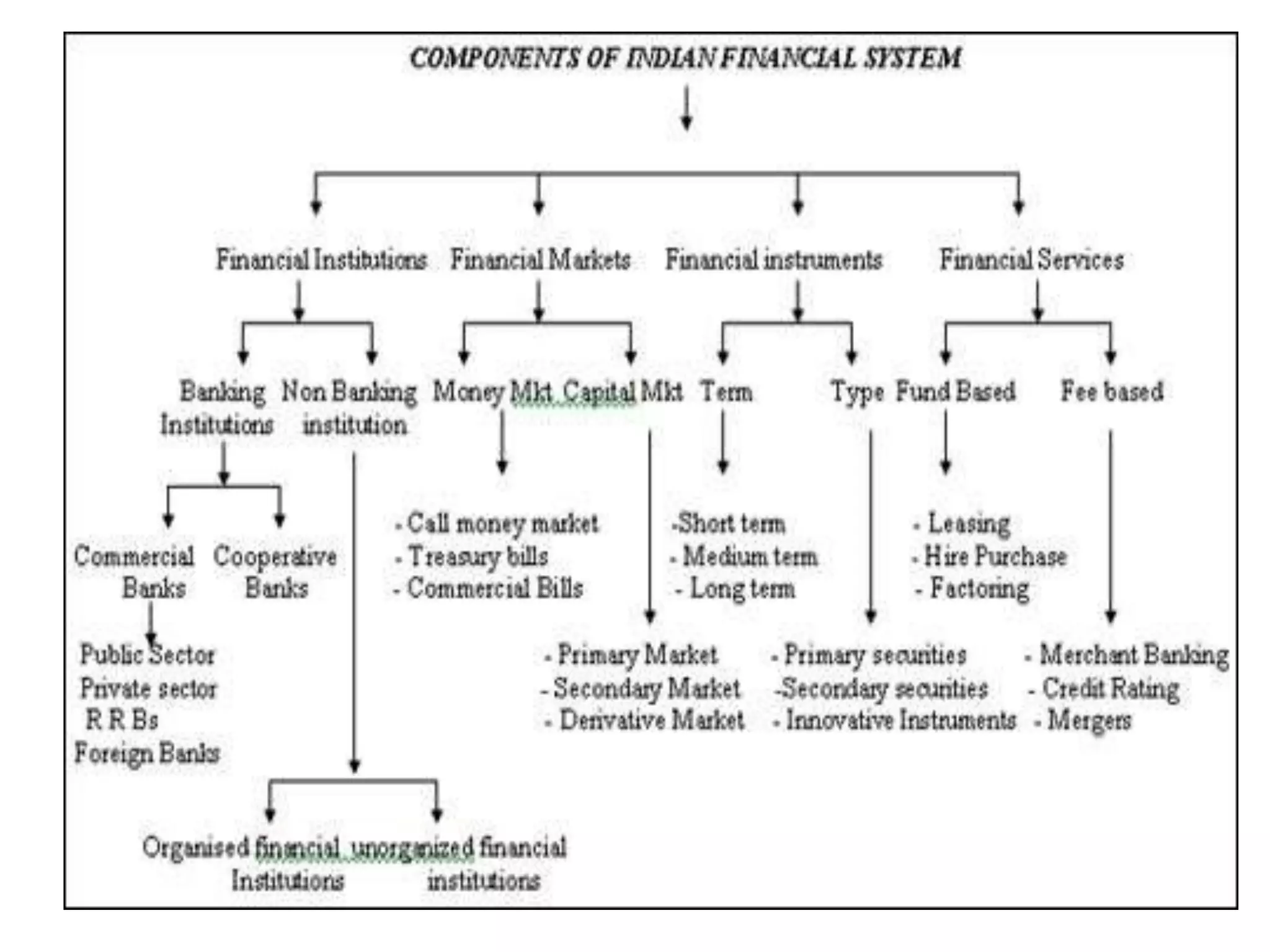

The document discusses the structure of the financial system. It describes how the financial system functions as an intermediary between savers and investors, channeling funds from areas of surplus to deficit. The financial system consists of individuals, institutions, markets, and instruments. It categorizes financial institutions as banking and non-banking, and classifies financial markets based on the type, maturity, and structure of financial claims traded. Financial instruments are used to raise capital and money market funds. Financial services facilitate financial transactions and the transformation of savings into investments.