Ba7202 financial management (unit3) notes

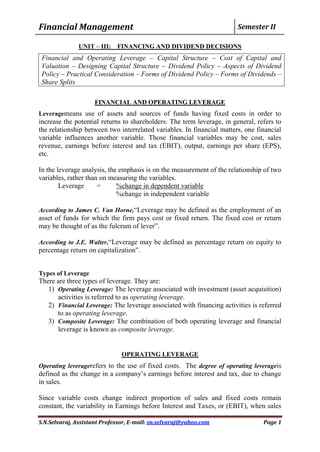

- 1. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 1 UNIT – III: FINANCING AND DIVIDEND DECISIONS Financial and Operating Leverage – Capital Structure – Cost of Capital and Valuation – Designing Capital Structure – Dividend Policy – Aspects of Dividend Policy – Practical Consideration – Forms of Dividend Policy – Forms of Dividends – Share Splits FINANCIAL AND OPERATING LEVERAGE Leveragemeans use of assets and sources of funds having fixed costs in order to increase the potential returns to shareholders. The term leverage, in general, refers to the relationship between two interrelated variables. In financial matters, one financial variable influences another variable. Those financial variables may be cost, sales revenue, earnings before interest and tax (EBIT), output, earnings per share (EPS), etc. In the leverage analysis, the emphasis is on the measurement of the relationship of two variables, rather than on measuring the variables. Leverage = %change in dependent variable %change in independent variable According to James C. Van Horne,“Leverage may be defined as the employment of an asset of funds for which the firm pays cost or fixed return. The fixed cost or return may be thought of as the fulcrum of lever”. According to J.E. Walter,“Leverage may be defined as percentage return on equity to percentage return on capitalization”. Types of Leverage There are three types of leverage. They are: 1) Operating Leverage: The leverage associated with investment (asset acquisition) activities is referred to as operating leverage. 2) Financial Leverage: The leverage associated with financing activities is referred to as operating leverage. 3) Composite Leverage: The combination of both operating leverage and financial leverage is known as composite leverage. OPERATING LEVERAGE Operating leveragerefers to the use of fixed costs. The degree of operating leverageis defined as the change in a company‟s earnings before interest and tax, due to change in sales. Since variable costs change indirect proportion of sales and fixed costs remain constant, the variability in Earnings before Interest and Taxes, or (EBIT), when sales

- 2. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 2 change is caused by fixed costs. Higher the fixed cost, higher the variability in EBIT for a given change in sales. Other things remaining the same, companies with higher operating leverage (because of higher fixed costs) are more risky. Operating leverage intensifies the effect of cyclicality on a company‟s earnings. As a consequence, companies with higher degrees of operating leverage have high betas. Combining Financial and Operating Leverages Operating leverage affects a firm‟s operating profit (EBIT), while financial leverage affects after tax or the earnings per share. The combined effect of two leverages can be quite significant for the earnings available to ordinary shareholders. Degree of Operating Leverage The degree of operating leverage (DOL) is defined as the percentage change in the earnings before interest and taxes relative to a given percentage change in sales. DOL = % Change in EBIT % Change in Sales DOL = ∆EBIT / EBIT ∆Sales / Sales DOL = Contribution where, Contribution = EBIT + Fixed cost EBIT DOL = Q (s–v) where, Q is the units of output, s is the unit Q (s– v) – F selling price, v is the unit variable cost and F is the fixed cost. DOL = EBIT +Fixed Cost = 1 + F EBIT EBIT Problem:A firm developed the following income statement based on an expected sales volume of 100,000 units. From the particulars given below calculate the degree of operating leverage. Rs. Sales (100,000 units at Rs.8) 800,000 Less: Variable costs (100,000 at Rs.4) 400,000 Contribution 400,000 Less: Fixed costs 280,000 EBIT 120,000 Solution: The following formula is used for computation. DOL = Q (s–v) where, Q is the units of output, s is the unit Q (s– v) – F selling price, v is the unit variable cost and F is the fixed cost.

- 3. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 3 DOL = 100,000 (Rs.8 – Rs.4) 100,000 (Rs.8 – Rs.4) – Rs.280,000 = Rs.400,000 = 3.33 120,000 DOL of 3.33 implies that for a given change in the company‟s sales, EBIT will change by 3.33 times. Problem: A company which manufactures its product for sale considers automation in its production. The technical expert appointed by the management tells them that they can choose a more automated production processes which will reduce unit variable cost to Rs.2, but will increase fixed costs to Rs.480,000. If the management accepts the expert‟s advice, then the income statement will look as follows. Rs. Sales (100,000 units at Rs.8) 800,000 Less: Variable costs (100,000 at Rs.2) 200,000 Contribution 600,000 Less: Fixed costs 480,000 EBIT 120,000 What will be the DOL with high fixed costs and low variable costs? Solution: DOL = Contribution where, Contribution = EBIT + Fixed cost EBIT DOL = Rs.600,000 = 5.0 Rs.120,000 If the company chooses the high-automated technology and if its actual sales happen to be more than expected, its EBIT will increase greatly; an increase of 100 percent in sales will lead to 5 percent increase in EBIT. Problem:The installed capacity of a factory is 600 units. Actual capacity used is 400 units. Selling price per unit is Rs.10. Variable cost is Rs.6 per unit. Calculate the operating leverage in each of the following three situations: i) When fixed costs are Rs.400. ii) When fixed costs are Rs.1000. iii) When fixed costs are Rs.1200.

- 4. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 4 Solution: Statement showing Operating Leverage (in Rs) Particulars Situation 1 Situation 2 Situation 3 Sales Variable cost (VC) Less: Contribution (C) [Sales−VC] Fixed cost (FC) Operating profit (OP) [C−FC] Operating leverage (C÷OP) 4,000 2,400 1,600 400 1,200 1600/1200 = 1.33 4,000 2,400 1,600 1,000 600 1600/600 = 2.67 4,000 2,400 1,600 1,200 400 1600/400 = 4.00 From the above it shows that the degree of operating leverage increases with every increase in share of fixed cost in the total cost structure of the firm. Operating Risk: Operating risk can be defined as the variability of EBIT (or return on assets). The environment – internal and external – in which a firm operates, determines the variability of EBIT. So long as the environment is given to the firm, operating risk is an unavoidable risk. A firm is better placed to face such risk if it can predict it with a fair degree of accuracy. The variability of EBIT has two components. Variability of sales Variability of expenses Significance of Operating Leverage Operating leverage tells the impact of sales on income. Depending on the operating leverage, a given percentage of increase in sales results in a higher percentage of increase in operating income and net profit. Equally, a decline in sales may wipe out the operating profit or turn into loss, even. FINANCIAL LEVERAGE Financial Leveragerefers to debt in a firm‟s capital structure. Firms with debt in the capital structure are called levered firms. The interest payments on debt are fixed irrespective of the firm‟s earnings. Hence interest charges are fixed costs of debt financing. The fixed costs of operations result in operating leverage and cause EBIT to vary changes in sales. Financial leverage is also known as trading on equity. It is defined as the ability of a firm to use fixed financial charges to magnify the effects of changes in EBIT on the earnings per share, i.e. preference share capital and debt capital including debentures with fixed rate of interest.

- 5. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 5 Characteristics of Financial Leverage o Concerned with Liabilities side of the Balance Sheet: It is concerned with the liabilities side of the balance sheet where different type of sources of capital is shown. o Related to Fixed Cost of Capital: if there is no fixed cost capital, then there will be no financial leverage. o Financial Risk: The financial risk of the firm increases with the presence of financial leverage. Combining Financial and Operating Leverages Operating leverage affects a firm‟s operating profit (EBIT), while financial leverage affects after tax or the earnings per share. The combined effect of two leverages can be quite significant for the earnings available to ordinary shareholders. A company can finance its investments by debt and equity. The company may also use preference capital. The rate of interest on debt is fixed irrespective of the company‟s rate of return on assets. The company has a legal binding to pay interest on debt. The rate of preference dividend is also fixed; but preference dividends are paid when the company earns profits. The use of fixed-charges sources of funds, such as debt and preference capital along with the owner‟s equity in the capital structure, is described as financial leverage or gearing or trading on equity. The use of term trading on equity is derived from the fact that it is the owner‟s equity that is used as a basis to raise debt; that is, the equity that is traded upon. The supplier of debt has limited participation in the company‟s profits and therefore he will insist on protection in earnings and protection in values represented by ownership equity. Measures of Financial Leverage The most commonly used measures of financial leverage are: 1. Debt ratioThe ratio of debt to total capital L1 = D / D+E = D/V Where, D is value of debt, E is value of shareholders‟ equity and V is value of total capital (i.e. D+E). D and E may be measured in term of book value. The book value of equity is called net worth. L Shareholder‟s equity may be measured in terms of market value. 2. Debt-equity ratioThe ratio of debt to equity L2= D/E 3. Interest coverage The ratio of net operating income (or EBIT) to interest charges L3 = EBIT /Interest

- 6. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 6 Degree of Financial Leverage Degree of financial leverage may be defined as the percentage change in taxable profits as a result of percentage change in operating profit. This may be put in the form of following equation: DFL = Percentage change in taxable income Percentage change in operating income The financial leverage affects the earnings per share. When the economic conditions are good and the firm‟s EBIT is increasing, its EPS increases faster with more debt in the capital structure. The degree of financial leverage (DFL) is defined as the percentage change in EPS due to a given percentage change in EBIT. DFL = % Change in EPS % Change in EBIT or DFL = ∆EPS / EPS ∆EBIT/ EBIT For Example, when EBIT increases from Rs.120,000 to Rs.160,000, EPS increases from Rs.1.65 to Rs.2.45 when it employs 50 percent debt and pa interest charges of Rs.37500 (in the earlier problem). Applying equation, DFL at EBIT of Rs.120,000 is as follows: DFL = ∆EPS / EPS ∆EBIT/ EBIT = (2.45 – 1.65) / 1.65 = 0.485 = 1.456 (160,000 – 120,000)/ 120,000 0.333 This implies that for a given change in EBIT, EPS will change by 1.456 times Significance of Financial Leverage Financial leverage is employed to plan the ratio between debt and equity so that earnings per share are magnified. The significance of financial leverage is as under: 1) Planning of Capital Structure:Financial leverage helps in planning the capital structure. The capital structure is concerned with the raising of long term funds, both from shareholders and long-term creditors. The structure has the implication of cost and risk that are to be borne in mind, while finalizing the capital structure. 2) Profit Planning: The earning per share is affected by the degree of financial leverage. If the profitability of the concern is increasing, the fixed costs will help in increasing the availability of profits for equity shareholders. When profits decline and do not cover the interest on debt, the sufferers will be equity shareholders. Therefore, financial leverage is important for profit planning.

- 7. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 7 COMPOSITE LEVERAGE Operating leverage measure percentage change in operating profit due to percentage changes in sales. It explains the degree of operating risk. Financial leverage measures percentage change in taxable profit (or EPS) on account of percentage change in operating profit (or EBIT). Thus, it explains the degree of financial risk. Both these leverages are closely concerned with the firm‟s capacity to meet its fixed costs (both operating and financial). In case both the leverages are combined, the results obtained will disclose the effect of change in sales over change in taxable profit (or EPS). Composite leverage, thus, expresses the relationship between revenue on account of sales (i.e. contribution or sales less variable cost) and the taxable income. It helps in finding out the resulting percentage change in taxable income on account of percentage change in sales. This can be computed as follows: Composite Leverage = Operating leverage × Financial leverage = C ×OP = C OP PBT PBT Where, C = Contribution (i.e. sales – variable cost) OP = Operating Profit (or) EBIT PBT = Profit before Tax but After Interest Problem: Following are the figures related to PQR Co: Sales Rs.10,00,000, Variable Costs 40% of sales, Fixed Cost Rs.2,00,000, Interest Rs.15,000 You are required to calculate (i) Operating leverage (ii) Financial leverage and (iii) Combined leverage. Also state change in the above leverages if selling price is increased by 15%. Solution: Particulars Amount (Rs) Sales Less: Variable cost (40% of 10,00,000) Contribution Less: Fixed cost Operating profit / EBIT Less: Interest Profit Before Tax / EBT 10,00,000 4,00,000 6,00,000 2,00,000 4,00,000 15,000 3,85,000 1) Operating Leverage = Contribution / EBIT = 6,00,000/4,00,000 = 1.5 times 2) Financial Leverage = EBIT / Profit before tax = 4,00,000/3,85,000 = 1.038 times 3) Combined Leverage = Operating leverage × Financial leverage = 1.5 × 1.038 = 1.557 times

- 8. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 8 If the selling price is increased by 15% Particulars Amount (Rs) Sales (10,00,000× 1.15) Less: Variable cost (40% of 11,50,000) Contribution Less: Fixed cost Operating profit / EBIT Less: Interest Profit Before Tax / EBT 11,50,000 4,60,000 6,90,000 2,00,000 4,90,000 15,000 4,75,000 1) Operating Leverage = Contribution / EBIT = 6,90,000/4,90,000 = 1.408 times 2) Financial Leverage = EBIT / EBT = 4,90,000/4,75,000 = 1.0315 times 3) Combined Leverage = Operating leverage × Financial leverage = 1.408 × 1.0315 = 1.452 times Problem: A company has sales of Rs.1,00,000. The variable costs are 40% of the sales while the fixed operating costs amount to Rs.30,000. The amount of interest on long-term debt is Rs.10,000. You are required to calculate the composite leverage and illustrate its impact if sales increase by 5%. Solution: Statement Showing Computation of Composite Leverage Particulars Amount (Rs) Sales Less: Variable cost (40% of sales) Contribution (C) Less: Fixed Operating cost Operating profit / EBIT Less: Interest Taxable Income (PBT) 1,00,000 40,000 60,000 30,000 30,000 10,000 20,000 Combined Leverage = C / PBT =60,000 / 20,000 = 3 The composite leverage of „3‟ indicates that with every increase of Re.1 in sales, the taxable income will increase by Rs.3 (i.e. 1× 3)

- 9. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 9 This can be verified by the following computations when the sales increase by 5% Particulars Amount (Rs) Sales Less: Variable cost Contribution (C) Less: Fixed Operating cost Operating profit / EBIT Less: Interest Taxable Income (PBT) 1,05,000 42,000 63,000 30,000 33,000 10,000 23,000 It is clear from the above computation that on account of increase in sales by 5% the profit before tax has increase by 15%. This can be verified as follows: Increase in percentage profits = Increase in profit × 100 Base profit = (3,000 / 20,000) × 100 = 15% Differences between Operating and Financial Leverage Basis of Difference Operating Leverage Financial Leverage 1) Objective The objective is to magnify the effect of changes in sales on operating profit. The objective is to magnify the effect of changes in operating profit on earnings per share. 2) Relationship It establishes relationship between operating profit and sales It establishes relationship between operating profit and return on equity 3) Measurement It measures a firm‟s ability to use fixed cost asset to magnify the operating profits It measures a firm‟s ability to use fixed cost funds to magnify the return to equity shareholders. 4) Relationship It relates to the assets side of the balance sheet It relates to the liability side of the balance sheet 5) Effect on Income It effects profit before interest and tax It effects profit after interest and tax 6) Risk It involves operating risk of being unable to cover fixed operating cost. It involves financial risk of being unable to cover fixed financial cost. 7) Decision It is concerned with investment decision. It is concerned with financing decision. 8) Stage It is described as first stage leverage It is described as second stage leverage

- 10. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 10 CAPITAL STRUCTURE In order to achieve the goal of indentify an optimum debt-equity mix, it is necessary for the finance manager to be conversant with the basic theories underlying the relationship between capital structure, cost of capital and value of firm. Meaning and Scope of Capital Structure Capital structure represents the relationship among different kinds of long term capital. Normally, a firm raises long term capital through the issue of shares, sometimes accompanied by preference shares. The share capital is often supplemented by debenture capital and others long-term borrowed capital. According to Prasanna Chandra, “The composition of a firm‟s financing consists of equity, preference and debt”. According to James C Van Horne,“The mix of a firm‟s permanent long-term financing represented by debt, preferred stock and common stock equity”. Capital structure is referred to as the ratio of different kinds of securities raised by a firm as long-term finance. The capital structure involves two decisions: (1) Types of securities to be issued are equity shares, preference shares and long- term borrowings (debentures). (2) Relative ratio of securities can be determined by process of capital gearing. On this basis the companies are divided into two categories: (a) Highly Geared Companies whose promotion of equity capitalization is small and (b) Low Geared Companies who equity capital dominates total capitalization. Components of Capital Structure The long-term funds of capital structure can broadly divided into two categories, viz., owners‟ capital and borrowed capital as follows: 1) Owners‟ Capital – (i) Equity capital, (ii) Preference capital and (iii) Retained Earnings. 2) Borrowed Capital – (i) Debentures and (ii) Term Loans Optimal Capital Structure Optimal Capital Structure is that capital structure or combination of debt and equity that leads to the maximum value of firm. At this point, average composite cost or weighted average cost is the minimum. If the borrowing leads the company to increase the market value of its shares, it is said that the company has drifted away from optimum capital structure. A company should plan in such as way that the market value of its shares is maximized. Types of Capital Structure The capital structure of any concern may be simple, compound and complex. (a) Simple Capital Structure: A single capital structure consists of single security base as a source of fund to finance the activities of a concern, e.g. equity share

- 11. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 11 capital issued by a concern. It is safe to use such type of capital structure when the prospects of earnings are unpredictable and uncertain. (b) Compound Capital Structure: In compound capital structure a combination of two security bases in the form of equity and preference capital or equity share capital and debentures are used as a source of funds. It is advisable to use such type of capital structure when annual earnings of a concern are uncertain but average earnings are rather good. (c) Complex Capital Structure: A complex capital structure is made up of multi- security base, consisting of equity share capital, preference share capital, debentures and loans from financial institutions. This type of capital structure is advisable where there is certainly of stable and adequate income to pay-off fixed financial charges. DESIGNING CAPITAL STRUCTURE Designing capital structure refers to the designing of an appropriate capital structure in the context of facts and circumstances of each firm. Designing the capital structure means selecting a desired debt-equity combination in advance. The initial capital structure is determined at the time the firm is promoted. So this structure should be designed very carefully. Capital structure designing is very important to survive the business in long-run. Liability side of balance sheet is made under perfect capital structure designing. Liability side is the mixture of finance of company which has collected from internal and external sources. Hence, perfect capital structure makes strong balance sheet. The following are the common approaches to determine the firm‟s capital structure: EBIT-EPS Analysis: It involves the comparison of alternatives of financing under various assumptions of EBIT. Cost of Capital: Cost is an important consideration in capital structure decision. It helps in designing the optimal capital structure of the firm. Cash Flow Analysis: The focus of this analysis is on the risk of cash insolvency i.e. the probability of running out the cash – given a particular amount of debt in the capital structure. The expected cash flows can be categorized into three groups – (i) Operating Activities, (ii) Investing Activities, and (iii) Financing Activities Leverage Analysis: This analysis emphasis on the measurement of the relationship of the two variables, rather than on measuring the variables. Leverage = % change in dependent variable % change in independent variable EBIT- EPS ANALYSIS The EBIT-EPS analysis is one of the important tools in the hands of financial manger to get an insight into the firm‟s capital structure. The Earnings Before Interest and Tax (EBIT) and Earnings Per Share (EPS) analysis is useful in examining the effect of financial leverage to analyze the behavior or EPS with varying levels of EBIT under

- 12. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 12 alternative financial plans. A capital structure may consist of debt and equity in different proportions. It should be noted that the 65 percent EPS is the "trailing" number, using the previous 4 quarters of earnings. Some analysts like to use "projected" EPS to analyze a stock's current value in respect to these estimates. EPS and ROE Calculations EPS is calculated by dividing profit after taxes, PAT also called net income, NI, by the number of shares outstanding. PAT is found out in two steps. First, the interest on debt, INT, is deducted from the earnings before interest and taxes, EBIT, to obtain the profit before taxes, PBT. Then taxes are computed on and subtracted from PBT to arrive at the figure of PAT. The formula for calculating EPS is as follows: Earnings per share = Profit after tax Number of shares EPS = PAT = (EBIT – INT) (1 – T) N N Where T is the corporate tax rate and N is the number of ordinary shares outstanding. If the firm does not employ any debt, then the formula is: EPS = EBIT (1 – T) N ROE is obtained by dividing PAT by equity (E). Thus the formula for calculating ROE is as follows: Profit after tax Return on Equity = -------------------------- Value of equity ROE = (EBIT – INT) (1 – T) E For calculating ROE either the book value or the market value equity may be used. Earnings per Share (EPS):For computation of earnings per share deduct from earnings before interest and tax both interest and tax. Divide earnings after interest and tax by number of equity shares. EPS (for equity shares) = (EBIT – 1) (1 – t) N EPS (for preference shares) = (EBIT – 1) (1 – t) – P N

- 13. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 13 Analyzing Alternative Financial Plans: Constant EBIT Problem:Suppose a new firm, Brightways Ltd, is being formed. The management of the firm is expecting a before-tax rate of return of 24 percent on the estimated total investment of Rs.500,000. This implies EBIT = 500,000*0.24 = Rs.120,000. The firm is considering two alternative financial plans: (i) either to raise the entire funds by issuing 50,000 ordinary shares at Rs.10 per share, or (ii) to raise Rs.250,000 by issuing 25,000 ordinary shares at Rs.10 per share and borrow Rs.250,000 at 15 percent rate of interest. The tax rate is 50 percent. What are the effects of the alternative plans for the shareholders‟ earnings? Solution:The effects of the alternative plans for the shareholders‟ earnings are calculated as follows: Effect of Financial Plans on EPS and ROE: Constant EBIT Financial Plan All-equity Debt-equity (Rs) (Rs) 1. Earnings before interest and taxes, EBIT 120,000 120,000 2. Less: Interest, INT 0 37,500 3. Profit before interest, PBT 120,000 82,500 PBT = EBIT – INT 4. Less: Taxes, T@50% 60,000 41,250 PBT×T 5. Profit after taxes, PAT 60,000 41,250 PAT = (EBIT – INT) (1 – T) 6. Total earnings of investors, 60,000 78,750 PAT + INT -------------------------------------------- 7. Number of ordinary shares, N 50,000 25,000 8. EPS = (EBIT – INT) (1 – T) / N 1.20 1.65 9. ROE = (EBIT – INT) (1 – T) / E 0.12 or 12% 0.165 or 16.5% The above calculations show the impact of the financial leverage is quite significant when 50 percent debt (debt of Rs.250,000 to total capital of Rs.500,000) is used to finance the investment. The firm earns Rs.1.65 per share, which is 37.5 percent more than Rs.1.20 per share earned with no leverage. ROE is greater by the same percentage. _____________________ Gain from Financial Leverage 1. EBIT on assets financed by debt, Rs.250,000*0.24 Rs.60,000 2. Less: Interest, Rs.250,000*0.15 Rs.37,500 3. Surplus earnings to the shareholders, Rs.250,000*(0.24–0.15) Rs.22,500 4. Less: Taxes at 50 percent Rs.22,500*0.50 Rs.11,250 5. After tax surplus earnings accruing to the share holders(leverage gain) Rs.11,250

- 14. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 14 Calculation of Indifference Point: The break-even or indifference point between two alternative methods of financing can be determined by a formula. In the earlier problem, suppose the firm is considering only two financial plans – an all-equity plan and 50% debt-equity plan. The firm wants to know the level of EBIT at which EPS would be the same under both the plans. The EPS formula under all-equity plan is: EPS = (1 – T) EBIT where N1is number of ordinary share under first N1 plan and since the firm has no debt, no interest charges exists. The EPS formula under debt-equity plan is: EPS = (1 – T) (EBIT – INT) where N2is number of ordinary share 2nd plan N2 and INT is the interest charges on debt. Setting the two formulae equal, we have the following: EPS = (1 – T) EBIT = (1 – T) (EBIT – INT) N1 N2 Problem: Calculation of Indifference Points Calculate the level of EBIT at which the indifference point between the following financing alternatives will occur: (i) Ordinary share capital Rs.10 lakh or 15% debenture of Rs.5 lakh and ordinary share capital of Rs.5 lakh (ii) Ordinary share capital of Rs.10 lakh or 13% preference share capital of Rs.5 lakh and ordinary share capital of Rs.5 lakh Assume that the corporate tax rate is 50 percent and the price of the ordinary share is Rs.10 in each case. Solution: The indifference points for the various combinations of the methods of finance are calculated as follows: (i) Ordinary shares Vs Ordinary shares and debentures. EBIT = N1 / N1 − N2 * INT = 100,000 / 100,000 – 50,000 *75000 = Rs.150,000 (ii) Ordinary shares Vs Ordinary and Preference shares EBIT = N1 / (N1 − N2)* PDIV = 100,000 / 100,000 – 50,000 * 65000 = 2 * 65,000 = Rs.130,000

- 15. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 15 COST OF CAPITAL AND VALUATION The cost of capital is affected by number of factors. Some are beyond a firm‟s control, but others are influenced by its financing and investment decisions. Factors the firm cannot control: (i) Level of Interest Rates: Higher interest rate also increases the cost of common and preferred equity capital. (ii) Tax Rates: Lowering the capital gains tax rates relativeto the rate on ordinary income makes stocks more attractive, and that reduces the cost of equity. Factors the firm can control: (i) Capital Structure Policy:If a firm change its capital structure, such as change can affect its cost of capital. The after-tax cost of debt is lower than the cost of equity. (ii) Dividend Policy:Since the retained earnings are income that has not been paid out as dividend, it can affect the cost of capital because it affects the level of retained earnings. (iii) Investment Policy: When the cost of capital is estimated, the required rate of return is used as the starting point on the firm‟s outstanding stock and bonds. Cost of Debt/Debenture Cost of debt is the contractual rate of interest or coupon rate payable on debt. Debt may be issued at par, at premium or discount. It may be perpetual or redeemable. The technique of computation of cost in each case has valued as follows: Debt Issued at Par: Generally cost of the debt (i.e. debentures and long term debt) is defined in terms of the rate of return that the debt investment must yield to protect the shareholder interest. Thus, the before tax cost of debt capital is simply the amount of interest payable on principal amount. Cost of Debt before tax (Kd) = I / P Where, I = Interest; P = Principal However, it requires to be adjusted by tax rate. The interest payable is an admissible deduction for computing the taxable income. It will considerable reduce the cost of debt capital. This can be expressed as follows: Kd = I(1 – t) Where, I = Interest rate payable t = Marginal tax rate of the firm Kd = Cost of debt after tax Problem SV & Company raises Rs.200,00 by the issue of 2000, 10% debentures of Rs.100 each payable at par after 10 years. If the rate of company‟s tax is, say, 50%. What is the cost of debt to the firm?

- 16. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 16 Solution Costof debt Kd = I(1 – t) = 0.10 (1 – 0.50) = 0.05 or 5% Debt Issued at Discount:The cost of debt issued at a discount can be computed as: Cost of debt (Kd) = [I/P](1 – t) Where, I = Interest rate P= Net proceeds (Face value – Discount) t = tax rate Problem Ashok Company issue 80,000, 9% debentures at a discount of 5%. The rate of tax is 50%. Compute the cost of debt capital. Solution Cost of debt (Kd) = [I/P](1 – t) = [7200/76000] × (1 – 0.50) =0.0947 × 0.50 = 0.474 or 4.7% Debt Issued at Premium:The cost of debt issued at premium can be computed as: Cost of debt (Kd) = [I/P](1 – t) Where, I = Interest rate P= Net proceeds (Face value + Discount) t = tax rate Problem B Ltd. issuers.100,000, 9% debentures at a premium at 10%. The costs of flotation are 2%. The tax rate applicable is 60%. Compute cost of debt-capital. Solution Cost of debt (Kd) = [I/P](1 – t) = [9000/107800] × (1 – 0.60) =0.0834 × 0.40 = 0.334 or 3.34% I = 100,000 × 9% = Rs.9000 P = Rs.100,000 + 10,000 – (0.02×110,000) = Rs.1,10,000 – 2200 = Rs.1,07,800 t = 60% or 0.60 Cost of Preference Share On preference share a fixed rate of dividend is paid. Though as far as dividend is concerned there is no legal binding on the board of directors to pay dividend but if any dividend is paid then it is to be paid to the preference shareholders first. The cost of preference capital is the function of dividend expected by its investor. In case

- 17. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 17 dividends are not paid to preference shareholders, it will affect the fund raising capacity of the firm. Normally, the dividend payable to the preference shareholders is to be treated as cost of preference share capital. It is computed as follows: Cost of Preference Capital (Kp) = D /NP Where, Kp = Cost of Preference share capital D = Annual Dividend NP = Net Proceeds from issue The dividend to preference shareholders is also given after tax and hence no adjustment is required to be regarding on account of taxes. Problem XYZ & Company issues 20,000, 12% preference shares of Rs.100 each at par. Calculate the cost of preference share capital. Solution Cost of Preference capital (Kp) = D /NP = (240,000 /20,00,000)×100 = 0.12 or 12% Cost of Equity Share The cost of equity is the maximum rate of return that the company must earn on equity financed portion of its investments in order to leave unchanged the market price of its stock. The cost of equity share capital can be computed in the following ways: Dividend Yield Method (or) Dividend/Price Ratio Method:According to this method, the cost of equity capital is the „discount rate that equates the present value of expected future dividends per share with the net proceeds (or current market price) of a share. Ke = D /NP (or) D /MP Where, Ke = cost of equity capital; D = expected dividend per share; NP = net proceeds per share; MP = market price per share. The basic assumptions underline this method is that the investors give prime importance to the dividends and risk in the firm remains unchanged. Problem ABC Ltd. has disbursed dividend of Rs.25 on each equity share of Rs.10. The current market price of equity share is Rs.60. Calculate the cost of equity as per dividend yield method.

- 18. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 18 Solution Ke = (Dividend per share /Market price per share) × 100 = (25 / 60) × 100 = 41.67% Problem A company issues 1000 equity shares of Rs.100 each at a premium of 10%. The company has been paying 20% dividend to equity shares holders for the post five yields and expects to maintain the same in future also. Compute the cost of equity capital will it make any difference if the market price of equity share is Rs.160? Solution Ke = D /NP = (20 /110) × 100 = 18.18% If the market price of equity share is Rs.160. Ke = D /MP = (20 /160) × 100 = 12.50% Dividend Yield plus Growth in Dividend Method:This method of calculating cost of equity capital is to substitute earning for dividends. When the dividends of the firm are expected to grow at a constant rate and the dividend-pay-out ratio is constant. This method may be used to compute the cost of equity capital. According to this method the cost of equity capital is based on the dividends and the growth rate. Cost of Equity Capital, Ke = D /NP + G Where, Ke = cost of equity capital; D = expected dividend per share; NP = net proceeds per share; G = rate of growth in dividends. Ke = D /MP + G where, M = Market price per share Further, in case cost of existing equity share capital is to be calculated, the NP should be changed with MP in the above equation. Problem XYZ Ltd‟s shares are quoted in stock exchange trading at Rs.120 each. Next year‟s dividend is expected to be Rs.30 per share and the subsequent dividends are expected to grow at an annual rate of 5% of the previous year‟s dividend. What is the cost of equity shares? Solution Ke = (Dividend /Market Price) × 100 + G = (30 /120) × 100 + 5% = 30%

- 19. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 19 Problem The current market price of an equity share of a company is Rs.90. The current dividend per share is Rs.4.50. In case the dividends are expected to grow at the rate of 7%, calculate the cost of equity capital. Solution Ke = D /MP + G = (4.5 /90) + 0.07 = 0.05 + 0.07 = 0.12 or 12% Earning Yield Method:According to this method, the cost of equity capital is the discount rate that equates the present values of expected future earnings per share with the net proceeds (or current market price) of a share. Ke = Earnings per share (Or) EPS Market Price per share MP Problem RS Ltd‟s shares are currently trading at price of Rs.70 with outstanding shares of Rs.500,000. Their expected profit after tax for the coming year is Rs.84 lakh. Calculate the cost of capital based on price earning method. Solution Ke = EPS = 16.8 / 70 = 0.24 or 24% MP EPS = 84,00,000 /500,000= 16.8 Earnings Growth Method:Under this method, earnings replace dividend and the cost is measured by the equation. Ke = (E /P) + g Where, E = Earnings per share; P = Current market price; g = Growth rate in earnings. Problem Te current price of an equity share of Rs.10 is Rs.20. The earnings per share is Rs.3. Growth rate in earnings is given to be 10% p.a. Calculate the cost o equity on earnings growth model. Solution Ke = (E /P) + g = (3/20) + 0.10 = 0.15 + 0.10 = 0.25 or 25%

- 20. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 20 Capital Asset Pricing Model:It describes the relationship between the required rate of return and the cost of equity capital and non-diversified or relevant risk, of the firm as reflected in its index of non-diversified risk beta. Ke = Rf + b(Km – Rf) Where, Ke = Cost of equity capital Rf = Rate of return required on risk free/security Km = The required rate of return on the market portfolio of assets b = The beta coefficient CAPM approach formally describes the risk-return trade-off for securities. It is based on certain assumptions: i) All investors have common expectations regarding the expected return. ii) All investors have same information about securities. iii) There are no restrictions on investments. iv) There are no taxes. v) There are no transactions cost. vi) No single investor an affect market price significantly. Problem Calculate the return on investment from the following information: Risk-free return 10.0% Market return 12.5% β 1.5 Solution Ke = Rf + b(Km – Rf) Return on investment = Risk free return + β(Market return – Risk free return ) = 10 + 1.5(12.5 – 10) = 13.75% Problem The market is giving an average return of 18%. The risk-free return is 11%. You are required to calculate: a) What return would be expected from an investment having a β-factor of 0.9? b) What β-factor would be necessary for an investment to yield a return of 21.6%? Solution Ke = Rf + b(Km – Rf) a) Return = 11% + 0.9(18% − 11%) = 17.3% b) Return = Risk free return + β(Market return – Risk free return ) 21.6% = 11% + β(18% − 11%) 10.6% = β(7%) β = 10.6/7 = 1.51

- 21. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 21 Cost of Retained Earnings It is a misconception that the retained earnings do not involve any cost because a firm is not required to pay dividends on retained earnings. The shareholders expect a return on retained profits. The cost of retained earnings may be considered as the rate of return which the existing shareholders can obtain by investing the after-tax dividends in alternative opportunity of equal qualities. It is thus, the opportunity cost of dividends forgone by the shareholders. Cost of retained earnings can be computed with the help of following formula: Kr= D/NP + G Where, Kr = Cost of retained earnings D = Expected dividend NP = Net proceeds of share issue G = Rate of growth To make adjustments in the cost in retained earnings for tax and cost of purchasing new securities, the formula may be adopted: Kr= [D/NP + G] × (1 – t)(1 – b) (or) Kr = Ke (1 – t)(1 – b) Where, Kr = Cost of retained earnings ;D = Expected dividend; NP = Net proceeds of share issue; G = Rate of growth; t = Tax rate; b = cost of purchasing new securities; Ke = Rate of return available to shareholders. Problem A firm‟s return available to shareholders is 15%, the average tax rate of shareholders is 40% and it is expected that 2% is brokerage cost that shareholders will have to pay while investing their dividends in alternative securities. What is the cost of retained earnings? Solution: Cost of retained earnings Kr = Ke (1 – t)(1 – b) = 15%(1 – 0.4)(1 – 0.02) = 0.15% × 0.6 × 0.98 = 8.82% DIVIDEND POLICY The term dividend policy refers to the policy concerning quantum of profit to be distributed as dividend. The concept of dividend policies implies that companies through their Board of Directors evolve a pattern of dividend payment which has a bearing on future action. According to Weston and Brigham, “Dividend policy determines the division of earnings between payments to shareholders and retained earnings”.

- 22. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 22 Dividend is that portion of profits of a company which is distributed among its shareholder according to the decision taken and resolution passed in the meeting of Board of Directors. This may be paid as a fixed percentage on the share capital contributed by them or at a fixed amount per share. It means only profits after meeting all the expenses and providing for taxation and for depreciation and transferring a reasonable amount to reserve funds should be distributed to shareholders as dividend. Retained earnings are the sources of internal finance for the financing of corporate future projects but payment of dividend constitute an outflow of cash to shareholders. Although both-expansion and payment of dividend-are desirable, these two are in conflicts. It is, therefore, one of the important functions of the financial management to constitute a dividend policy which can balance these two contradictory view paints and allocate the reasonable amount of profits after tax between retained earnings and dividend. Factors Determining Dividend Policy A number of considerations determine the dividend policy of company. Stability of Earnings Age of corporation Liquidity of Funds Needs for Additional Capital Trade Cycles Government Policies Taxation Policy Legal Requirements Past dividend Rates Ability to Borrow Policy of Control Repayments of Loan Time for Payment of Dividend Regularity in Dividend Payment Nature of Dividend Policy The dividend policy has the following natures of its own: o Tied-up with Retained Earnings:A dividend policy is tied-up with the retained earnings policy. It has the effect of dividing net earnings into two parts – retained earnings and dividends. o Constitutes Important Areas of Decision-Making:Distribution of dividends reduces the cash funds of the business and to that extent it has to depend upon external sources of finance. o Impact on Shares: The payment of dividends influences the market price of shares. Higher the rate of dividend, greater the price of shares and vice versa. o Optimal Dividend Policy: A policy marked with few or no dividends payment fluctuations, over a long period of time, having a favorable impact on the wealthof shareholders. Importance of Dividend Policy 1) The firm has to balance between the growth of the company and the distribution to the shareholders. 2) It plays an important role in determining the value of a firm. 3) Stockholders visualize dividends as signals of the firm‟s ability to generate income.

- 23. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 23 4) The decision to pay dividend is independent of investment decisions dividends can indirectly influence the external financing plans. For example, a decision to pay high dividends will leave less internal funds for reinvestment in the firm. This could force the firm to generate funds from new stocks or bond issues. 5) It has to also to strike a balance between the long term financing decision and the wealth maximization. 6) The market price gets affects if dividends paid are less. 7) Retained earnings help the firm to concentrate on the growth, expansion and modernization of the firm. ASPECTS OF DIVIDEND POLICY The payment of dividend of a company involves the legal and procedural aspects. Legal Aspects The amount of dividend that can be legally distributed is governed by company law, judicial pronouncements in leading cases, and contractual restrictions. The important provisions of company law pertaining to dividends are: i) Companies can pay only cash dividends (with the exception of bonus shares). No dividend shall be declared or paid by a company for any financial year except out of the profits earned. ii) Dividends can only paid out of the profits earned during the financial year after providing depreciation and after transferring to reserve some percentage. iii) Due to inadequacy or absence of profits in any year, dividends may be paid out of the accumulated profits of previous years. iv) Dividends cannot be declared for past years for which accounts have been closed. v) Dividend including interim dividend once declared becomes a debt. This can be revoked with the consent of the shareholders. Procedural Aspects The important events and dates in the dividend payment procedure are: a) Board Resolution: The dividend decision is the prerogative of the board of directors. The resolution has to be passed in this regard. b) Shareholder Approval: The resolution of the board of directors to pay the dividend has to be approved by the shareholders in the annual general meeting. c) Record Date: The dividend is payable to shareholders whose names appear in the Register of Members as on the record date. d) Dividend Payment: Once a dividend declaration has been, dividend warrants must be posted within 30 days. e) Unpaid Dividend: Within a period of 7 days, after the expiry of 30 days, unpaid dividends must be transferred to a special account opened with a scheduled bank.

- 24. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 24 PRACTICAL CONSIDERATION There are two important dimensions of a firm‟s dividend policy: 1) What should be the average pay-out ratio? 2) How stable should the dividends be over time? Pay-out Ratio A major aspect of the dividend policy of a firm is its dividend payout D/P ratio, that is, the percentage share of the net earning distributed to the shareholders as dividend. The considerations relevant for determining the dividend pay-out ratio are as follows: Funds Requirement Liquidity Access to External Sources of Financing Shareholder Preference Difference in the Cost of External Equity and Retained Earnings Control Taxes Stability of Dividends Irrespective of the long-term pay-out ratio followed, the fluctuation in the year-to-year dividends may be determined mainly by one of the following guidelines: Stable Dividend Pay-out Ratio Constant Dividend Per share Stable Dividends or Steadily Changing Dividends FORMS /TYPES OF DIVIDEND POLICY Regular Dividend Policy Payment of dividend at the usual rate is termed as regular dividend. The investors such as retired persons, widows and other economically weaker person prefer to get regular dividends. Advantages of Regular Dividend Policy A regular dividend policy offers the following advantages: It establishes a profitable record of the company. It creates confidence among the shareholders. Types of Dividend Policy Regular Dividend Policy Stable Dividend Policy Irregular Dividend Policy No Dividend Policy

- 25. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 25 It aids in long-term financing and renders financing easier. It stabilizes the market value of shares. The ordinary shareholders view dividends as a source of funds to meet their day-today living expenses. If profits are not distributed regularly and are retained, the shareholders may have to pay a higher rate of tax in the year when accumulated profits are distributed. However, it must be remembered that regular dividends can be maintained only by companies of long standing and stable earnings. A company should establish the regular dividend at a lower rate as compared to the average earnings of the company. Stable Dividend Policy The term „stability of dividend‟ means consistency or lack of variability in the stream of dividend payments. In more precise terms, it means payment of certain minimum amount of dividend regularly. A stable dividend policy may be established in any of the following forms: (i) Constant Dividend per Share: Some companies follow a policy of paying fixed dividend per share irrespective of the level of earnings year after year. A policy of constant dividend per share is most suitable to concerns whose earnings are expected to remain stable over a number of years. (ii) Constant Payout Ratio: Constant payout ratio means payment of a fixed percentage of net earnings as dividends every year. The amount of dividend of such a policy fluctuates in direct proportion to the earnings of the company. The policy of constant payout is preferred by the firms because it is related to their ability to pay dividends. (iii) Stable Rupee Dividend plus Extra Dividend: Some companies follow a policy of paying constant low dividend per share plus an extra dividend in the years of high profits. Such a policy is most suitable to the firm having fluctuating earnings from year to year. Advantages of Regular Dividend Policy A stable dividend policy is advantageous to both the investors and the company on account of the following: It is sign of continued normal operations of the company It stabilizes the market value of shares It creates confidence among the investors It improves the credit standing and makes financing easier It provides a source of livelihood to those investors who view dividends as a source of funds to meet day-to-day expenses. Irregular Dividend Policy Some companies follow irregular dividend payment on account the following: (i) Uncertainty of earnings (ii) Unsuccessful business operations (iii) Lack of liquid resources

- 26. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 26 (iv) Fear of adverse effects of regular dividends on the financial standing of the company No Dividend Policy A company may follow a policy of paying no dividend presently because of its unfavorable working capital position or on account of requirements of funds for further expansion and growth. FORMS OF DIVIDENDS Dividends can be classified in various forms. Dividends paid in the ordinary course of business are known as Profit dividends, while dividends paid out of capital are known as Liquidation dividends. Dividends may also be classified on the basis of medium in which they are paid. Equity Preference InterimRegular Special Dividend Dividend DividendDividendDividend Cash Stock Bond Property Composite Dividend Dividend Dividend Dividend Dividend On the Basis of Types of Shares 1) Equity Dividend: Dividend paid on equity shares called as equity dividend. 2) Preference Dividend:Preferencedividend is the dividend paid to preference shareholders. On the Basis of Modes of Payment 1) Cash Dividend:A cash dividend is a usual method of paying dividends. 2) Bonus Share/Stock Dividend: Stock dividend means the issue of bonus shares to the existing shareholders. 3) Scrip or Bond Dividend: A scrip dividend promise to pay the shareholders at a future specific date. 4) Property Dividend:Property dividends are paid in the form of some assets other than cash. They are distributed under exceptional circumstances and are not popular in India. Dividend On the Basis of Types of Shares On the Basis of Mode of Payment On the Basis of Time of Payment

- 27. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 27 5) Composite Dividend:When dividend is paid partly in the form of cash and partly in other form, it is called as composite dividend. On the Basis of Time of Payment 1) Interim Dividend:It is the dividend paid between two annual general meetings. 2) Regular Dividend:Dividend declared in every Annual General Meeting. 3) Special Dividend:When the company earns abnormal profit it will declare special dividend. SHARE SPLITS Share Split or Stock Split is the process of splitting shares with high face value into shares of lower face value. It‟s like getting an Rs.20 note changed for two Rs.10 notes. A share split simply involves a company altering the number of its shares outstanding and proportionally adjusting the share price to compensate. The most common stock split is two-for-one in which each share becomes two shares. The price per share immediately adjusts to reflect the stock split, since buyers and sellers of the stock all know about the stock split. For example, if you owned 25 shares of ABC at Rs.15 per share, and there was a 2-1 stock split, you would then own 50 shares of Rs.7.5 each. For example, Assume that ABC Corporation has 10000 shares of Rs.100 per common stock outstanding with a current market price of Rs.150 per share. The Board of Directors declares the following stock split: 1) Each common shareholder will receive 5 shares for each share held. This is called 5-for-1 stock split. As a result, 50000 shares (10000×5) will be outstanding. 2) The par of each share of common stock will be reduced to Rs.20 (Rs.100/5). The par value of the common stock outstanding is Rs.10,00,000 both before and after the stock split as shown below: Before Split After Split Number of shares Par value per share 10,000 × Rs.100 50,000 × Rs.20 Total Rs.10,00,000 Rs.10,00,000 A stock split does not require journal entry in the books of accounts, but is disclosed in the notes of the financial statements. Since there are more shares outstanding after the stock split, the market price of the stock should decrease. Thus, the market price of the stock would be expected to fall after stock split.

- 28. Financial Management Semester II S.N.Selvaraj, Assistant Professor, E-mail: sn.selvaraj@yahoo.com Page 28 Reasons for Share Splits (a) Companies usually split their stock when they think the price of their stock exceeds the amount smaller investors would be willing to pay. (b) It is aimed at making the stock more affordable and liquid from retail investor‟s point of view. (c) Generally, there are more buyers and sellers of shares trading at Rs.100 than say, Rs.400, as retail shareholders may find low price stocks to be better bargains. (d) Stock splits are usually initiated after a huge run-up in the share. This run-up may link to the performance of the stock. Difference between Bonus Shares and Share Split Point of Difference Bonus Share Share Split Meaning Bonus shares mean additional free shares allotted to the existing shareholders. It is a process of dividing the face value of shares. Face Value In bonus issue, face value of the share is not changing. In stock split, face value is changing. Share Capital In bonus issue, the share capital and number of shares are increased. In stock split, share capital is not changed, but the number of shares is changed. Dividend Company has to give more dividends after bonus issue, because by the increase of the share capital. In stock split, the share capital is not increasing. So there is no need for more dividends in future. Reserves Only a certain amount of the reserves is used. The reserves are not capitalized. Text Books 1. M.Y.Khan and P.K.Jain, “Financial Management” Tata McGraw Hill, 6th Edition, 2011. 2. I.M.Pandey, “Financial Management” Vikas Publishing House Pvt. Ltd., 10th Education 2012. References 1. AswatDamodaran, Corporate Finance Theory and Practice, John Wiley & Sons, 2011. 2. James C Vanhorne, Fundamentals of Financial Management, PHI Learning, 11th Edition, 2012. 3. Brigham Ehrhardt, Financial Management Theory and Practice, Cengage Learning, 12th Edition, 2010. 4. Prasanna Chandra, Financial Management, Tata McGraw Hill, 9th Edition, 2012. 5. Srivatsava, Mishra, Financial Management, Oxford University Press, 2011.