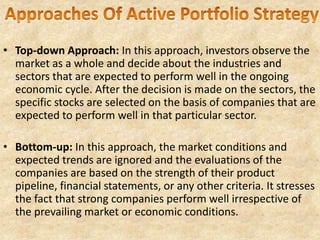

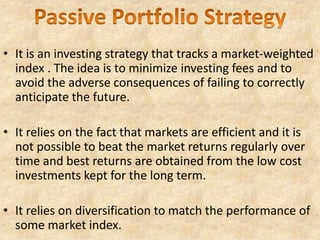

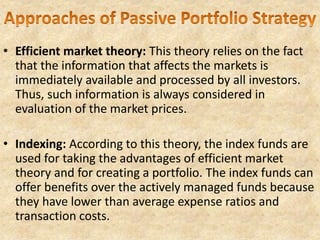

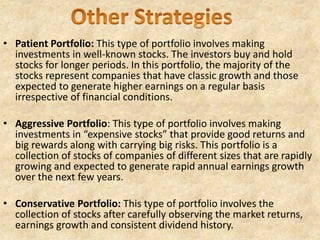

Portfolio strategy is a roadmap that investors use to achieve financial goals by designing optimal portfolios. There are two main types of portfolio strategies: active and passive. Active strategies use forecasting techniques to buy and sell securities frequently to achieve high returns, while passive strategies track market indexes with low fees to match market performance over the long run. Portfolio strategies also differ in their investment approaches, such as top-down which observes the market overall versus bottom-up which focuses on individual company strengths. Other considerations in developing a portfolio strategy include an investor's risk tolerance, asset allocation, rebalancing over time, performance measurement, and responding to market innovations.