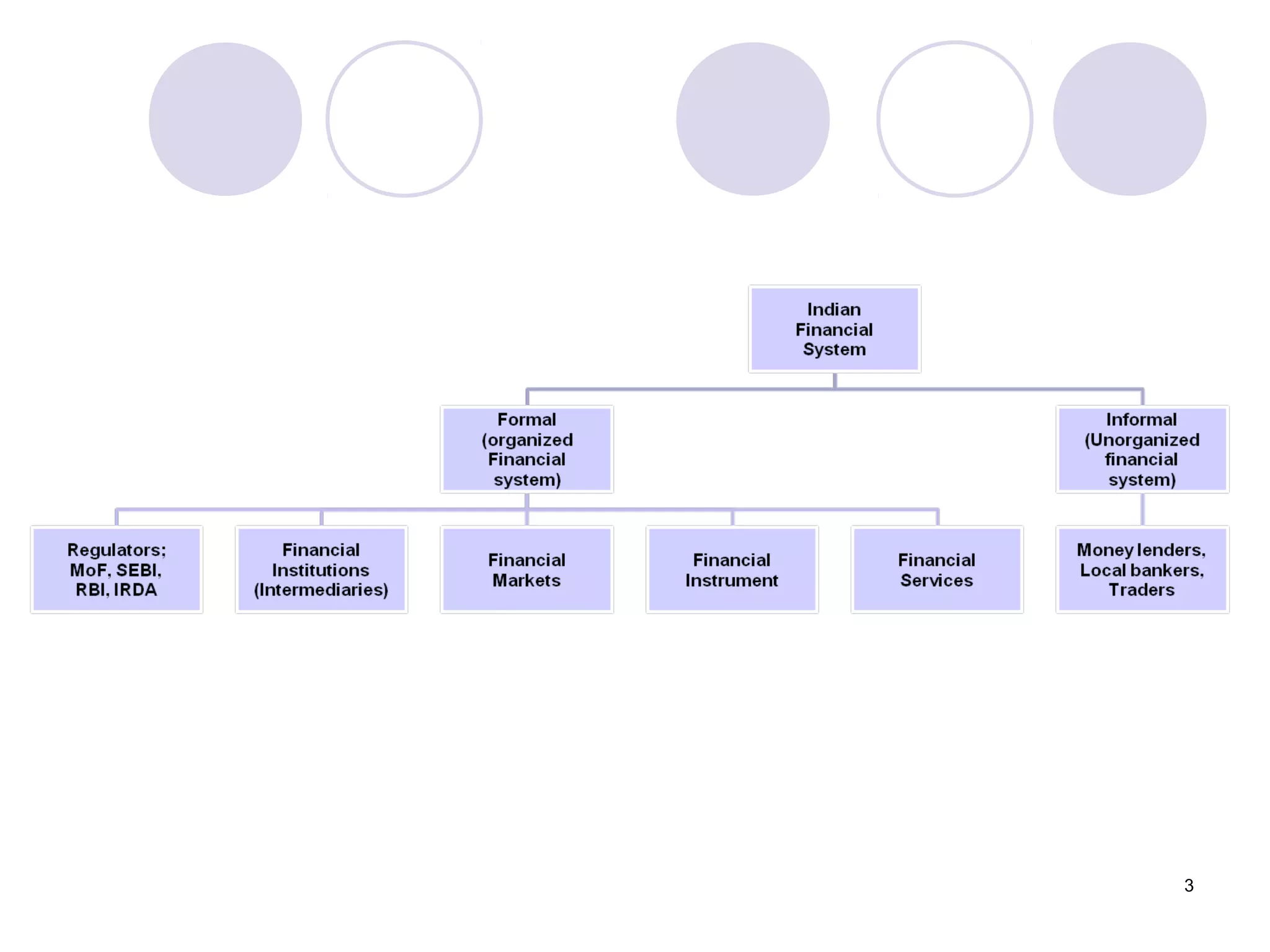

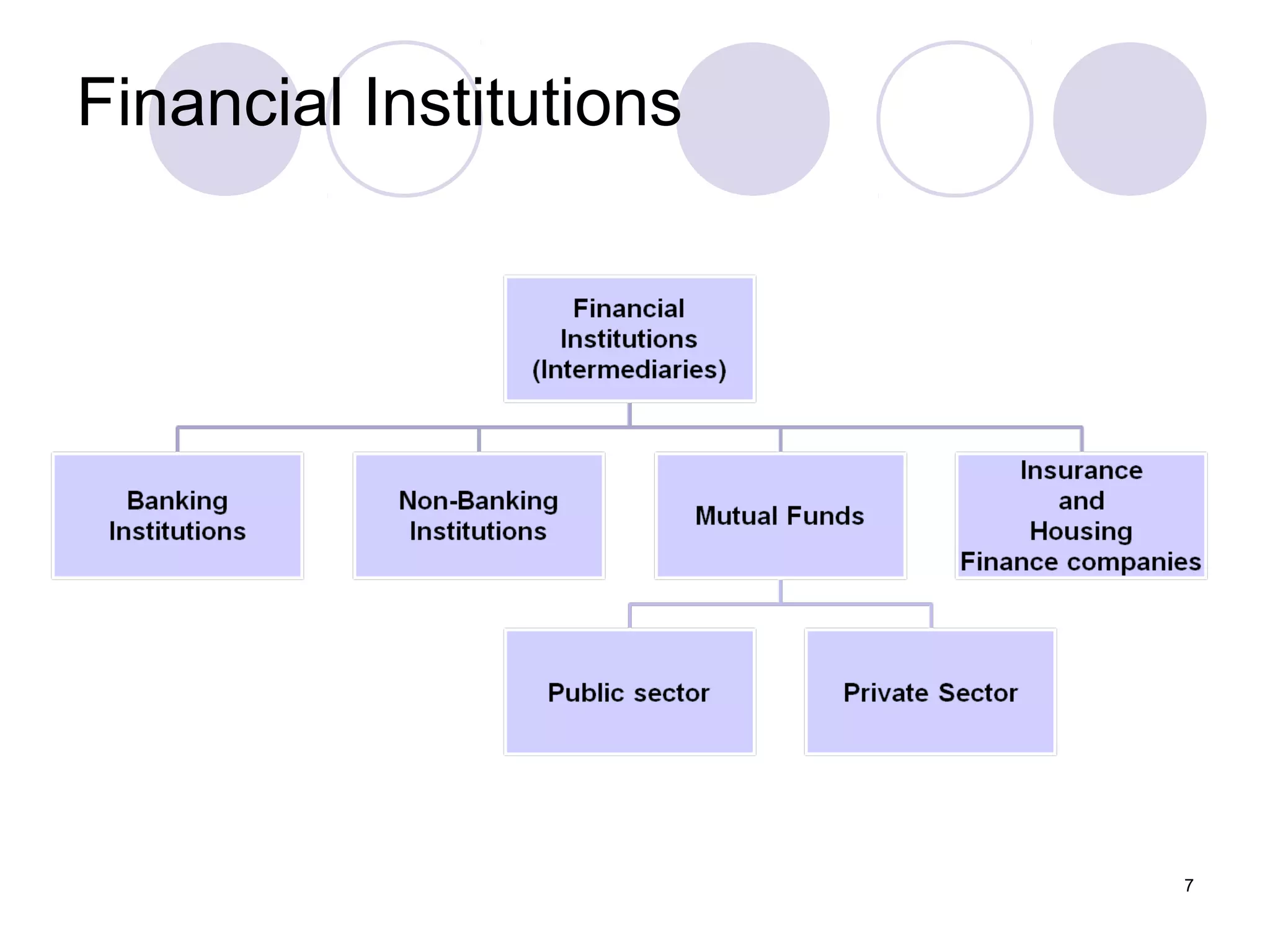

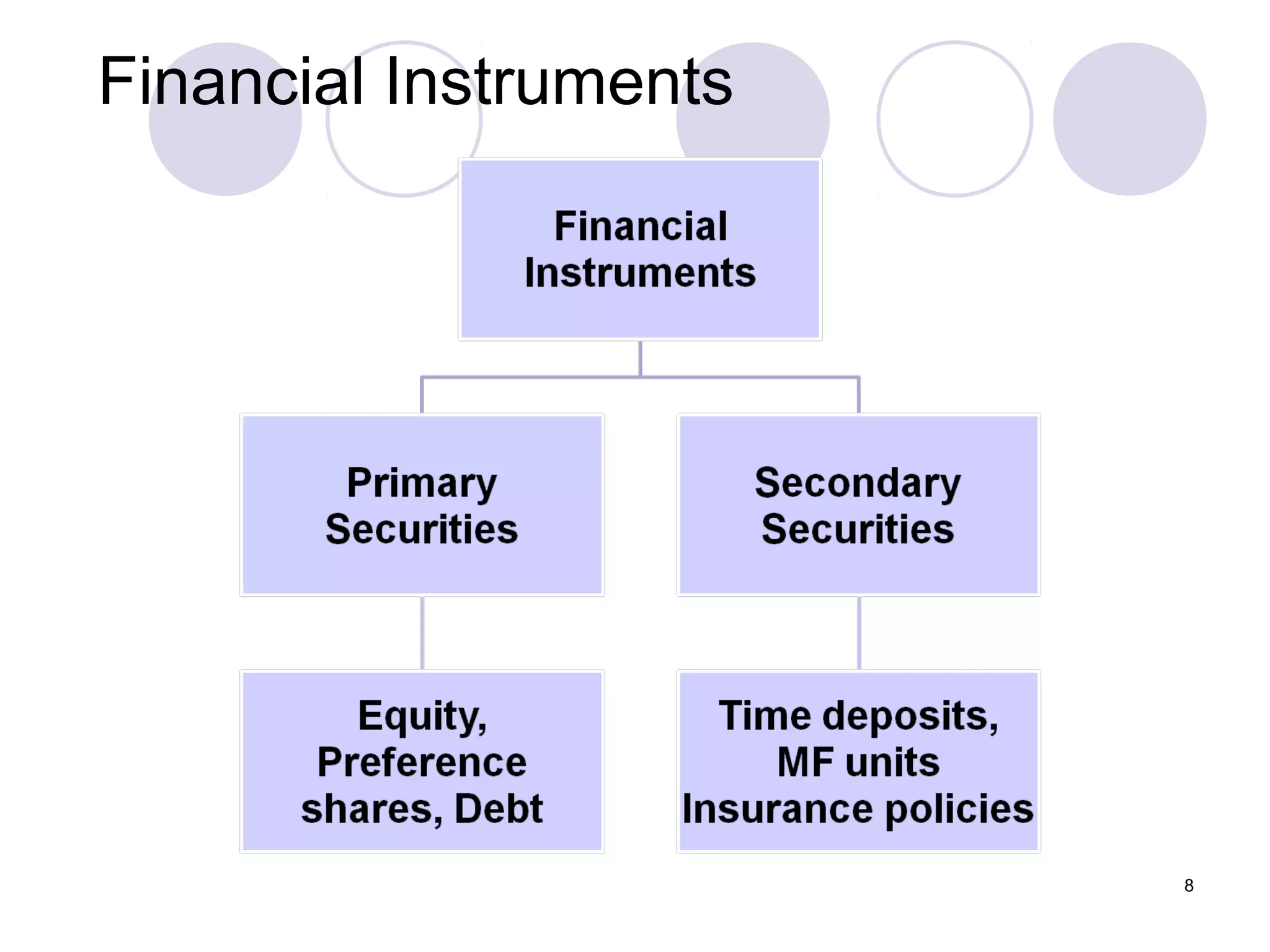

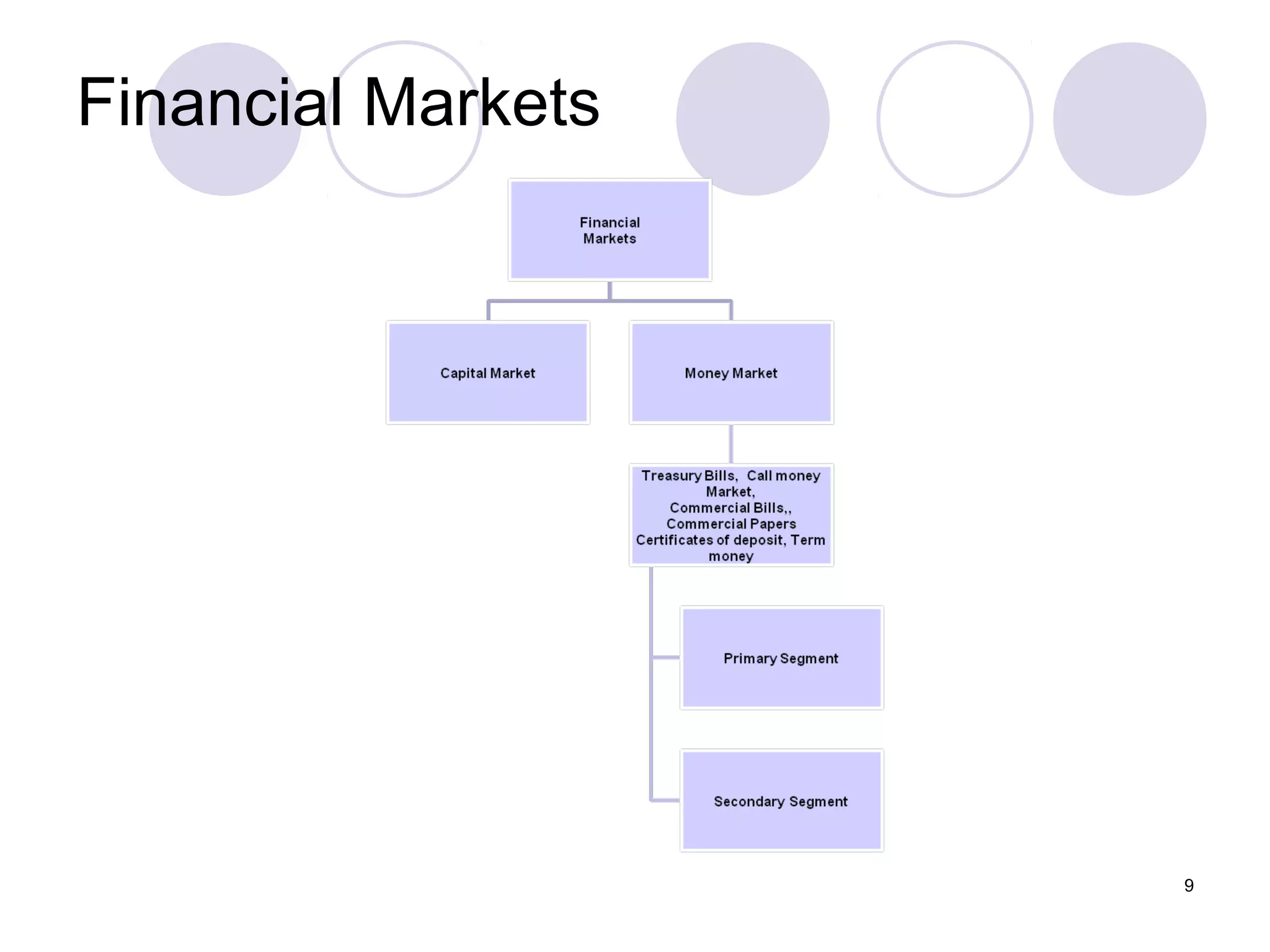

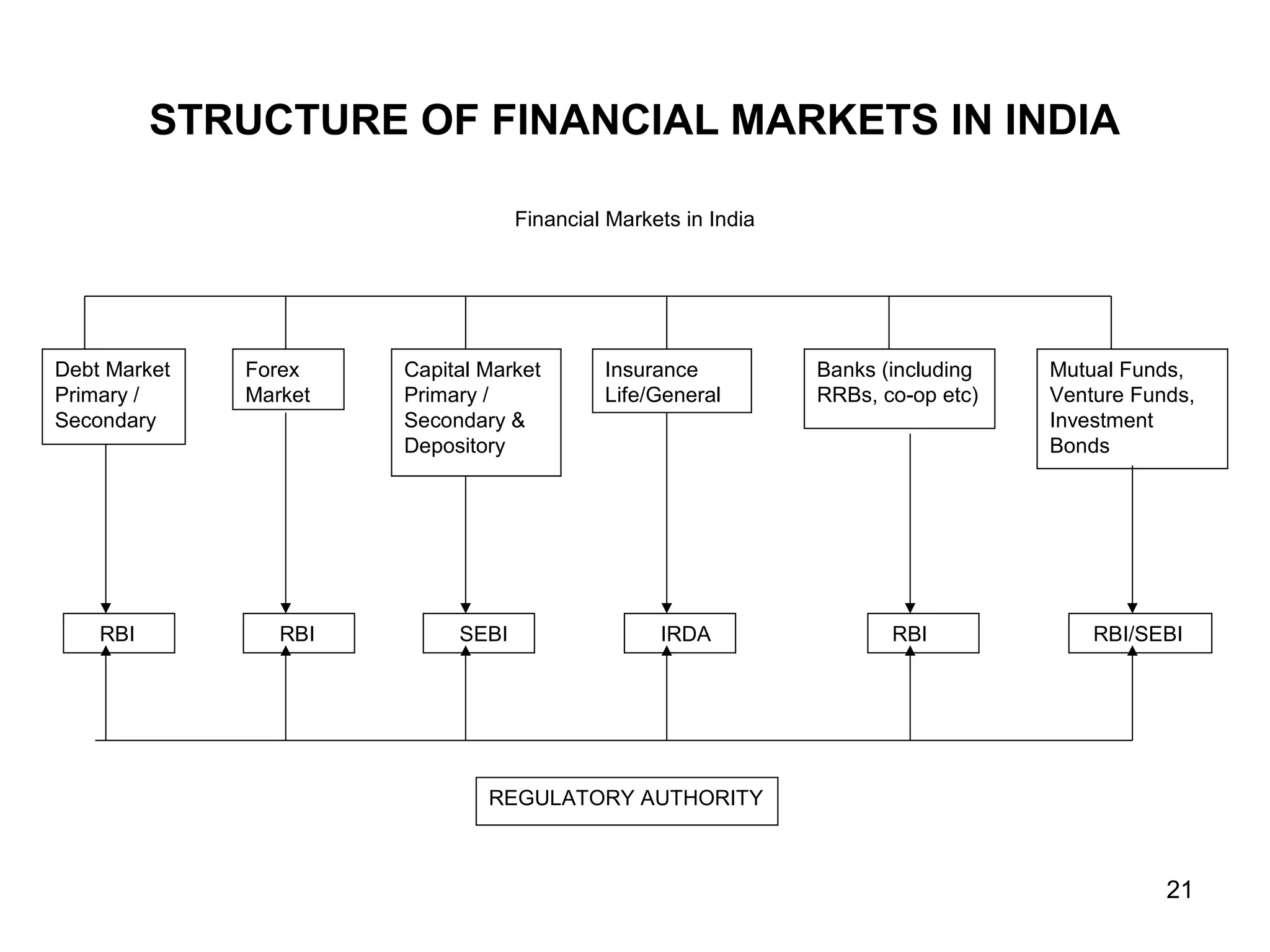

The document provides an overview of the Indian financial system. It discusses that the Indian financial system consists of both formal and informal sectors. The formal sector is regulated and caters to modern economic needs, while the informal sector is unregulated and deals with traditional, rural activities. The key components of the formal system are regulators like RBI and SEBI, financial institutions, instruments, markets, and services. The document then outlines the evolution of the Indian financial system from the pre-1951 private sector era to the current period of globalization.