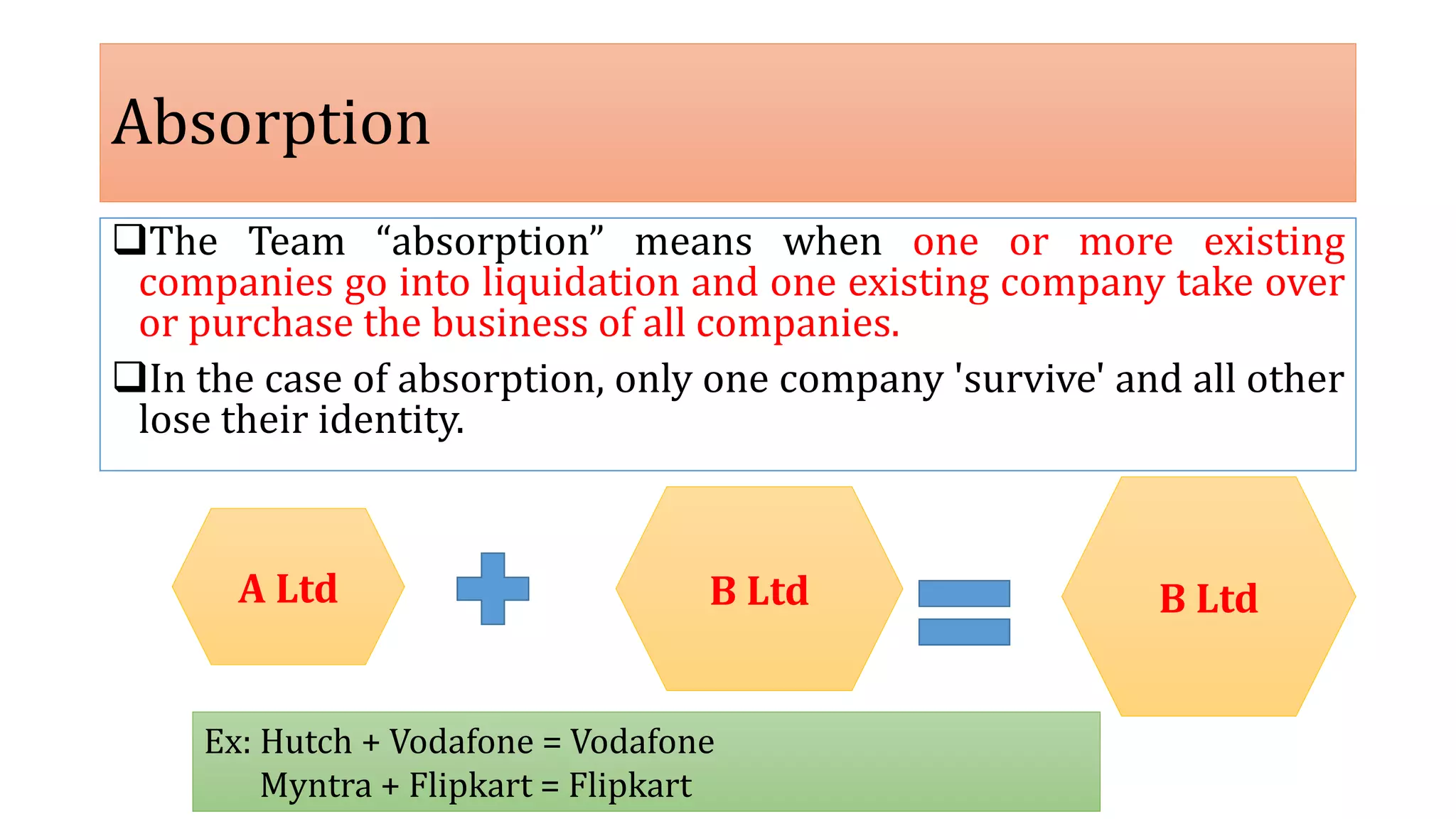

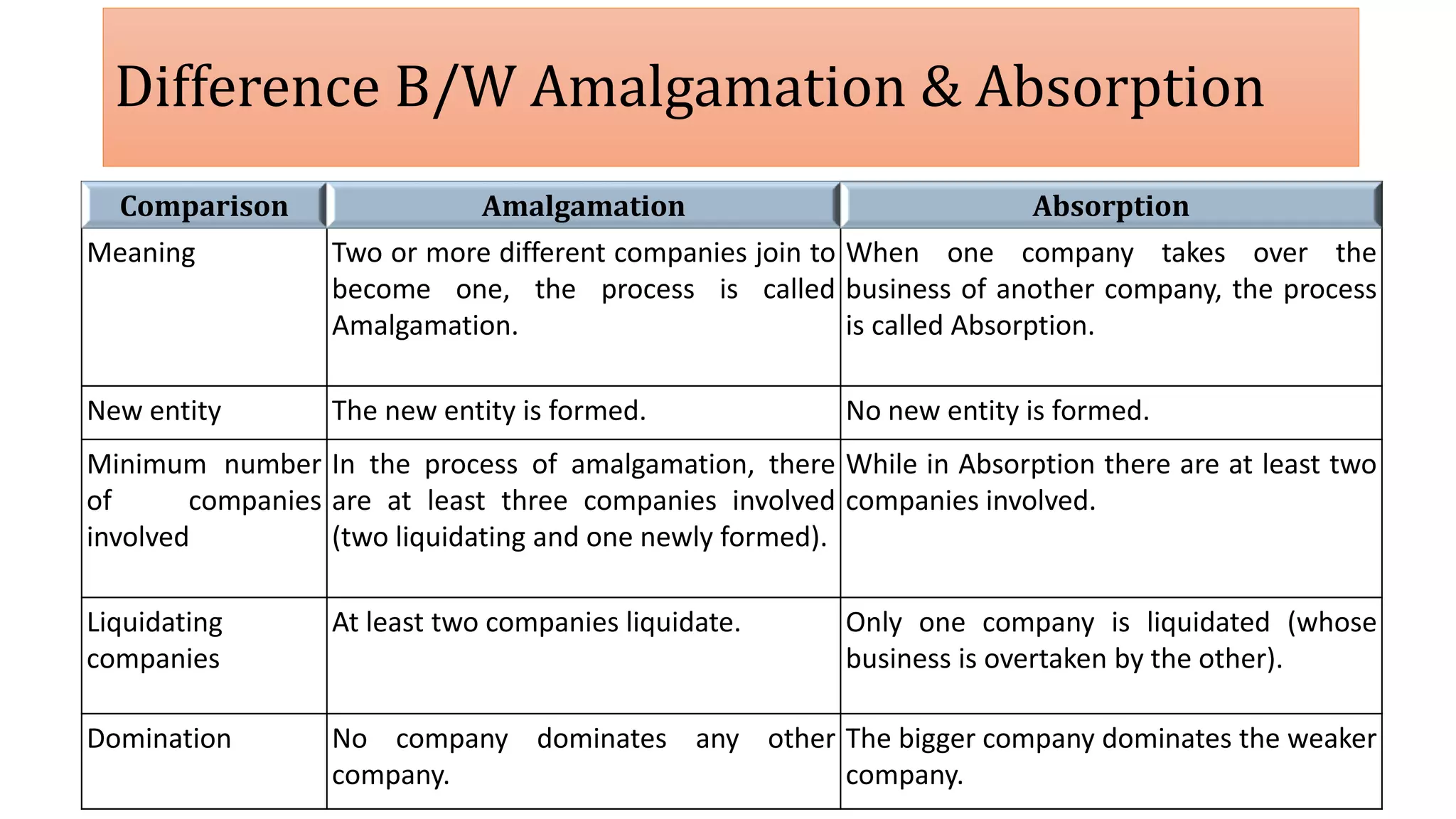

The document discusses the concepts of amalgamation and absorption in corporate accounting, defining amalgamation as the unification of multiple companies to form a new entity, while absorption involves one company taking over another, with only one entity remaining post-transaction. It details the differences between the two processes, such as the number of companies involved, the existence of a new entity, and the dynamics of dominance. Additionally, it outlines methods for calculating purchase consideration in these processes, including lump sum, net payment, and net asset methods.