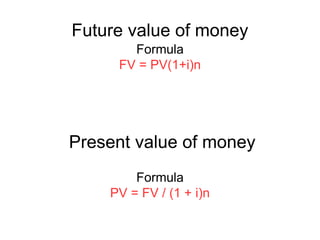

The document discusses various objectives and functions of financial management. The key objectives are profit maximization and wealth maximization. It also discusses the changing role of financial managers in areas like raising funds, investment decisions, and understanding capital markets. Additionally, it outlines the interface of financial management with other functional areas like production, materials, personnel, and marketing departments.