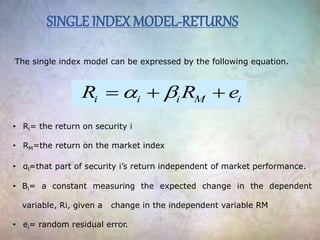

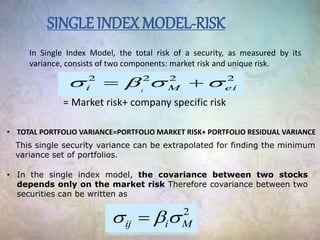

The document summarizes William Sharpe's single index model from 1963, which simplified Harry Markowitz's earlier portfolio selection model. The single index model assumes that only one macroeconomic factor, represented by a market index like the S&P 500, influences the systematic risk of stock returns. It expresses the return of a security as the sum of its expected excess return, its sensitivity to market movements, and random error. This allows estimating portfolio variance and minimum variance portfolios based only on market risk rather than the full covariance matrix.